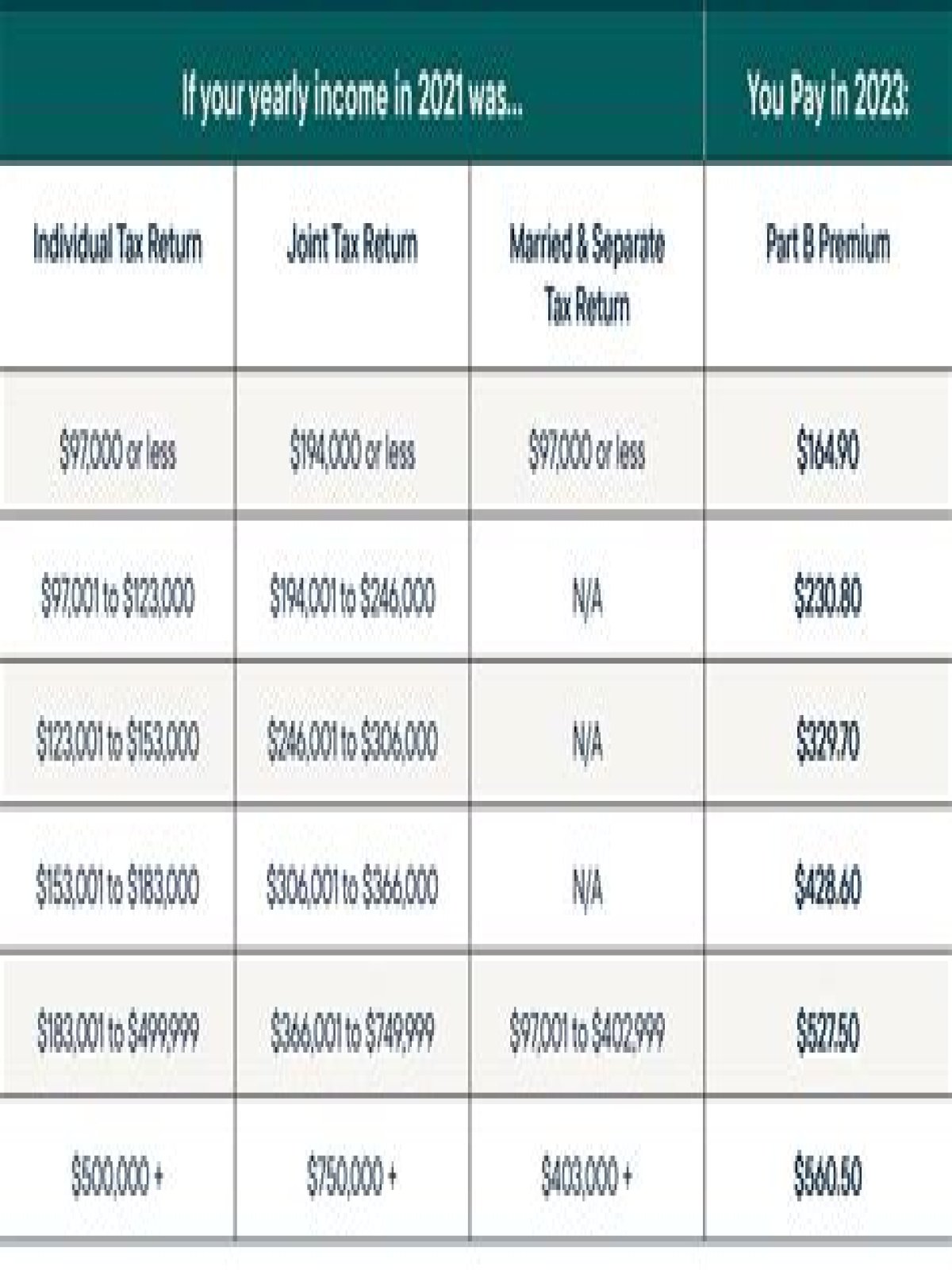

Most people get Part A without paying a premium, so there isn’t anything to deduct. If you do pay a Part A premium and aren’t getting Social Security benefits, you can deduct the premium. Part B premiums. Part B premiums are tax deductible as long as you meet the income rules.

Is Medicare Part F tax deductible?

Are Medicare Plan F premiums tax-deductible? When filing your federal tax return, Medicare Plan F premiums would be tax-deductible. Additionally, any medical expenses that you pay for out-of-pocket can also be deducted on your taxes.

Are Medicare deductibles tax deductible?

You can deduct medical premiums for Medicare and your other medical expenses. To do so, these must be more than a certain percentage of your adjusted gross income (AGI). Depending on your age and the tax year, this percentage is either: 7.5% of your AGI.

Can you deduct Medicare premiums on your income tax?

If you itemize deductions on your income taxes, Medicare costs, such as premiums and copayments, may be deductible. Your unreimbursed medical and dental expenses, including premiums, deductibles, copayments and other Medicare expenses, may be deductible to the extent that they exceed 7.5% of your adjusted gross income.

Are there any tax deductions for Medicare Part B?

Medicare Part B premiums are tax deductible as long as you meet the income rules. Medicare Part C premiums. You can deduct any Medicare Part C premiums if you meet the income rules. Medicare Part D premiums.

Are there any tax deductions for Medigap insurance?

Not all Medicare Supplement insurance expenses apply to tax deductions. Even though the cost of Medigap premiums is subject to tax deductions, not all expenses are deductible. All Medigap expenses are considered a medical expenditure and follow the guidelines for this type of deduction.

Can you deduct part C premiums on your taxes?

Part C premiums. You can deduct Part C premiums if you meet the income rules. Part D premiums. As with parts B and C, you can deduct your Part D premiums if you meet the income rules. Medigap. Medigap premiums can also be tax deductible.