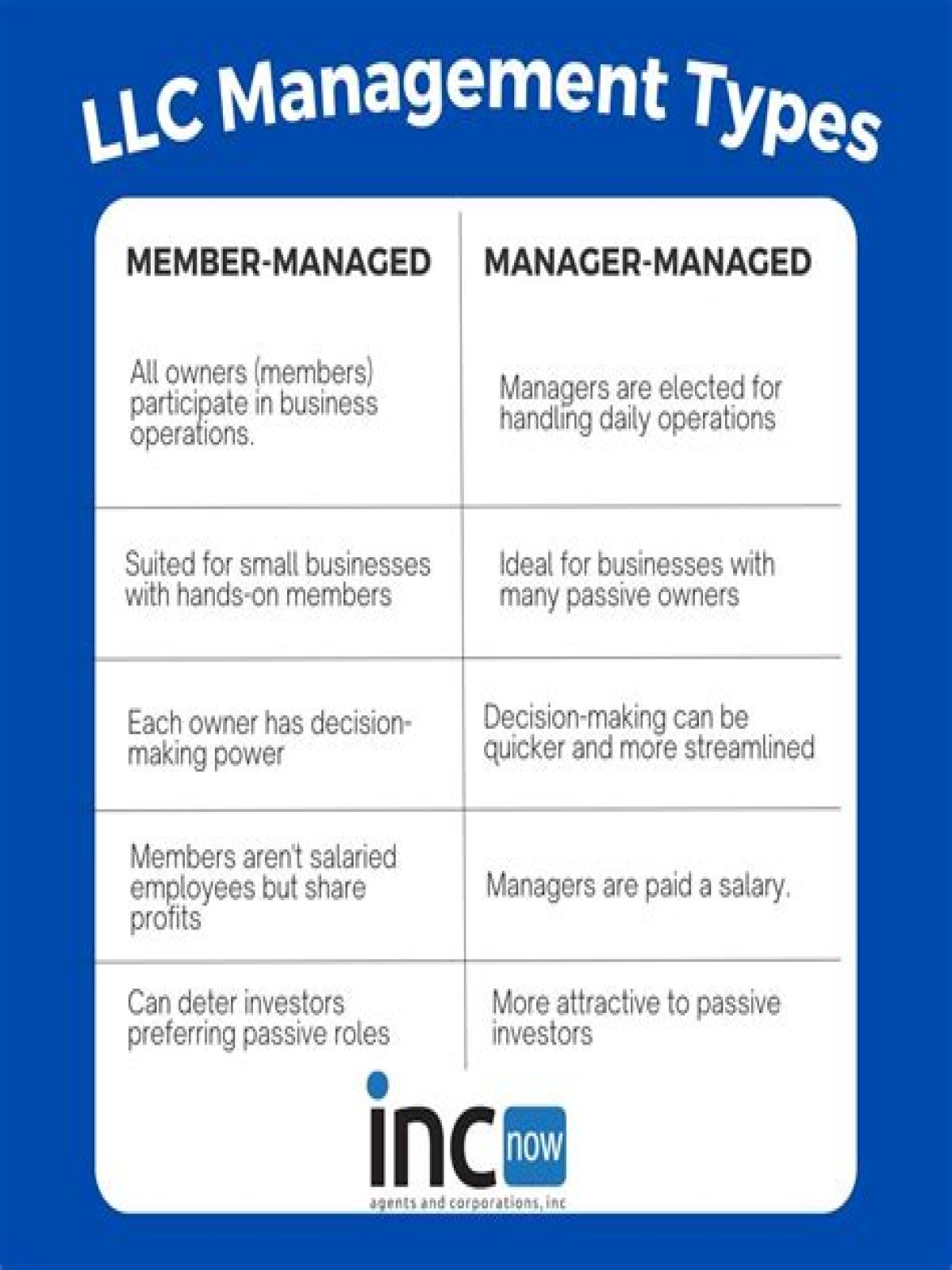

The main difference between manager and member managed is the ability to have passive investors with manager-managed LLCs. Because, with a member-managed business, all owners have a say. Members must have a more hands-on role in a member-managed LLC. The main example is when some members want to be passive investors.

Do LLCs have managing members?

Limited Liability Companies (LLCs) can have as many managing members as they choose, but it’s a good idea to lay out exactly who the company managers are and what they are responsible for in the LLC’s operating agreement.

What’s the difference between member managed and manager managed LLC?

Member-Managed vs. Manager-Managed. Most LLCs are member-managed by default in most states. That is, no manager is selected and member management is assumed. In most states, manager management must be designated in the Operating Agreement.

Who are the owners and managers of a LLC?

LLC Members are owners. Most LLCs are Member-Managed. LLCs can also have Managers (which may or may not own the LLC). And LLCs can be Manager-Managed.

Can a non managing member of a LLC?

Generally, a non-managing member of an LLC will be taxed on certain fringe benefits he or she receives, such as medical insurance paid by the company. A managing member, having his or her income considered as earned income rather than passive income, may be able to enjoy a tax-free receipt of fringe benefits.

Who is the manager of a limited liability company?

The manager of an LLC is responsible for the day-to-day operations of a limited liability company (LLC). The owners of an LLC are usually called members. LLCs can either be single-member or multi-member, depending on how many people own the company. Like any other business, LLCs use managers to help run the company.