North Carolina General Statute 55B requires any limited liability company organized after June 5, 1969 to qualify in North Carolina as a Professional Limited Liability Company (PLLC).

How do I set up a PLLC in NC?

Forming a PLLC in North Carolina (in 6 Steps)

- Step One) Choose a PLLC Name.

- Step Two) Designate a Registered Agent.

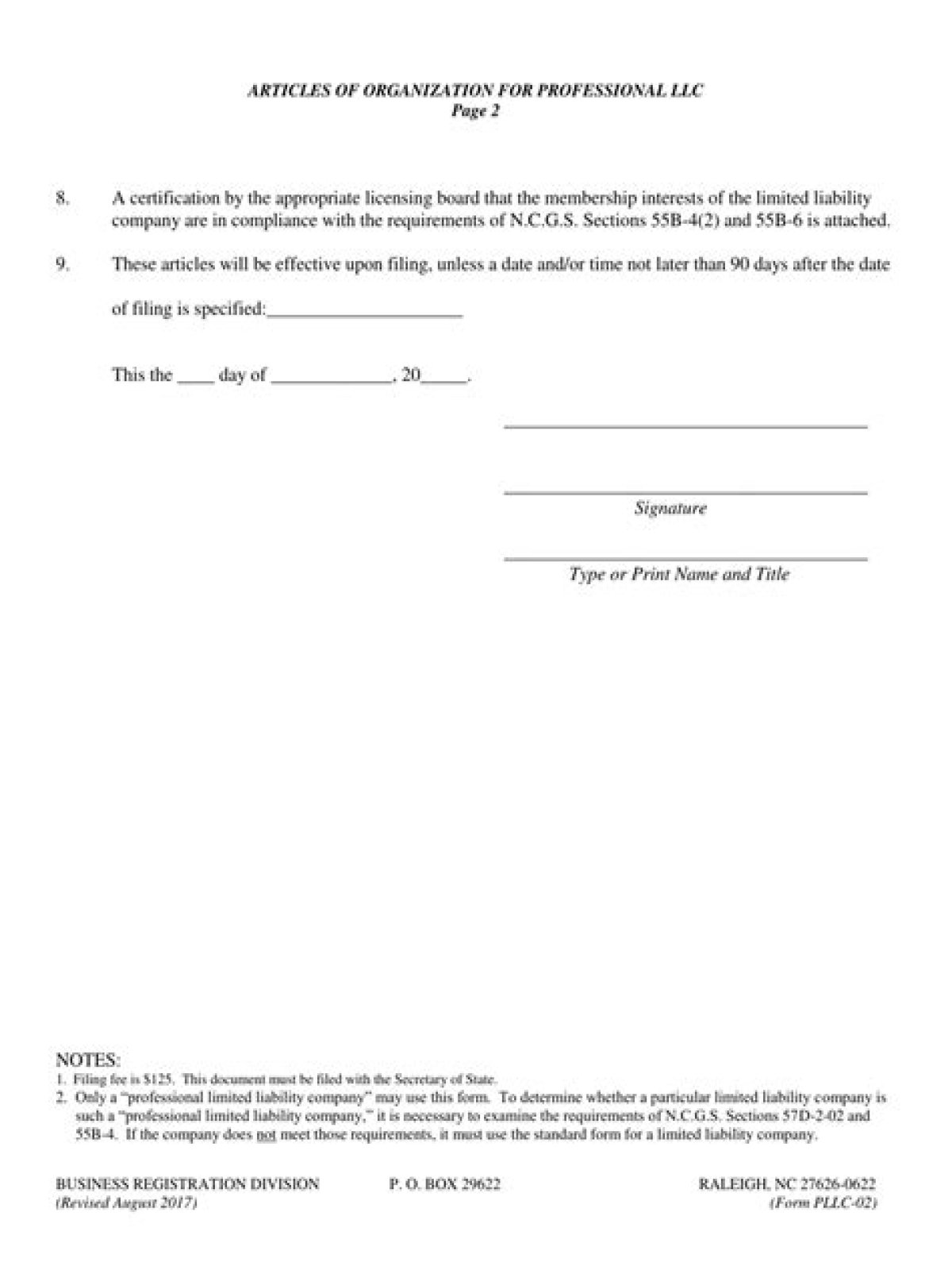

- Step Three) File Formation Documents with the State.

- Step Four) Create an Operating Agreement.

- Step Five) Handle Taxation Requirements.

- Step Six) Obtain Business Licenses and Permits.

Does NC have PLLC?

A North Carolina PLLC is a limited liability company (LLC) formed specifically by people who will provide North Carolina licensed professional services. Like other LLCs, PLLCs protect their individual members from people with claims for many (but not all) types of financial debts or personal injuries.

Do I have to have a pllc?

A Professional LLC (PLLC) is a type of Limited Liability Company formed for the purpose of providing professional services. Professional services are those where a person is licensed by the state for the service they provide. In most states, all members of a PLLC are required to be licensed.

What is the purpose of a PLLC?

A professional limited liability company (PLLC) is a business structure that offers personal asset protection for business owners in licensed occupations, such as medicine and law. Only recognized in some states, PLLCs are subject to the same laws as ordinary LLCs.

Can a company be an owner of a PLLC in NC?

No company may be an owner of the Professional Limited Liability Company (PLLC). In addition, all limited liability companies qualifying in North Carolina as professional limited liability companies must use the suffix “PLLC” after the company name.

What do you need to know about PLLC’s Corp?

A PLLC is a professional limited liability company. PLLC S Corp. Starting a combination PLLC S corp (Professional Limited Liability Company S corp) can provide many advantages for a business owner, particularly when it comes to taxes. Utilizing both business structures may be an ideal option for your company.

How to form a limited liability company in North Carolina?

Complete the North Carolina Secretary of State Form PLLC-01 (Application for Certificate of Authority- Professional Limited Liability Company) below – On the first part of Line 1, put your actual company name with “LLC” after it. On the second part of Line 1, put your company name with “PLLC” after it.

Can a third party company form a PLLC?

A few states require that a licensed professional be the main organizer of the professional limited liability company and sign all of the organizational documents, meaning a third-party company cannot form the PLLC. Then the documents may be filed with the secretary of state.