In contrast to public companies and nonprofits, there is no easily searchable database that provides EIN information for private companies. To find this EIN information, procure a W-2 statement issued by the company, and look at box B on the form. The EIN appears just below the company’s name and address.

Is EIN information public?

If you are a registering as a business, the Employer Identification Number is public information. If you are an individual registering as a business and providing your Social Security Number (SSN) as your EIN, it will also be viewable by the public, but will be referred to as an EIN, not a SSN.

Can a sole proprietor get an EIN number?

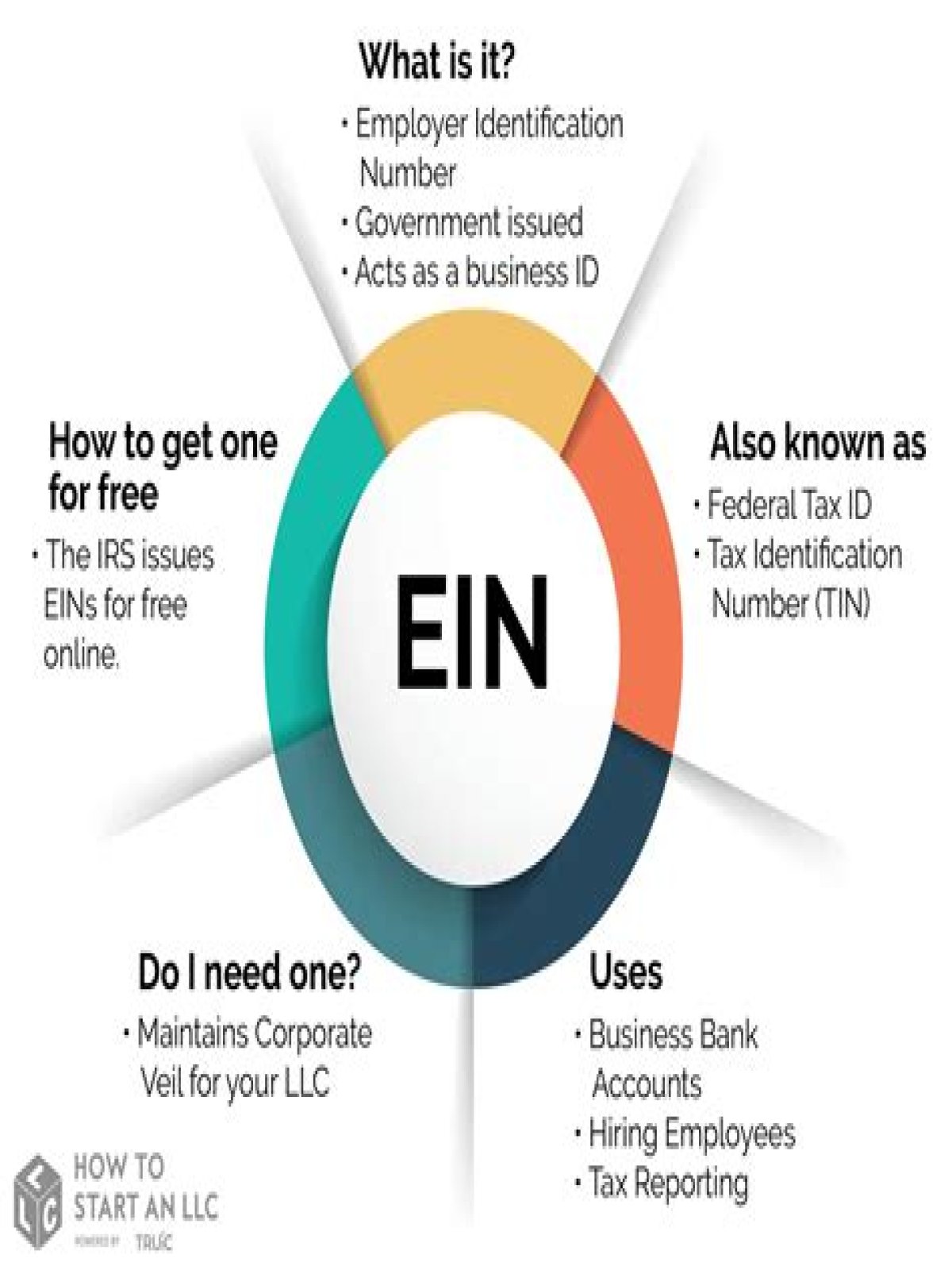

A sole proprietor can use his personal SSN rather than obtain an EIN. Furthermore, a partnership or LLC with no employees need not obtain an EIN. However, once the business hires employees, they must obtain one. Furthermore, corporations must always obtain an EIN.

Do you need an EIN to start a business?

Just like you need to incorporate your business or form an LLC, acquiring your EIN is a necessary step in establishing your business. For many businesses, having an EIN is a legal requirement, though there are some exceptions.

Where can I get an IRS Ein number?

An EIN, also referred to an Employer Identification Number, is issued by the Internal Revenue Service (IRS). This is essentially a business social security number used for tax purposes. It is simple to obtain an EIN; you can visit the IRS website and obtain your EIN immediately after submitting an online application.

Do you have to share your Ein with a client?

You are not required to share your EIN. It is public record and your client could find it on their own if they wanted to, however it is still important to protect your EIN to avoid fraud. It is your decision whether to share it with that client or not.