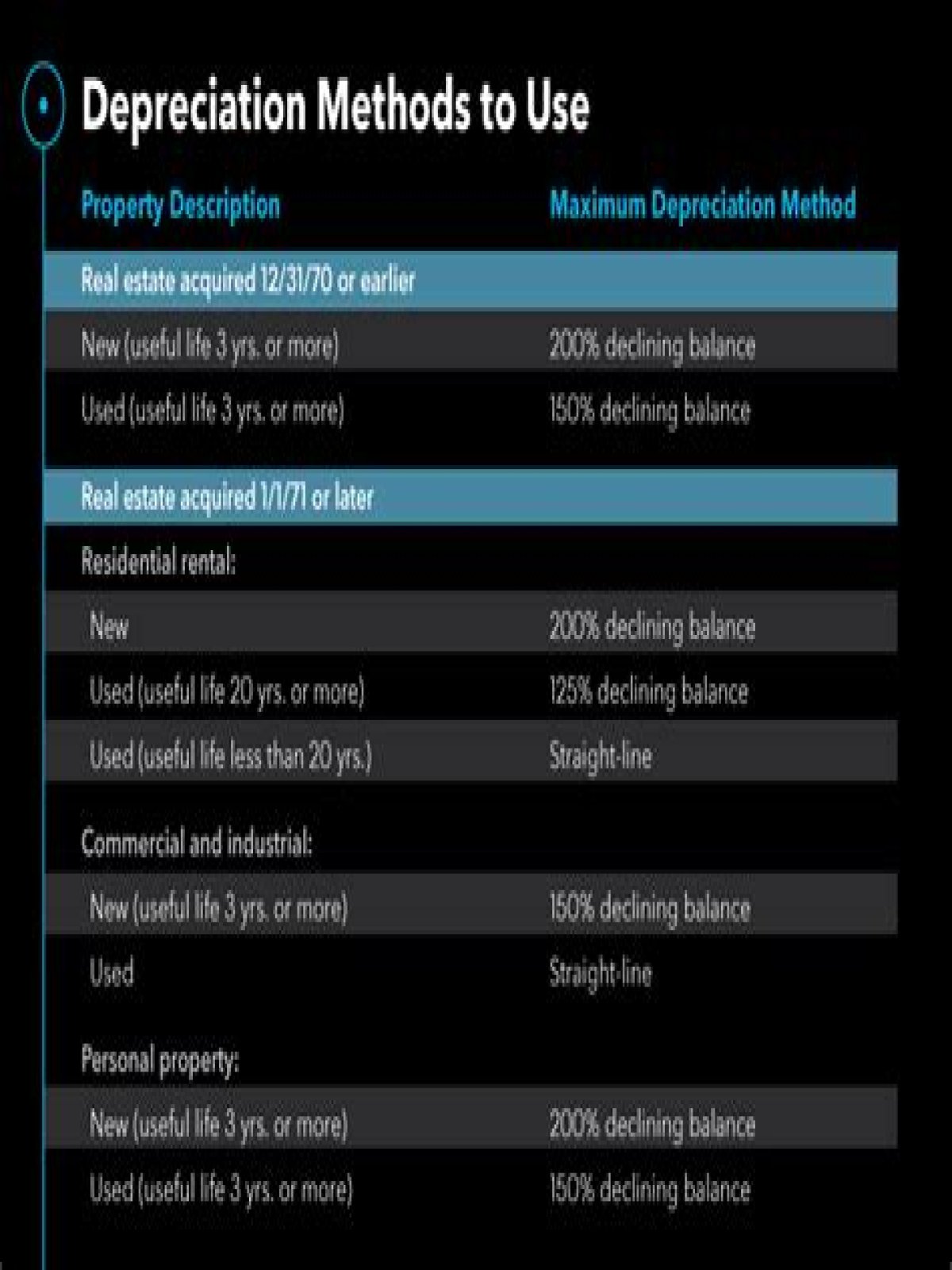

California does not conform to either the Accelerated Cost Recovery System (ACRS) or Modified Accelerated Cost Recovery System (MACRS) systems of depreciation for corporate tax purposes. California conforms only to the depreciation methods specified in IRC §167, prior to the enactment of the ACRS and MACRS systems.

In which of these areas of depreciation has California conformed to federal law?

California law conforms to federal law for the following: 2003‑75 for more information. The additional first-year depreciation, or the election to expense the cost of the property as provided in IRC Section 179, with modification.

Does California conform to qualified improvement property?

Under the CARES Act, the depreciation method for QIP changed from 39-year property to 15-years Modified Accelerated Cost Recovery System (MACRS) property and thus makes it eligible for 100-percent bonus depreciation for federal tax. California does not conform to the federal treatment of bonus depreciation or the CARES …

Does California conform 199A?

199A, “Qualified Business Income,” under which a non-corporate taxpayer, including a trust or estate, who has qualified business income (QBI) from a partnership, S corporation, or sole proprietorship is allowed a deduction. California does not conform to the deduction for qualified business income of pass-through …

Does California allow 2019 bonus depreciation?

UPDATED 7/18/19: Conformity effective for tax years beginning on or after January 1, 2019, but taxpayers can elect to have conformity apply to tax years beginning after January 1, 2018. Bonus depreciation increased to 100% and applies to both new and used property.

How does California conform to federal depreciation rules?

California Corporate: California does not conform to the federal treatment of bonus depreciation. California provides its own set of rules for calculating depreciation and requires an addition modification for bonus depreciation deducted at the federal level.

Are there any tax conformity changes in California?

These provisions will simplify tax compliance for California taxpayers as differing federal and California tax reporting for certain transactions will no longer be required. Unfortunately, California has yet to conform to most of the changes enacted by the TCJA. The conformity changes included in AB 91 are highlighted below.

Can a California corporation choose the class life depreciation range?

The federal Class Life Asset Depreciation Range (ADR) System provisions, which specifies a useful life for various types of property. However, California law does not allow the corporation to choose a depreciation period that varies from the specified asset guideline system.

What are the rules for bonus depreciation in California?

Corporate: California does not conform to the federal treatment of bonus depreciation. California provides its own set of rules for calculating depreciation and requires an addition modification for bonus depreciation deducted at the federal level. Cal.