According to IRS guidelines, it is possible to have a W-2 employee who also performs work as a 1099 independent contractor so long as the individual is performing completely different duties that would qualify them as an independent contractor.

Who gets a W-2 and who gets a 1099?

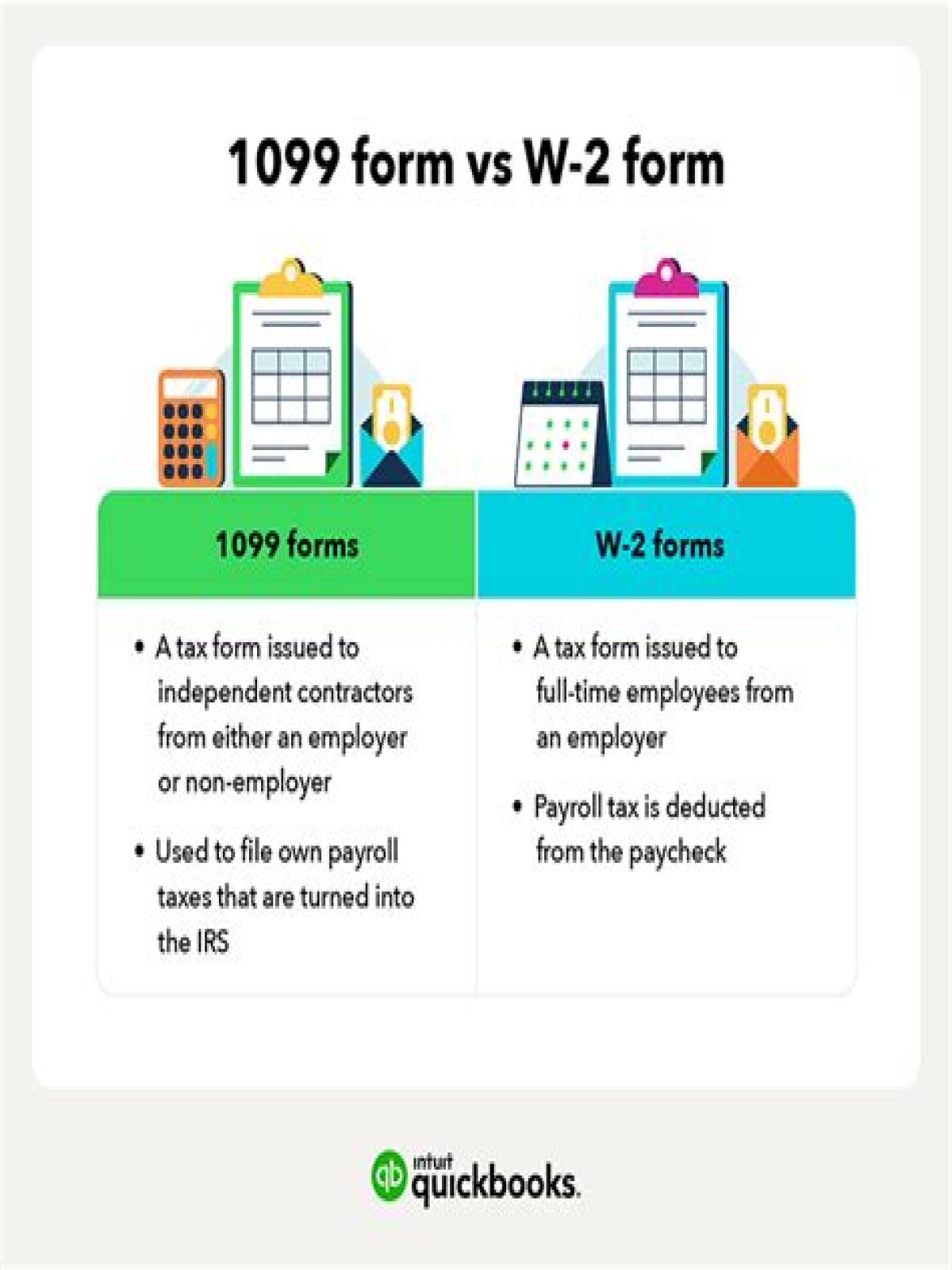

Simply put, 1099s and W-2s are two separate tax forms for two different types of workers. If you’re an independent contractor, you get a 1099 form. If you’re an employee, you receive a W-2.

When would I provide a Form W-2 and a Form 1099 to the same person?

The safest and most common situation in which an employee receive a W2 and a 1099 is when that employee already has an independent business that actively serves other clients on the side.

Do you have to report both W-2 and 1099?

You are required to report the income listed on both forms each year to the Internal Revenue Service on your personal income returns, but your income as an employee and independent contractor will be reported differently. It is uncommon, but there are times when an individual will receive a Form W-2 and Form 1099 from the same business.

What’s the difference between a 1099 MISC and a W-2?

A Form 1099-MISC is the tax form you receive from a company you contracted with. A W-2 is the tax form you receive as an employee from your employer. The major difference between these forms is the tax section.

What should freelancers do with both W-2 and 1099 income?

That means if you make $30,000 on your W-2 and $20,000 on your Schedule C and if you have $1000 in deductible business phone expenses, $600 or 3/5 can no longer be deducted on the federal return and $400 or 2/5 should go on your Schedule C. Remember I said that this allocation is only for something you can’t directly trace.

Where do I put my W-2 income on my 1040?

The process for reporting your Form W-2 income is relatively straightforward: you list the income from Line 10 of the Form W-2 on your Form 1040, Individual Income Tax Return. You then list any interest, dividends, retirement accounts, or Social Security benefits you have received on lines 2a through 5b.