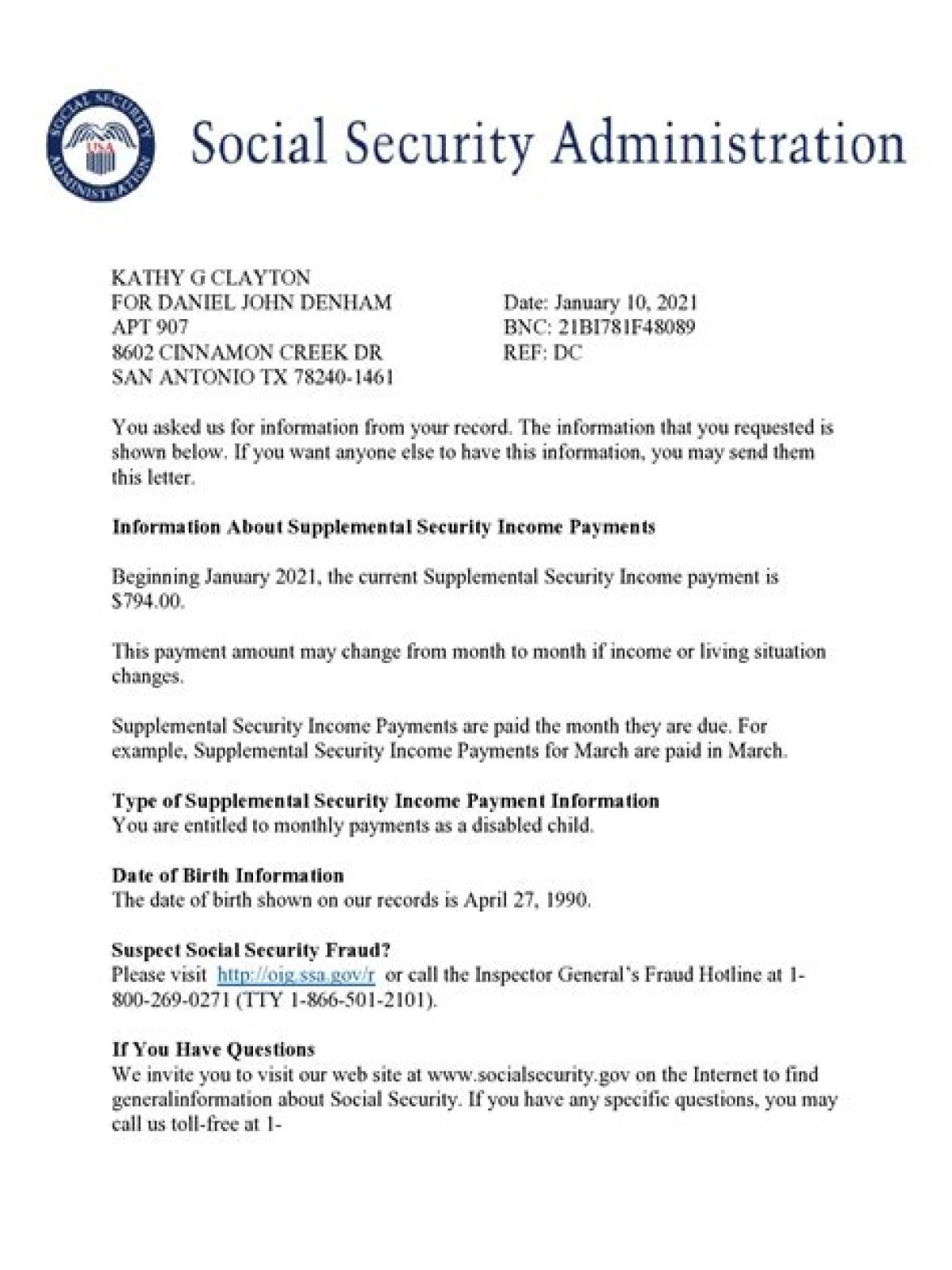

The most common documentation for proof of SSN includes: Social Security card. 1040 Tax Return (federal or state versions acceptable) W2 and/or 1099s (includes 1099 MISC, 1099G, 1099R, 1099SSA, 1099DIV, 1099S, 1099INT)

How can you legally avoid paying Social Security?

Here’s how to reduce or avoid taxes on your Social Security benefit:

- Stay below the taxable thresholds.

- Manage your other retirement income sources.

- Consider taking IRA withdrawals before signing up for Social Security.

- Save in a Roth IRA.

- Factor in state taxes.

- Set up Social Security tax withholding.

Do you have to pay taxes on your Social Security benefits?

This usually happens only if you have other substantial income in addition to your benefits (such as wages, self-employment, interest, dividends and other taxable income that must be reported on your tax return). You will pay tax on only 85 percent of your Social Security benefits, based on Internal Revenue Service (IRS) rules.

What can I submit as proof of my Social Security number?

– Stride Health What documentation can I submit as proof of my Social Security Number (SSN)? Please note that documents must include your first name, last name, and SSN. W2 and/or 1099s (includes 1099 MISC, 1099G, 1099R, 1099SSA, 1099DIV, 1099S, 1099INT)

When do I get my Social Security tax return?

Each January, you will receive a Social Security Benefit Statement (Form SSA-1099) showing the amount of benefits you received in the previous year. You can use this Benefit Statement when you complete your federal income tax return to find out if your benefits are subject to tax.

How much income is exempt from Social Security tax?

Anything you earned over this threshold is exempt from Social Security tax. You would do the same but multiply by 12.4% if you’re self-employed. For taxes due in 2021, refer to the Social Security income maximum of $137,700 as you’re filing for the 2020 tax year.