You can access your federal tax account through a secure login at Once in your account, you can view the amount you owe along with details of your balance, view 18 months of payment history, access Get Transcript, and view key information from your current year tax return.

How much federal tax do I owe without penalty?

Generally, most taxpayers will avoid this penalty if they owe less than $1,000 in tax after subtracting their withholdings and credits, or if they paid at least 90% of the tax for the current year, or 100% of the tax shown on the return for the prior year, whichever is smaller.

How is the total amount of tax owed calculated?

Your total tax owed is based on your adjusted gross income (AGI). When you complete your Form 1040 and its attached schedules, you enter all of your income from various categories, such as wages, interest and dividends, and business income.

Do you pay taxes on the first$ 9, 875 in income?

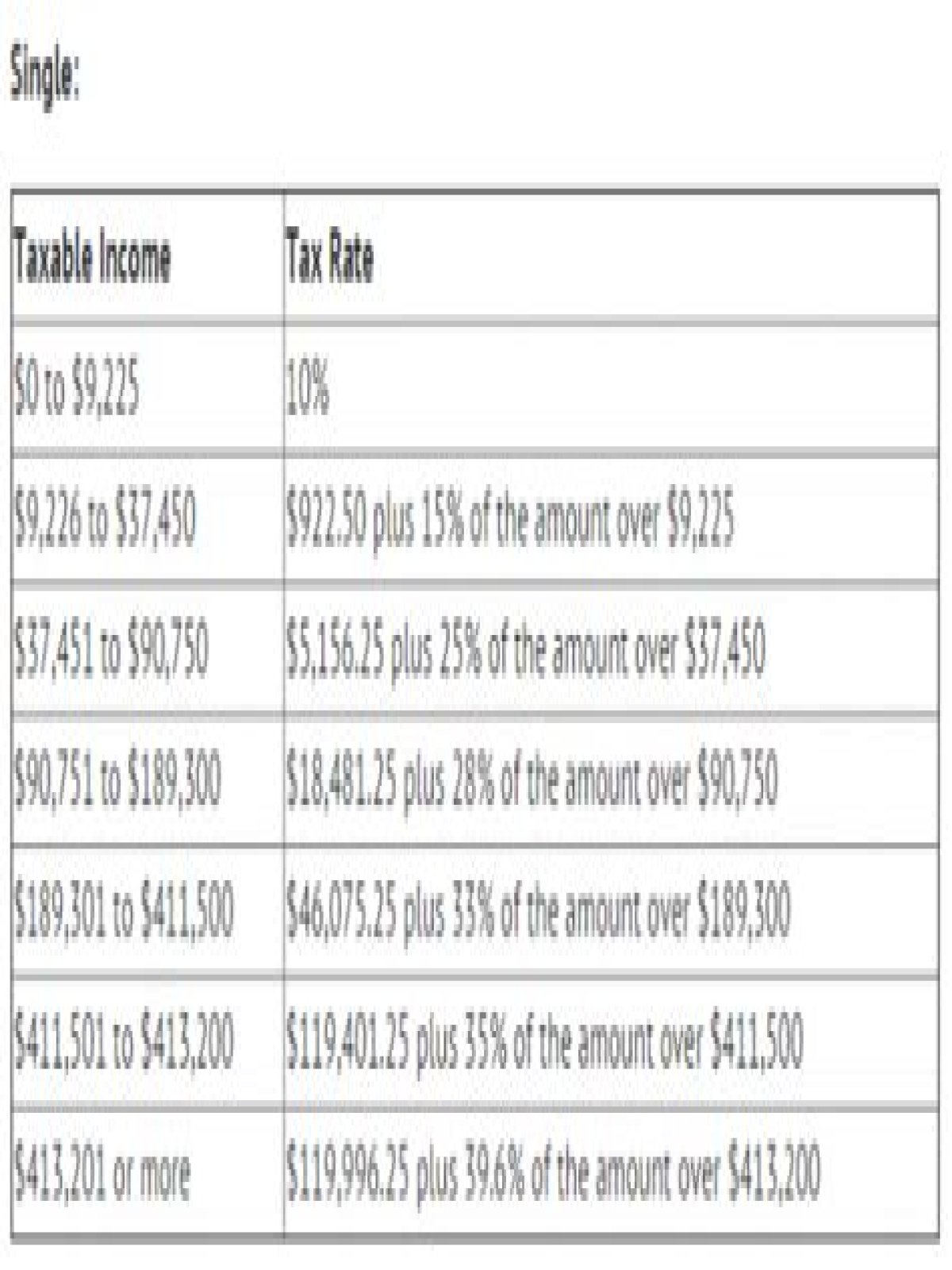

No. Actually, you pay only 10% on the first $9,875; you pay 12% on the rest. (Look at the tax brackets above to see the breakout.) Example #2: If you had $50,000 of taxable income, you’d pay 10% on that first $9,875 and 12% on the chunk of income between $9,876 and $40,125.

How much of your income is taxed at 22%?

The total bill would be about $6,800 — about 14% of your taxable income, even though you’re in the 22% bracket. That 14% is called your effective tax rate. That’s the deal only for federal income taxes.

How does the government decide how much tax you pay?

The government decides how much tax you owe by dividing your taxable income into chunks — also known as tax brackets — and each chunk gets taxed at the corresponding tax rate. The beauty of this is that no matter which bracket you’re in, you won’t pay that tax rate on your entire income.