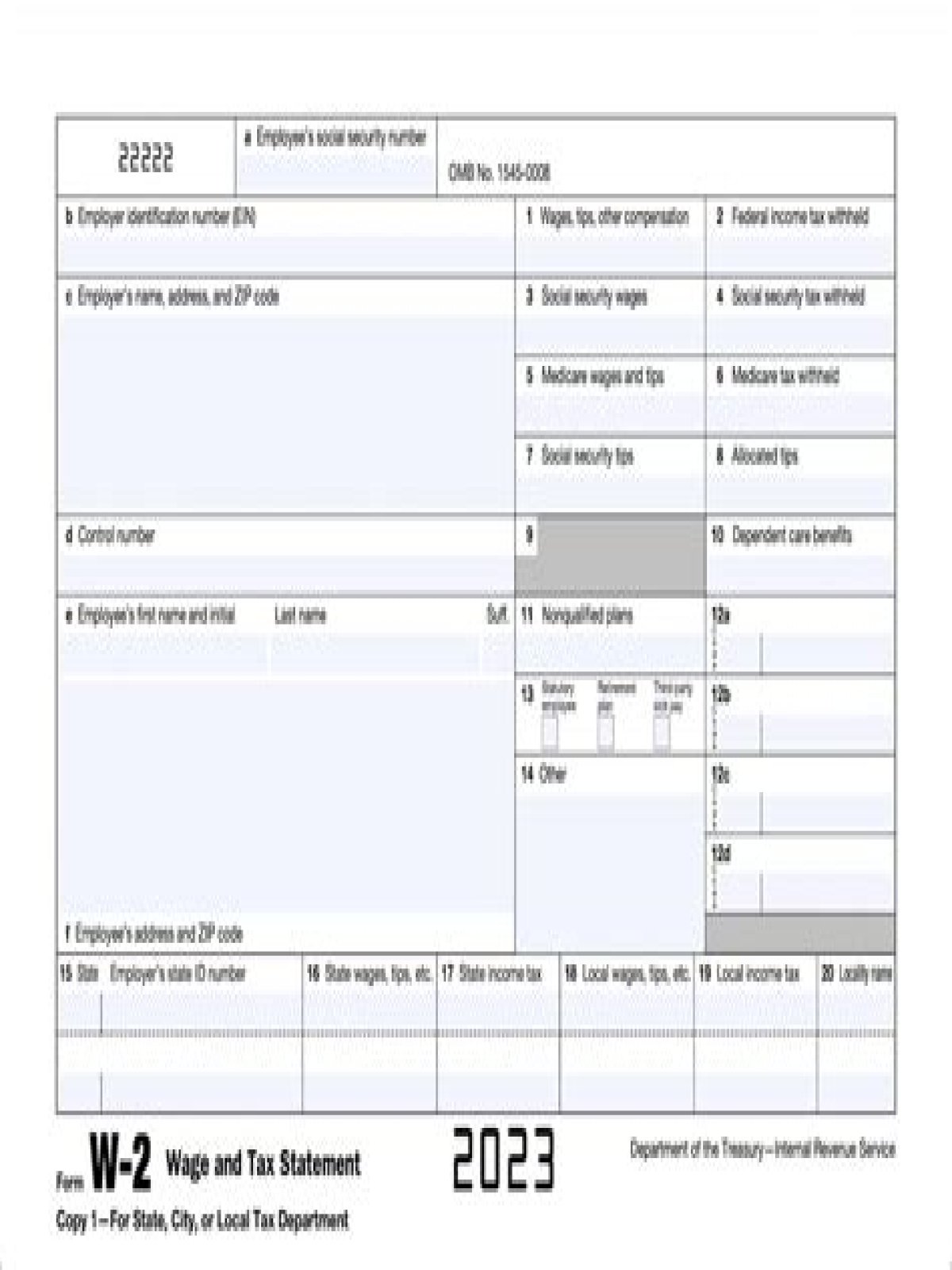

IRS Form W-2, the “Wage and Tax Statement,” reports an employee’s income from the prior year, how much tax the employer withheld and other information. Employers send employees a Form W-2 in January (and a copy to the IRS). Employees use Form W-2 to prepare their tax returns.

Do I have a W-2 form?

The IRS requires employers to report wage and salary information for employees on Form W-2. To insure you have it in time, the IRS requires your employer to send you a W-2 no later than January 31 following the close of the tax year, which is usually December 31. You should only receive a W-2 if you are an employee.

Are there different types of w2 forms?

Condensed W-2 Forms: These forms combine different W-2 Copies on the same page, all for the same employee. W-2 Copies B, C, 2 can all appear on the same page, depending on how many parts you need to file.

What do you need to know about W-2 forms?

Form W-2 is filed by employers to report wages, tips, and other compensation paid to employees as well as FICA and withheld income taxes.

What are the most common errors on a W2 form?

Common W-2 errors include using the wrong year’s form, failing to include information, putting information in the wrong box, and failing to stop Social Security withholding at the maximum for the year. 13 Once you have created W-2 forms, your next decision is how to distribute them to employees.

Do you have to sign the W-2 Transmittal Form?

The W-3 form is only used when you are sending paper copies of the W-2 form to the Social Security Administration. If you decide to file employee W-2 forms with the Social Security Administration online, you don’t have to submit a W-3 transmittal form. If you are sending W-2 and W-3 forms by mail, you must sign the W-3 form.

What to do if you Cant get Your W-2 from your employer?

The IRS might ask you to file a Form 4852 with your tax return if you’re unable to get your W-2 from your employer. This form acts as a substitute for Form W-2. You can also ask your employer to correct any wrong information on your Form W-2.