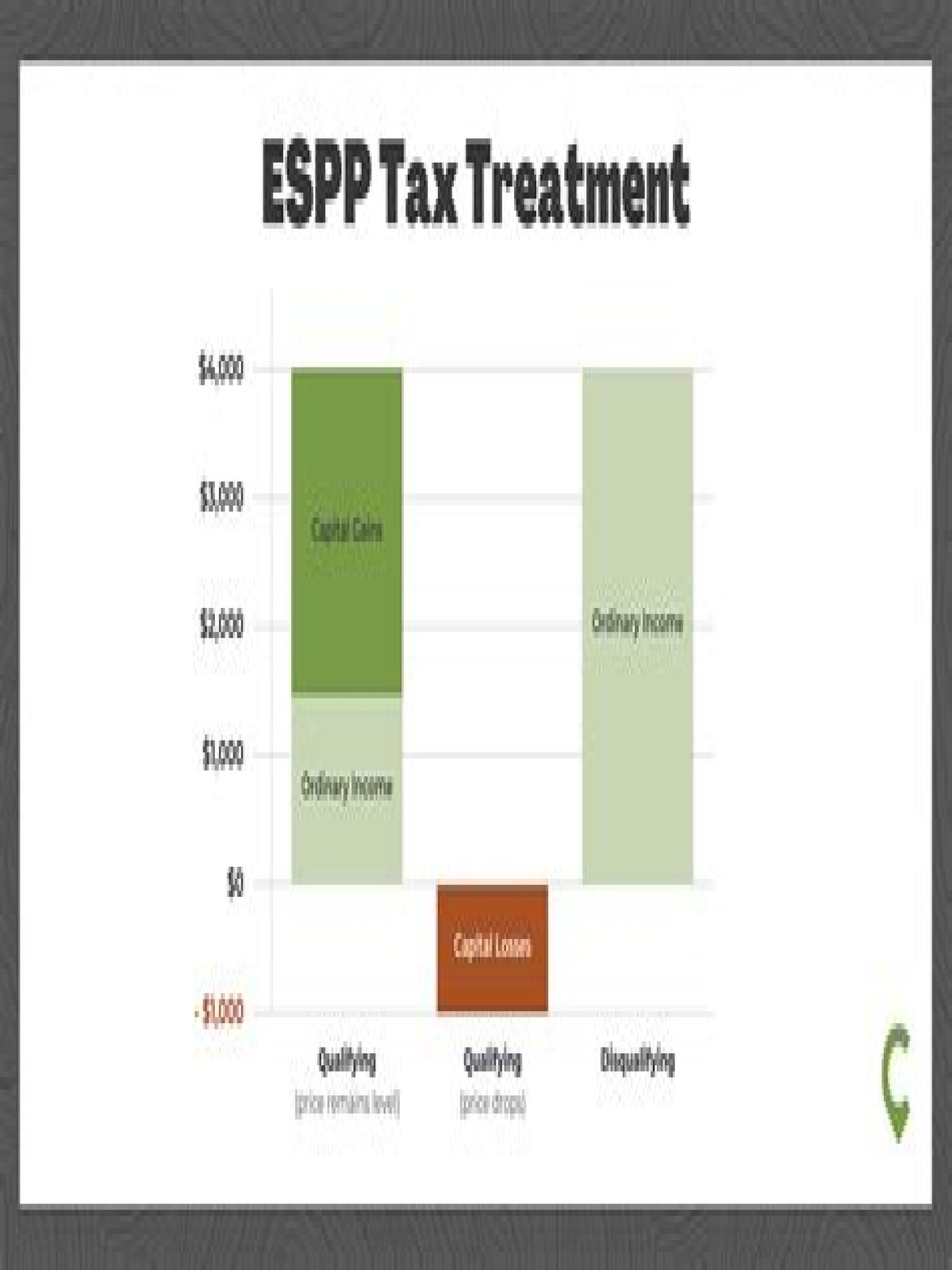

When you buy stock under an employee stock purchase plan (ESPP), the income isn’t taxable at the time you buy it. You’ll recognize the income and pay tax on it when you sell the stock. When you sell the stock, the income can be either ordinary or capital gain.

How is ESPP contribution calculated?

1. You contribute to the ESPP from 1% to 10% of your salary. The contribution is taken out from your paycheck. This is calculated on pre-tax salary but taken after tax (unlike 401k, no tax deduction on ESPP contributions).

How do you calculate adjusted cost basis for ESPP?

The market price was $10/share when these 1,000 shares were purchased. Your employer added the discount as income to your W-2. Therefore your true basis is $10 * 1,000 = $10,000. If you didn’t sell all the shares purchased in that lot, multiply the number of shares you sold by $10.

Are employee stock purchase plans Pretax?

Unlike pre-tax contributions to a 401(k), contributions to an ESPP are made with after-tax dollars. This means a “true” reduction of $22,500 per year of cash flow from your paycheck.

Are ESPP plans worth it?

Are ESPPs good investments? These plans can be great investments if used correctly. Purchasing stock at a discount is certainly a valuable tool for accumulating wealth, but comes with investment risks you should consider. An ESPP plan with a 15% discount effectively yields an immediate 17.6% return on investment.

Do I use adjusted cost basis for ESPP?

ESPP shares are covered securities as defined by the IRS. Schwab is required to report the purchase price as the cost basis on ESPP sales; Schwab does not adjust the cost basis price to account for income that may be reported on the W-2.

Does ESPP show up on w2?

When you sell ESPP shares, your employer reports your ESPP income as wages in box 1 of your Form W-2. Whether you had a qualified or disqualified disposition determines how much of the income is on your W-2. The tax amounts, along with the value of your shares, may be reported on your W-2.

Should you sell ESPP right away?

If you are risk-averse, you might consider selling your ESPP shares right away so you don’t have overexposure in one stock, particularly that of your own employer. However, selling too early may have unfavorable tax consequences compared to holding the stock for a longer period of time.

What is a good percentage to contribute to ESPP?

If you haven’t ever contributed to your company’s ESPP before, select a percentage of your pay that feels comfortable (maybe 1-5% of your salary). This will help you get acquainted with how ESPPs work and will give you confidence to increase the percentage later.

Is ESPP taxed twice?

Paying tax twice on the discount. With ESPPs, the purchase discount for tax purposes is reported to the IRS on Form W-2 and is included in your income in the year of sale.

What happens to ESPP when you leave?

If I leave the company, what happens to the money that has been deducted from my paycheck to purchase ESPP shares? You will continue to own stock purchased for you during your employment, but your eligibility for participation in the plan ends. The money that you paid is not saved for purchase to the six-month point.