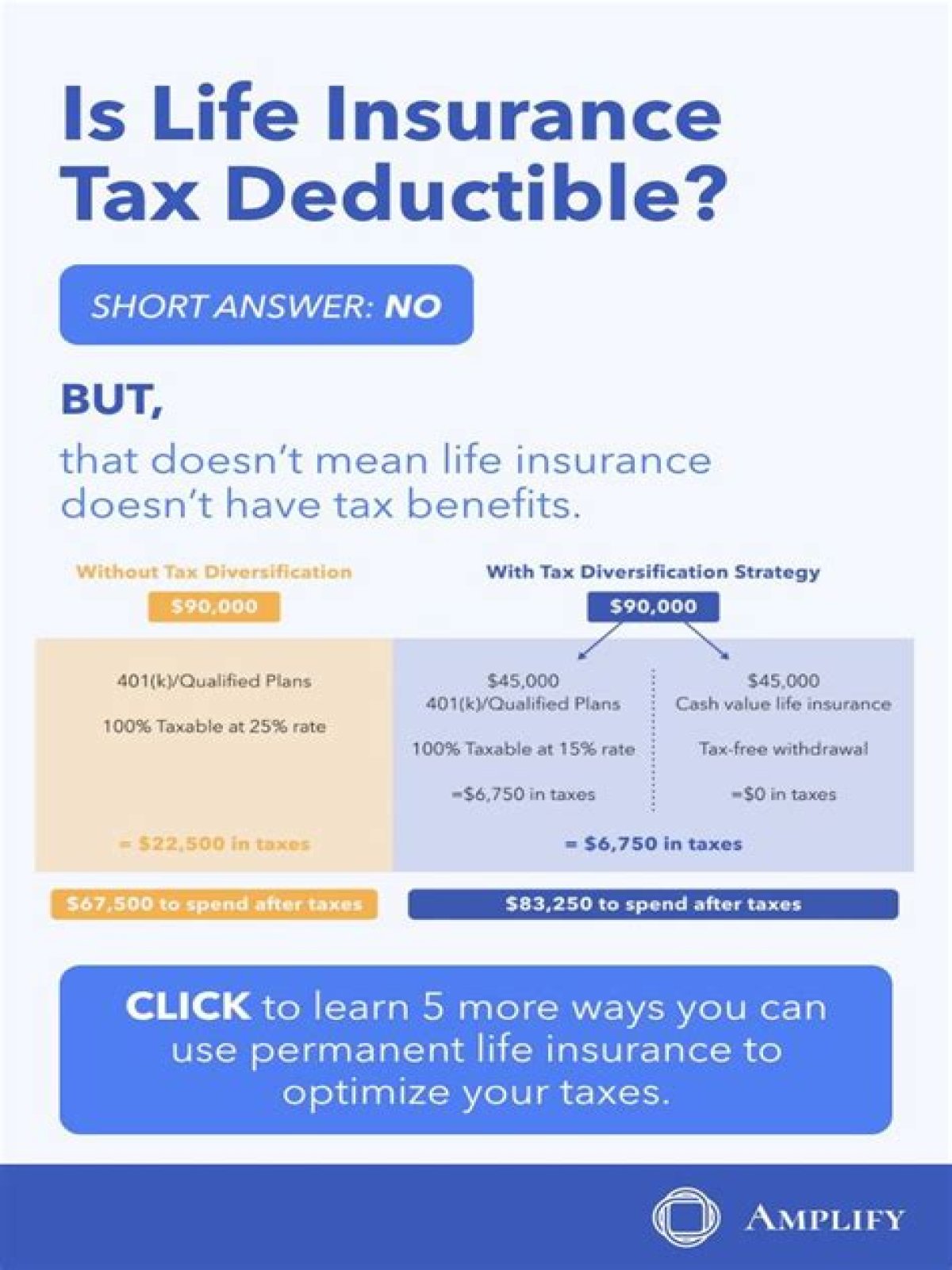

Usually, no. Life insurances such as death cover, TPD and trauma insurance is usually not tax deductible outside of super. However, the premiums you pay for income protection insurance are tax deductible if you buy the policy outside of your super fund.

Can I write off life insurance?

Unfortunately, your life insurance premiums are not tax-deductible, with rare exceptions. You can never deduct life insurance premiums from your taxes if you bought a policy for yourself (meaning it pays out upon your death). The only exceptions are when you pay premiums for someone else’s policy.

Is life insurance covered under 80C?

The investment in life insurance can be deducted up to Rs 1,50,000. Apart from several other items provided under section 80C, a taxpayer, being an individual or a Hindu Undivided Family (HUF), can claim deduction under section 80C in respect of premium on life insurance policy paid by him/it during the year.

Is total and permanent disability insurance tax deductible?

With total and permanent disablement (TPD) insurance cover, premiums are only deductible to the extent that the TPD insurance definition meets the ‘disability superannuation benefit’ definition in the Tax Act. Trauma insurance premiums are not tax deductible.

Are life insurance premiums tax free?

Life insurance premiums, under most circumstances, are not taxed (i.e., no sales tax is added or charged). These premiums are also not tax-deductible. If an employer pays life insurance premiums on an employee’s behalf, any payments for coverage of more than $50,000 are taxed as income.

When are life insurance premiums tax-deductible?

When are Life Insurance Premiums Tax-Deductible? As an individual, when you pay life insurance premiums, they are not deductible on your income tax return. However, if you are a business owner and you pay life insurance premiums on behalf your employees, your expenses may be deductible.

Can a business deduct the cost of life insurance?

However, if you are a business owner and you pay life insurance premiums on behalf your employees, your expenses may be deductible. If you pay premiums for your employee’s group life insurance, you can deduct the cost as a business expense on your statement of business income and expenses.

Can a LLC deduct life insurance premiums for employees?

While the IRS allows LLCs to deduct most of the insurance premiums associated with business expenses, life insurance premiums are not eligible. However, if you’re the owner of an LLC and are paying life insurance premiums for employees, these premiums may be deductible.

Are there any tax deductions for group life insurance?

Group life insurance is employer-subsidized life insurance. It’s typically offered as an employee benefit. The employer is listed as co-owner or at least a partial beneficiary of the policy. Since the employer stands to gain from this contract and it’s not an essential operating expense, premiums are not tax-deductible.