A1: Employers are no longer required to routinely submit Forms W-4 to the IRS. However, in certain circumstances, the IRS may direct you to submit copies of Forms W-4 for certain employees in order to ensure that the employees have adequate withholding.

Can HR advise on W4?

Giving tax advice isn’t illegal. If you work in HR, you’re likely trained on tax basics, like how to fill out a W4 and how to approach common deductions like charity donations. So offering general guidance to your employees is totally fine.

What is a W4 form used to tell an employer?

Form W-4 tells you, as the employer, the employee’s filing status, multiple jobs adjustments, amount of credits, amount of other income, amount of deductions, and any additional amount to withhold from each paycheck to use to compute the amount of federal income tax to deduct and withhold from the employee’s pay.

Why did my employer give me a W4?

Employees fill out a W-4 form to inform employers how much tax to withhold from their paycheck based on filing status, dependents, anticipated tax credits, and deductions. If the form is filled out incorrectly, you may end up owing taxes when you file your return.

When do you hire an employee do you need a Form W-4?

When you hire an employee, you must have the employee complete a Form W-4, Employee’s Withholding Allowance Certificate (PDF). Form W-4 tells you, as the employer, the marital status, the number of withholding allowances, and any additional amount to use when you deduct federal income tax from the employee’s pay.

Where can I get a Form W-4 withholding certificate?

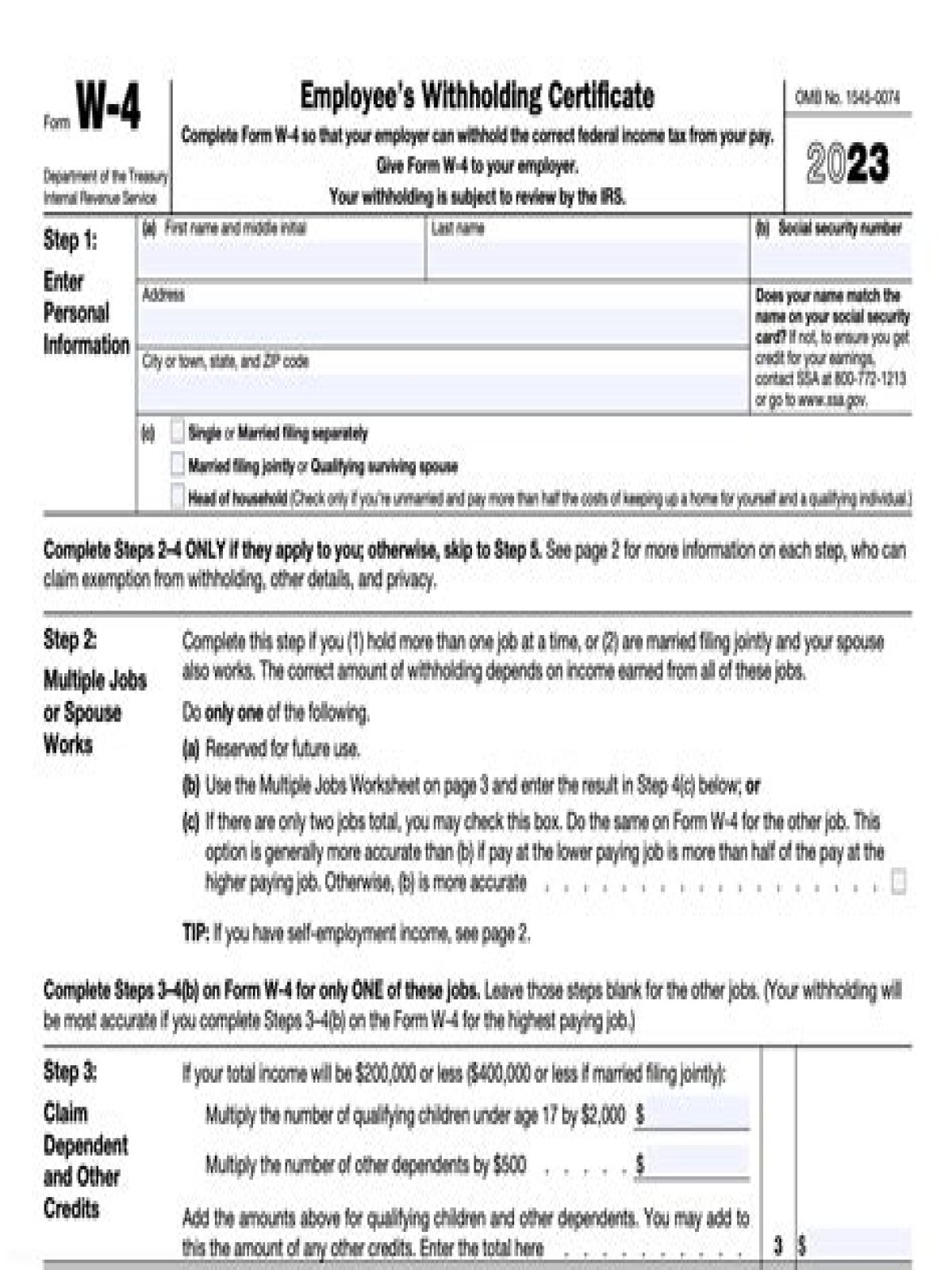

Form W-4 (Rev. December 2020) Department of the Treasury Internal Revenue Service . Employee’s Withholding Certificate Complete Form W-4 so that your employer can withhold the correct federal income tax from your pay. Give Form W-4 to your employer. Your withholding is subject to review by the IRS. OMB No. 1545-0074. 2021. Step 1: Enter Personal

What makes an employee exempt from tax on a W-4?

To qualify for this exempt status, the employee must have had no tax liability for the previous year and must expect to have no tax liability for the current year. A Form W-4 claiming exemption from withholding is valid for only the calendar year in which it’s furnished to the employer.

How do I adjust my W-4 to account for self employment?

Make adjustments to your W-4 with your employer to account for your self-employment income or pay quarterly estimated taxes to cover this income using Form 1040-ES, Estimated Tax for Individuals. Withholding for this type of income is made by claiming extra withholdings on line 4c.