IT-201-V (12/20) (back) Fee for payments returned by banks – The law allows the Tax Department to charge a $50 fee when a check, money order, or electronic payment is returned by a bank for nonpayment.

Do I have to file state taxes in NY?

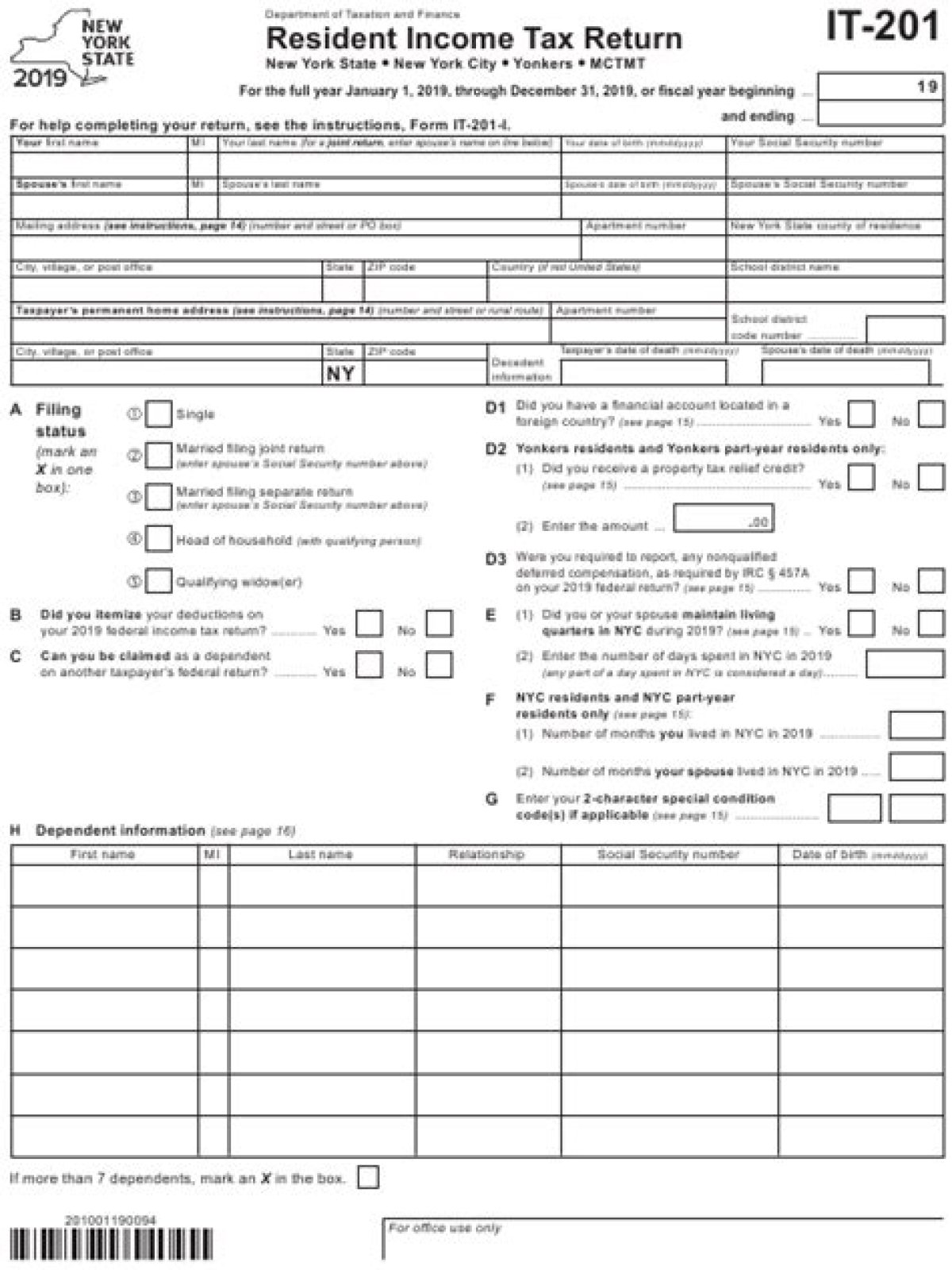

Generally, you must file a New York State resident income tax return if you are a New York State resident and meet any of the following conditions: You have to file a federal return. You want to claim a refund of any New York State, New York City, or Yonkers income taxes withheld from your pay.

How to file a New York state tax return?

Partnership instructions are in Form IT-204-I.) New York Partner’s Schedule K-1. (The instructions are for the partner. Partnership instructions are in Form IT-204-I.) Fiduciary Income Tax Return. Claim for Noncustodial Parent New York State Earned Income Credit. See updated information for instructions.

How to fill out Nys 45 withholding tax form?

Instructions on form New York State, City of New York, and City of Yonkers Certificate of Nonresidence and Allocation of Withholding Tax NYS-1 (Fill-in) NYS-1-I (Instructions) Return of Tax Withheld NYS-45 (1/19) (Fill-in) NYS-45-I (1/20) (Instructions)

How to obtain a New York State Withholding Exemption Certificate?

New York State Certificate of Exemption from Withholding (Native Americans) IT-2104-MS (Fill-in) Instructions on form New York State Withholding Exemption Certificate for Military Service Personnel IT-2104-P (Fill-in) Instructions on form Annuitant’s Request for Income Tax Withholding IT-2104-SNY (Fill-in) (2020) Instructions on form

How to file a tax extension in New York?

New York Tax Extension Tip: If you are a fiscal-year filer and you need a state tax extension, you must call the NY Department of Taxation and Finance. Click here for the telephone contact list. Form IT-370 (Application for Automatic Six-Month Extension of Time to File for Individuals):