$11.58 million For 2020, the exemption was $11.58 million per individual, or $23.16 million per married couple. For 2021, an inflation adjustment has lifted it to $11.7 million per individual and $23.4 million per couple. For 2020 and 2021, the top estate-tax rate is 40%. The increase in the exemption is set to lapse after 2025.

How long do you have to pay federal estate tax?

The due date of the estate tax return is nine months after the decedent’s date of death, however, the estate’s representative may request an extension of time to file the return for up to six months.

How is federal estate tax calculated?

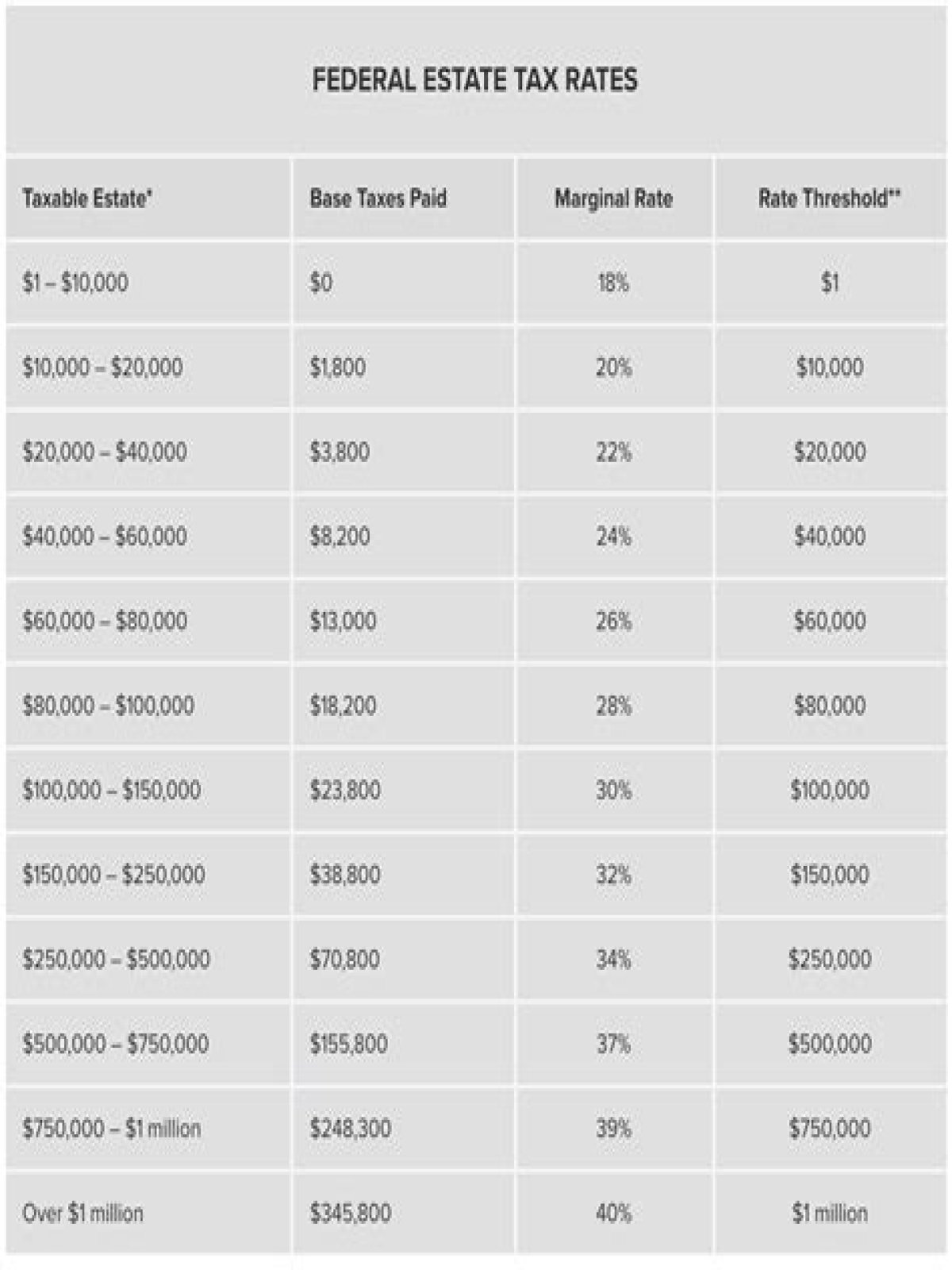

The federal estate tax is owed by only about 1 out of 700 estates. The estate tax is calculated by adding together the decedent’s taxable estate (the gross estate less allowable deductions) and the decedent’s adjusted taxable gifts to determine the estate tax base (see below).

What’s the federal tax rate on an estate above$ 11.4 million?

The portion of the estate that’s above that $11.4 million threshold will ostensibly be taxed at the top federal statutory estate tax rate of 40%. In practice, however, various discounts, deductions, and loopholes allow skilled tax accountants to pare the effective rate of taxation to well below that level.

How does the federal estate tax exemption work?

How the Exemption Works. The gross value of your estate must exceed the exemption amount for the year of your death before estate taxes become due. Even then, only the value over the exemption is taxable.

What kind of taxes do you have to pay on an estate?

There are three types of taxes you can pay: income tax, inheritance tax and estate tax. Estate tax is levied on what you pass on after your death. These items can include cash, retirement accounts, property and more. Currently, you don’t have to pay federal estate tax if the estate is less than $5.45 million for 2016.

How much is excluded from federal estate tax?

The federal estate tax exemption is the amount excluded from estate tax when a person dies. For 2021 that amount is $11.7 million. Here’s how it works.