2014 Form 1099-R 2014 1099-R Instructions for Recipient Generally, distributions from pensions, annuities, profit-sharing and retirement plans (including section 457 state and local government plans), IRAs, insurance contracts, etc., are reported to recipients on Form 1099-R. Qualified plans.

When to file a 1099-R pension distribution?

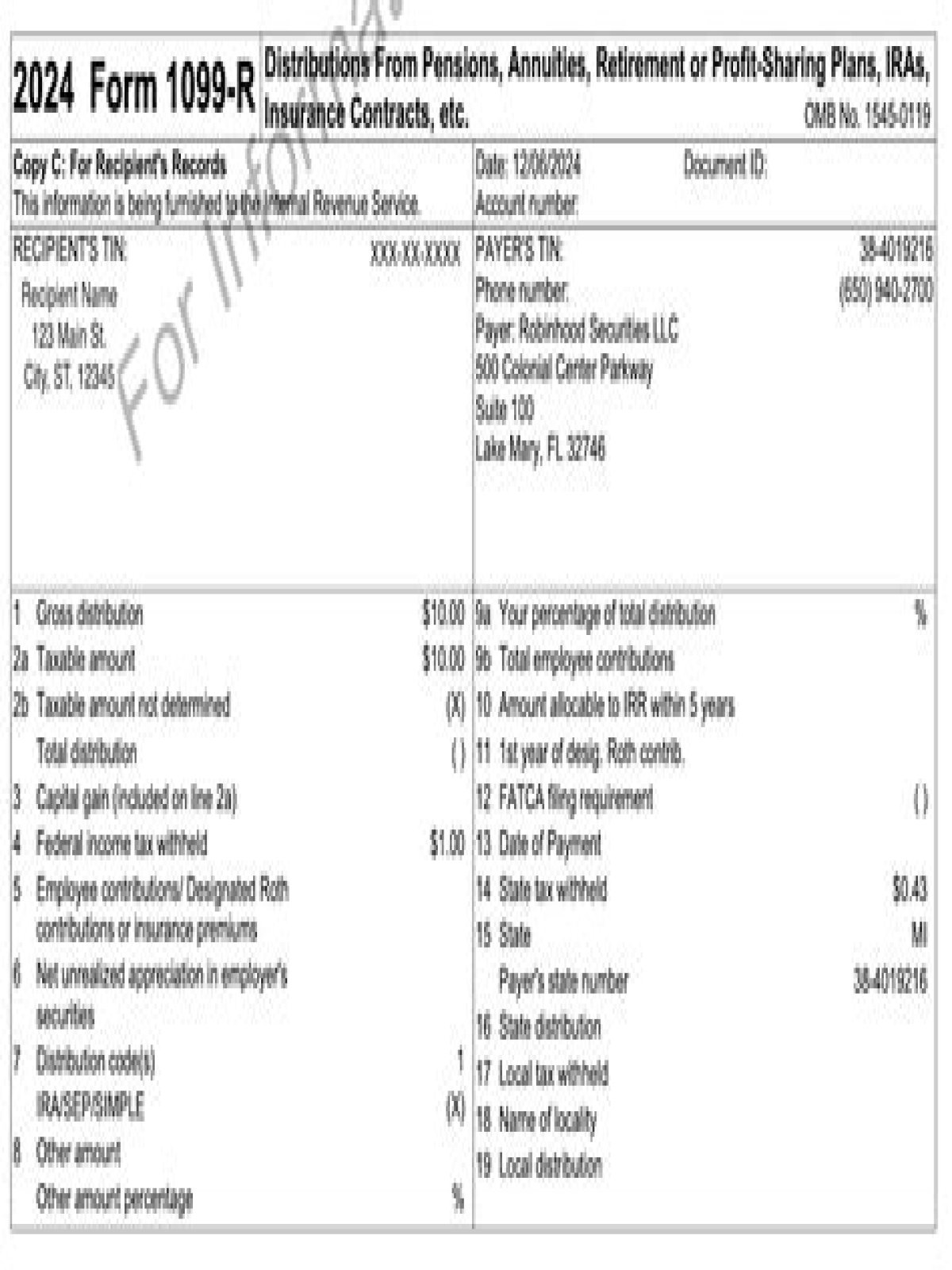

About Form 1099-R, Distributions From Pensions, Annuities, Retirement or Profit-Sharing Plans, IRAs, Insurance Contracts, etc. File Form 1099-R for each person to whom you have made a designated distribution or are treated as having made a distribution of $10 or more from:

What does Form 1099-R stand for in IRS?

Form 1099-R, 2015. In the United States, Form 1099-R is a variant of Form 1099 used for reporting on distributions from pensions, annuities, retirement or profit sharing plans, IRAs, charitable gift annuities and Insurance Contracts.

What do I need to file a 1099-R for?

File Form 1099-R for each person to whom you have made a designated distribution or are treated as having made a distribution of $10 or more from: Profit-sharing or retirement plans. Any individual retirement arrangements (IRAs). Annuities, pensions, insurance contracts, survivor income benefit plans.

When to file Form 1099-MISC 2014 miscellaneous income copy B?

Form 1099-MISC 2014 Miscellaneous Income Copy B For Recipient Department of the Treasury – Internal Revenue Service This is important tax information and is being furnished to the Internal Revenue Service. If you are required to file a return, a negligence penalty or other sanction may be imposed on you if this income is taxable and the IRS

When to mail 1099 forms to independent workers?

A. Mailing form 1099 to the worker. January 31, 2019, is the deadline for furnishing the 1099-MISC forms to independent contractors and service providers you paid money to during 2018. Mail a copy of the 1099 form to the independent worker or service provider by that date.

What kind of income do I report on 1099-MISC?

Simply put, a 1099 employee is a self-employed contractor or business owner as opposed to one of your employees. What type of income do I report on a 1099 form? The 1099-MISC should be used for reporting payments to independent workers — not payments to employees. For employees, you use form W-2 instead to report employment income you paid them.