Hotel Occupancy Tax: 3% of the listing price including any cleaning fees, for reservations 29 days or shorter.

What is a business tax in TN?

Tennessee’s excise tax, which effectively is an income tax, is a flat 6.5% tax on net earnings from doing business in the state. All capital losses are claimed in the year incurred. Generally speaking, only general partnerships and sole proprietorships are exempt from the excise tax.

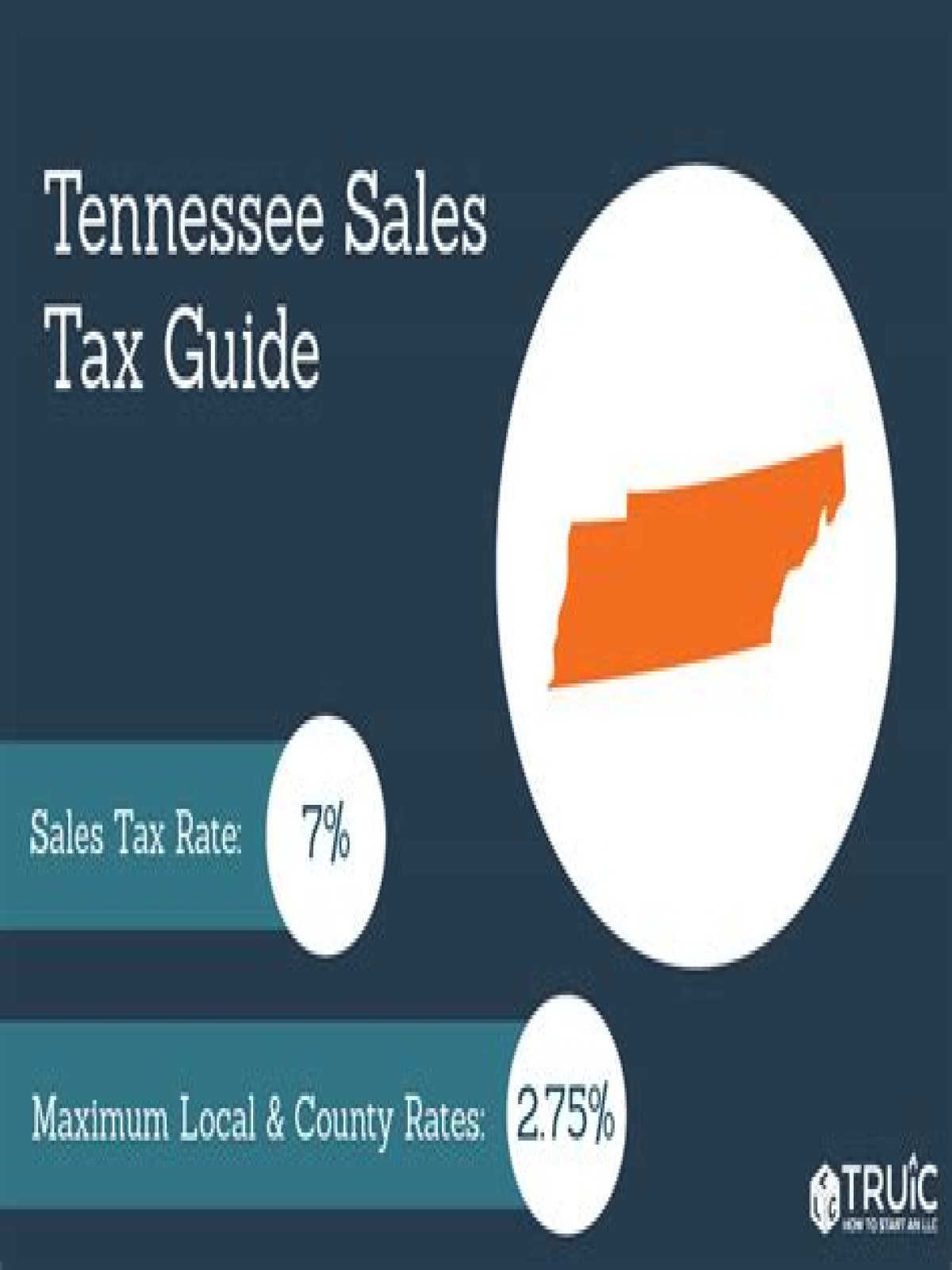

What is the sales tax in Tennessee 2019?

7% Overview. The sales tax is Tennessee’s principal source of state tax revenue accounting for approximately 60% of all tax collections. The sales tax is comprised of two parts, a state portion and a local portion. The general state tax rate is 7%.

What is the hotel tax in Pigeon Forge TN?

Hotel/Motel Tax is 2-1/2% (2.50%) of total gross hotel sales making a total of 12.25% sales tax to the customer. This is an add-on tax to the customer.

Who is eligible for property tax relief in Tennessee?

Property Tax Relief Tennessee state law provides for property tax relief for low-income elderly and disabled homeowners, as well as disabled veteran homeowners or their surviving spouses. This is a state program funded by appropriations authorized by the General Assembly.

Where to file addresses for taxpayers in Tennessee?

These Where to File addresses are to be used ONLY by TAXPAYERS AND TAX PROFESSIONALS filing individual federal tax returns in Tennessee during Calendar Year 2021. If you live in TENNESSEE …

Do you have to pay income tax in Tennessee?

Overview of Tennessee Taxes. Tennessee has no income tax on salaries and wages. There is a flat statewide rate for all income from interest and dividends.

How to get sales tax information in TN?

The Department of Revenue offers a toll-free tax information line for Tennessee residents. The number is (800) 342-1003. If calling from Nashville or outside Tennessee, you may call (615) 253- customers in the previous 12-month period are required to collect and remit Tennessee sales tax. Effective October 1, 2020 (Page 23)