You must report all income earned from fantasy sports either as “other income” on Schedule 1 for Form 1040, or as business income on Schedule C. If you use the first approach, your fantasy sports is considered a hobby and you can’t deduct any of your expenses or losses.

Is FanDuel legit?

FanDuel is legit and provides users with virtually every legitimate way to deposit money on their platforms other than cryptocurrency. You won’t be lacking here. FanDuel does the best job at protecting beginner users.

Is DFS rigged?

No, it’s not rigged, but the average person playing is at a disadvantage. once the games start, you can see who picked who, so it is open for all to see.

Is it safe to give FanDuel my SSN?

Yes, you can bet on sports without a social security number. It’s a slightly different situation online because operators like DraftKings and FanDuel require the last four digits of your social security number to deposit and sign up for an account.

How quickly does FanDuel payout?

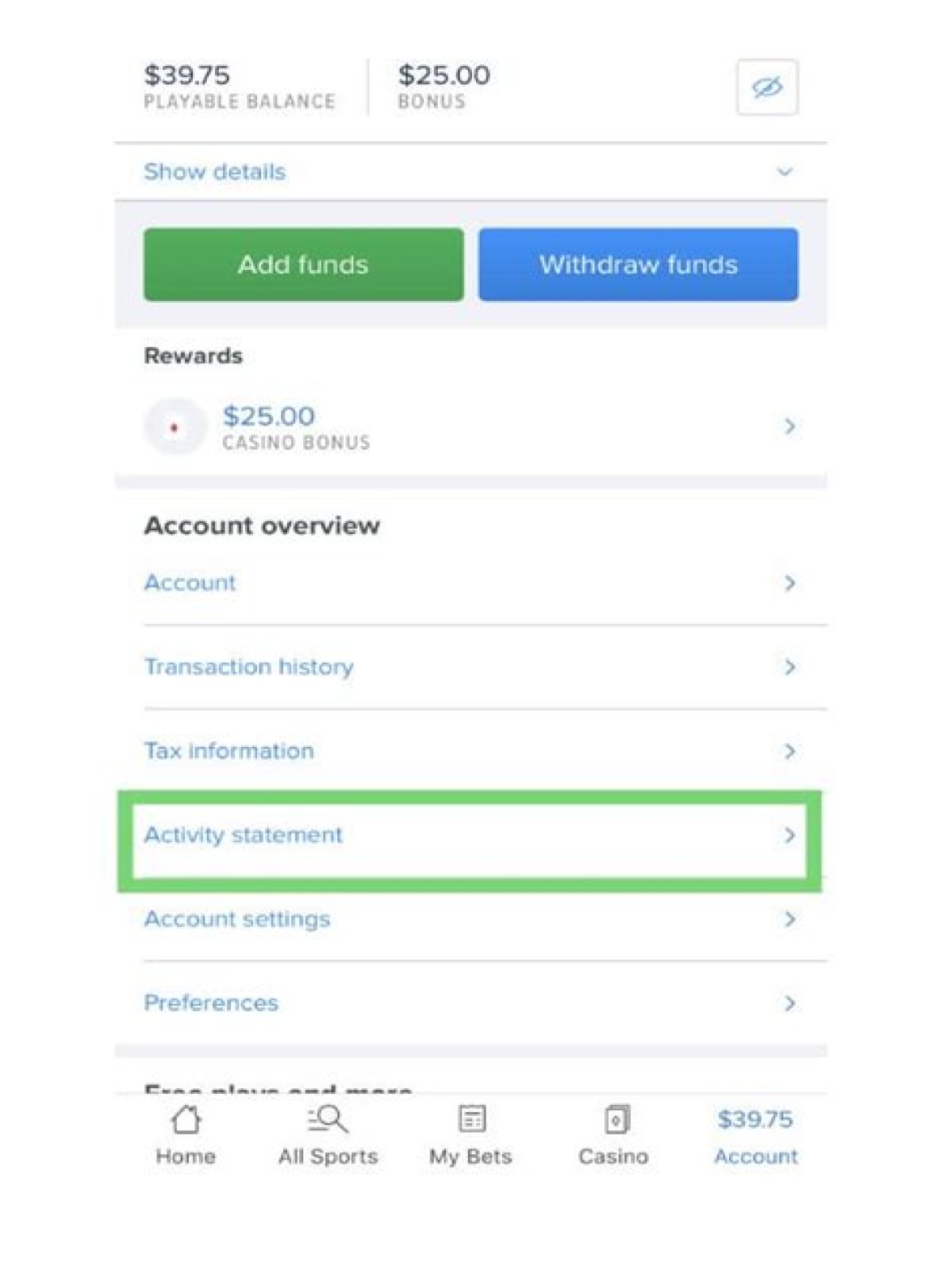

We offer three methods to withdraw funds. If you withdraw via PayPal it takes 48 hours to process. If you withdraw via online banking it takes 2-4 business days to process. If you withdraw via check, it should arrive within 7 to 10 business days.

What percent of DFS players are profitable?

DFS affords a huge advantage to skilled players. In the first half of the 2015 Major League Baseball (MLB) season, 91 percent of DFS player profits were won by just 1.3 percent of players (exhibit). Here is the breakdown: The top 11 players paid, on average, $2 million in entry fees and profited $135,000 each.

Which is better FanDuel or DraftKings?

The main differences would be drafts and league structure within their matching sports. DraftKings offers a lower rake at the higher stakes games. They also offer more high stakes contests and options than FanDuel. They can also handle a bigger volume of players when it comes down to it.

When did FanDuel start daily fantasy sports betting?

In 2009, FanDuel reimagined the concept of fantasy sports, giving fans the ability to play one-day fantasy sports for real cash prizes. And despite many imitators, there’s still no better place to play. After launching in 2018, it didn’t take long for FanDuel to become America’s go-to for sports betting and the #1 online sportsbook.

Do you have to report fantasy sports losses on Form 1040?

Reporting income or loss from fantasy sports on Form 1040. If you use the first approach, you can deduct losses up to the amount of your winnings by itemizing your deductions on Schedule A. If you take the standard deduction instead of itemizing deductions, you can’t deduct fantasy sports losses.

Which is the best daily fantasy lineup optimizer?

The optimizer, projections, and tools are second to none. This is the best site to step up your daily fantasy game. Daily Fantasy Nerd has the best lineup optimizer and is a great tool for helping me pick my lineups for daily fantasy sports. Many thanks and keep up the good work!

How do you report income from fantasy sports?

(Withdrawals + Year End Account Balance) – (Deposits – Beginning Year Account Balance) = net profits. You must report all income earned from fantasy sports either as “other income” on Schedule 1 for Form 1040, or as business income on Schedule C.