Independent contractors who earn less than $600 from a single client or agency still have to pay applicable state and federal taxes on that income even though they may not receive a 1099-MISC form. Now I’m confused. Do I have to complete a 1099-MISC reporting form on personal services of more than $600 as well?

What are the rules for giving out a 1099 tax form?

In addition to giving independent contractors 1099-Misc forms, you need to give a 1099-Misc for services, rent of office space or machinery, prizes and awards and pension-sharing plans.

What’s the title of a 1099 for a business?

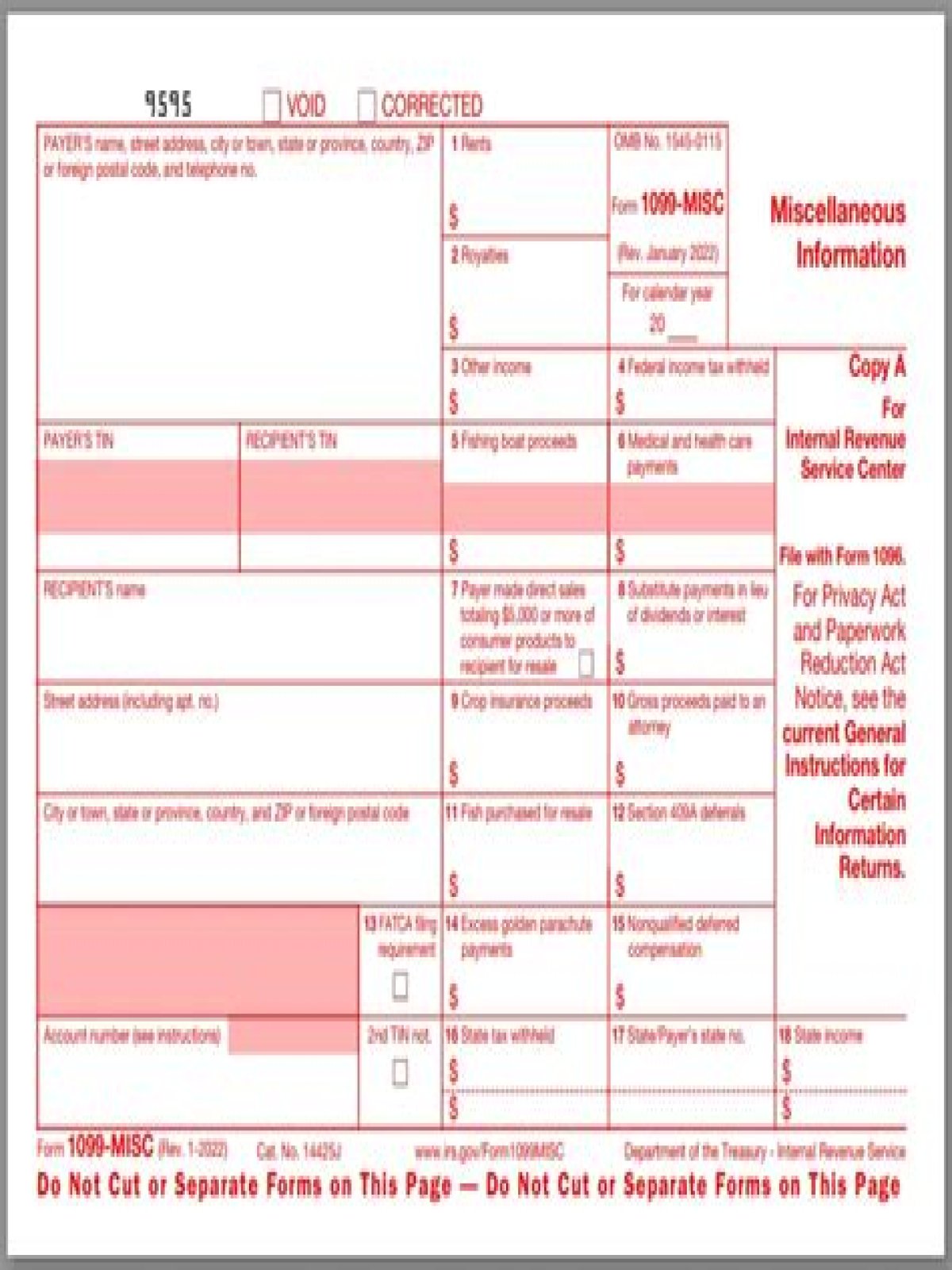

Also, the title and purpose of Form 1099-MISC has been changed from Miscellaneous Income to Miscellaneous Information. 1099-NEC. Businesses will now file Form 1099-NEC for each person in the course of the payor’s business to whom they paid at least $600 during the year.

Why is 1099-K important for small business?

Since the 1099-K is an accountability tool for the IRS, it’s important for you to make sure your business income reflects the accurate amount of money you received and takes into account online transactions (as listed on your 1099-K forms) as well as income received in the form of cash and checks.

When do you have to mail out 1099s to vendors?

Taxpayers are required to issue and mail out all Form 1099-NEC and 1099-MISC to vendors by January 31st. (Wish you would have kept better records when paying folks during 2020?) Deadline to IRS.

What do you need to know about the 1099 form?

You can think of the 1099 form as the equivalent of a W-2 form for independent workers; both forms are information returns. Whether you hire people to perform services that help your business run smoothly, or you receive payment for services as an independent contractor, 1099-MISC is the form you’ll need. When do I have to report 1099 income?