The most common forms of equity compensation awards are non-qualified stock options (NQSOs), incentive stock options (ISOs), restricted stock units (RSUs), and restricted stock awards (RSAs). The awards themselves generally are not transferable and therefore cannot be given to charity.

How do I report capital gains on options?

However, when you sell an option—or the stock you acquired by exercising the option—you must report the profit or loss on Schedule D of your Form 1040. If you’ve held the stock or option for less than one year, your sale will result in a short-term gain or loss, which will either add to or reduce your ordinary income.

How do I donate stock options?

The simplest strategy is to exercise the NQSOs, sell the stock and then donate those cash proceeds in the same tax year. Though exercising the options will result in ordinary income taxation, the subsequent donation of cash proceeds should help to offset that tax liability.

When to buy a call option on a stock?

Call options give you the right to “buy” a stock at a specified price. You buy a Call option when you think the price of the underlying stock is going to go up. In the example above let’s say you bought an IBM December 95 “Call option” instead. This option gives you the right to “buy” IBM stock for $95 on or before the 3rd Friday of December.

Can you use put options to lock in gains?

You have probably heard about using put options to lock in a gain on a stock that has moved up in price. This is also one of the ways investors can lock in gains on a long call position.

When does a call option increase in value?

Call options “increase in value” when the underlying stock it’s attached to goes “up in price”, and “decrease in value” when the stock goes “down in price”. Call options give you the right to “buy” a stock at a specified price. You buy a Call option when you think the price of the underlying stock is going to go up.

Is it a win-win to donate stock to charity?

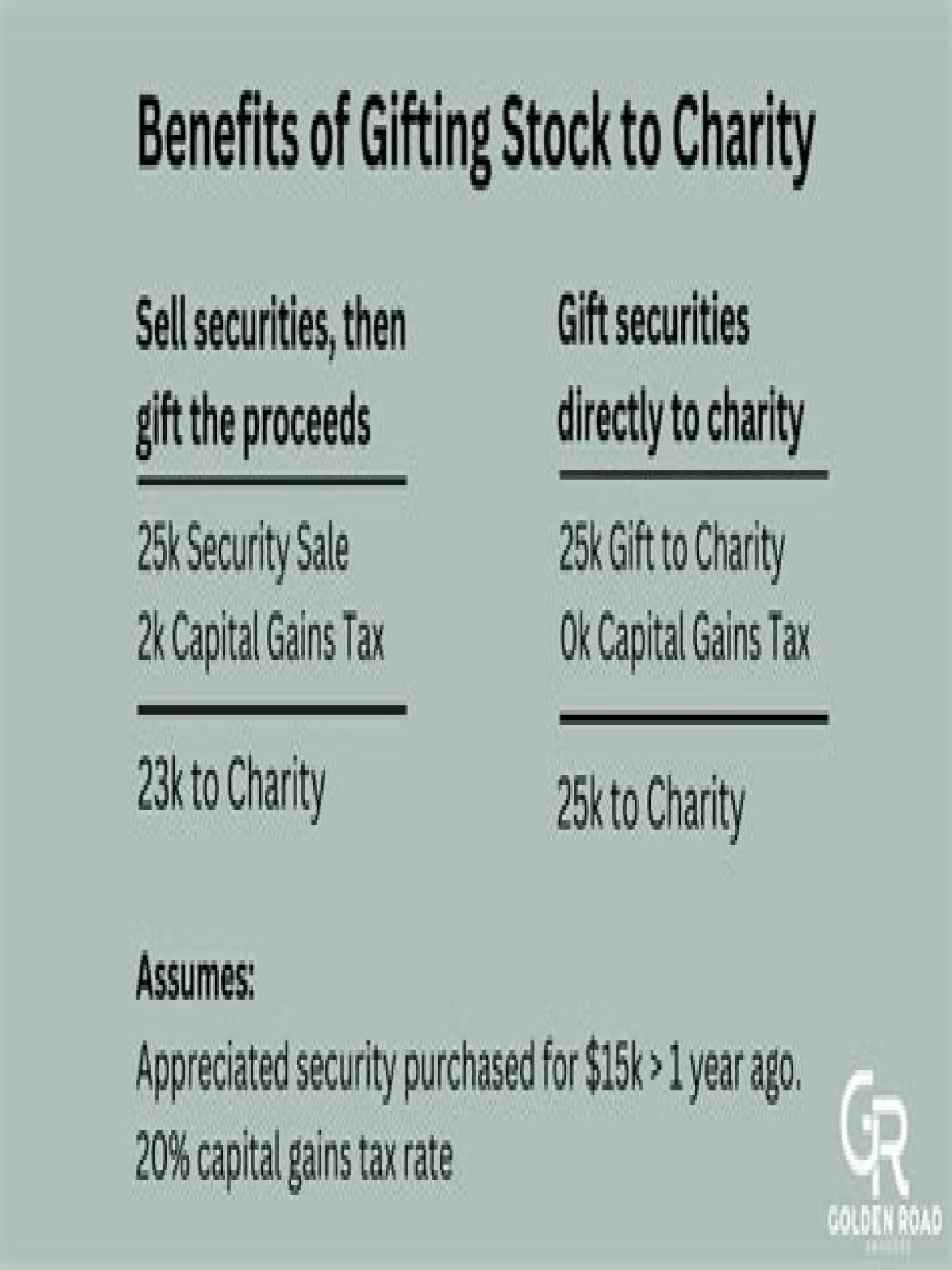

Donating Appreciated Stock to Charity. Donating stock to charity offers a win-win for both you and the organization you’re donating to. A donation of stock allows you to deduct the full market value of the stock from your taxable income.