First, try contacting the financial institution that settled the debt. If that doesn’t work, you can request a wage and income transcript for the tax year in question from the IRS. You can request it online or by calling 800-908-9946.

Can you get duplicate 1099?

How To Get A Replacement 1099. Calling your client is usually the easiest way to get a copy of a lost Form 1099. Your customer or the issuer is required to keep copies of the 1099s it gives out to non-employees. You’ll want to ask for a copy of the one they already sent you.

What do I do if I get an incorrect 1099 C?

Contact the issuer. If they realize their mistake, they may be able to issue you a new 1099-C form right away. If they feel that they have reported the correct amount, you may need to set up a meeting or conference call to discuss how they came up with the total and request a statement or breakdown of the amount.

Where do the copies of a 1099 go?

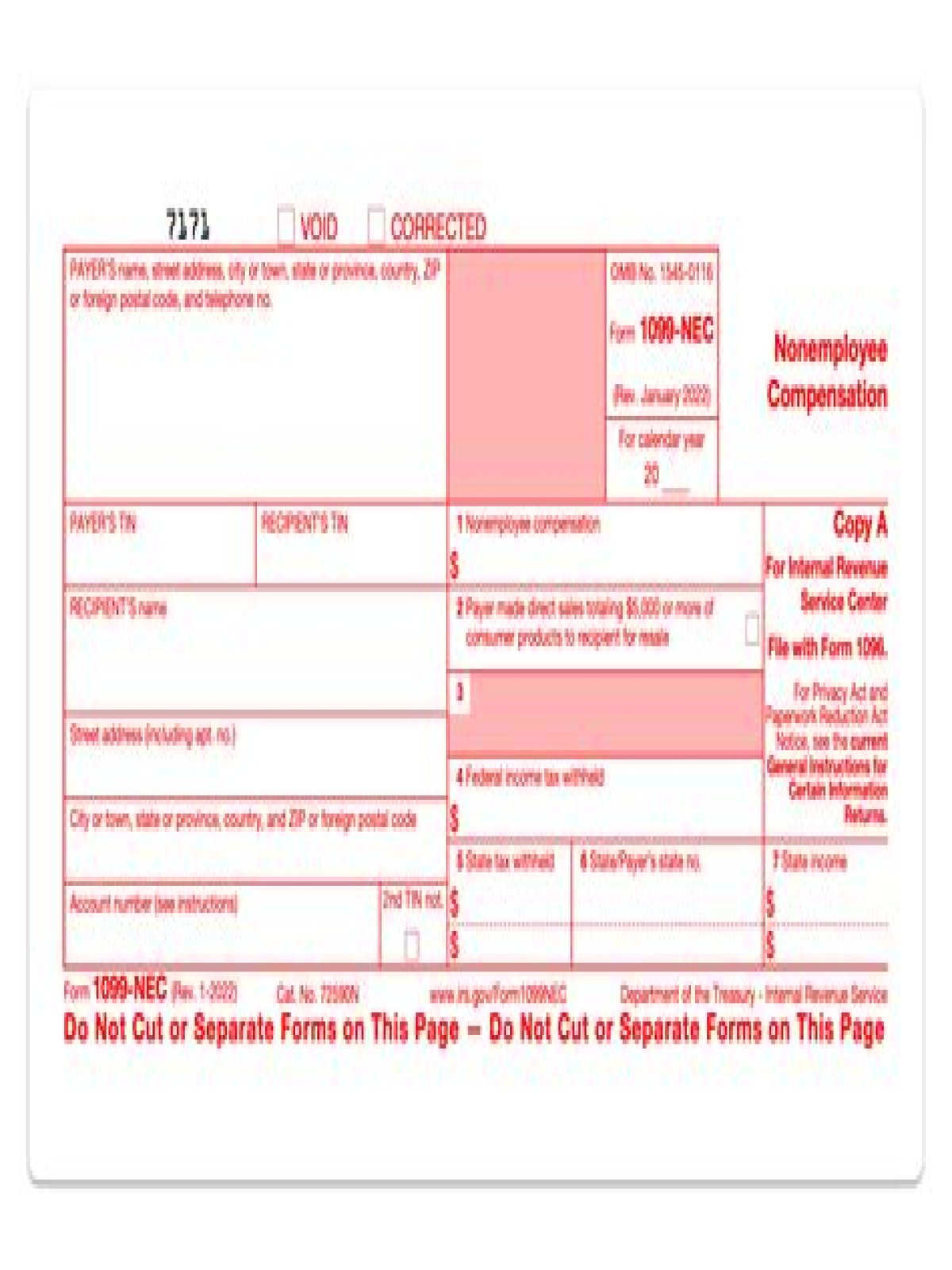

For many employers, all five copies of the 1099 form are essential: Copy A—Goes to the IRS. Copy 1—Goes to the state tax agency. Copy 2—Goes to the recipient. Copy B—Goes to the recipient. Copy C—Stays with employer for record keeping.

Is the 1099 copy 2 superfluous for the recipient?

The Payer and Payee are in a state in which there is no income tax assessed for that 1099 filing. Keep in mind that the recipient may be the resident of a different state. Are you sure you know the laws of that state well enough to know that the 1099 Copy 2 is superfluous for the recipient?

What do you need to know about 1099-C tax form?

Form 1099-C is used to report canceled debt, which is generally considered taxable income, to the IRS.

What does Form 1099-C cancellation of debt mean?

What Is Form 1099-C: Cancellation of Debt? Form 1099-C (entitled Cancellation of Debt) is one of a series of “1099” forms used by the Internal Revenue Service (IRS) to report various payments and transactions, excluding employee wages.