Summary: Kansas has passed an economic nexus law, effective July 1, 2021, requiring that all out-of-state sellers and marketplace facilitators register for the collection and remittance of sales and compensating use tax if they have over $100,000 in gross sales during the previous or current calendar year.

Does Kansas have franchise tax?

Kansas Department of Revenue — Franchise Tax (Maximum tax of $20,000) Business entities that have $1 million of net worth or more in the state must pay to the Kansas Department of Revenue for tax year 2010 a franchise tax of . 03125 percent of the total net worth.

Does Kansas require state income tax?

Kansas residents and nonresidents of Kansas earning income from Kansas sources are required to annually file an income tax return, K-40. Kansas income tax conforms to many provisions of the Internal Revenue Service.

What is economic nexus income tax?

Nexus is defined as a business’s connection to or presence in a state sufficient to be subject to state taxes. This is generally a minimum threshold. Once this level is passed, the state may be able to tax the business’s income and/or require that business to collect and remit state sales tax.

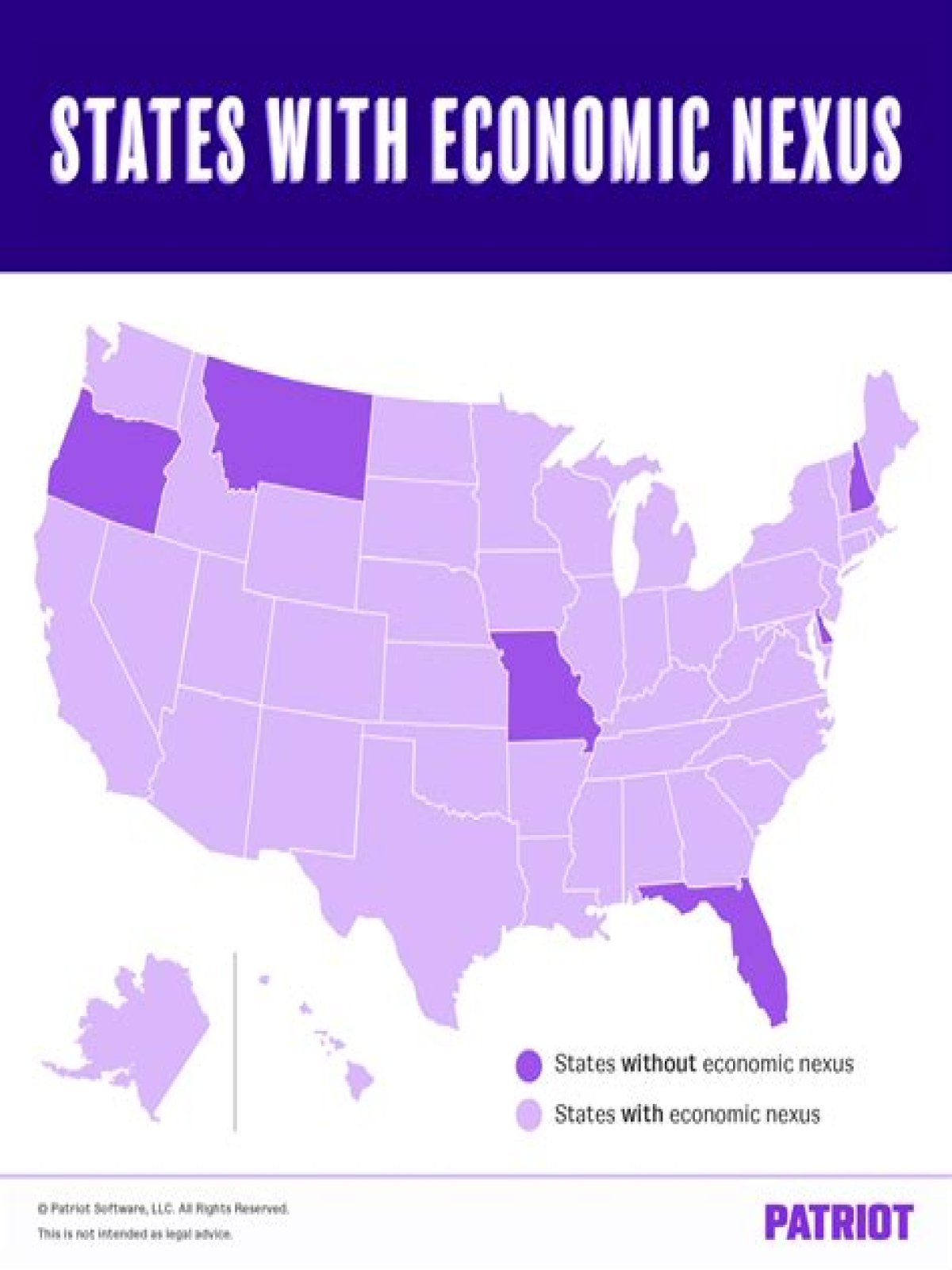

What states have economic nexus?

Economic Nexus State Guide

| State | Effective Date | Threshold |

|---|---|---|

| Texas | October 1, 2019 | $500,000 |

| Utah | January 1, 2019 | $100,000 or 200 or more separate transactions |

| Vermont | July 1, 2018 | $100,000 or 200 or more separate transactions |

| Virginia | July 1, 2019 | $100,000 or 200 or more separate transactions |

What is the business tax rate in Kansas?

4% Kansas corporations are subject to Kansas’s corporate income tax at the flat 4% rate, with an additional 3% surtax on income over $50,000.

How is corporate income tax assessed in Kansas?

Corporate Income. Corporate income tax is assessed against every corporation doing business in Kansas or deriving income from sources within Kansas. A Kansas corporation income tax return must be filed by all corporations doing business within or deriving income from sources within Kansas who are required to file a federal income tax return,…

Do you have to file a Kansas corporation tax return?

A Kansas corporation income tax return must be filed by all corporations doing business within or deriving income from sources within Kansas who are required to file a federal income tax return, whether or not a tax is due. Do I need to file a separate election to be treated as a Subchapter S corporation?

Can a foreign company have a state nexus?

The aggressive application of state nexus standards may surprise foreign companies that may be under the impres- sion that the existence of a tax treaty between their home jurisdiction and the United States avoids state income tax. As this article will describe, however, the states are generally not parties to U.S. tax treaties.

When do you have to pay sales tax in Kansas?

Economic Nexus Threshold Beginning July 1, 2021, retailers that have in excess of $100,000 of cumulative gross receipts from Kansas customers in the current or immediately preceding calendar year are considered a “retailer doing business in this state,” and are subject to a requirement to register in the state and to collect and remit sales tax.