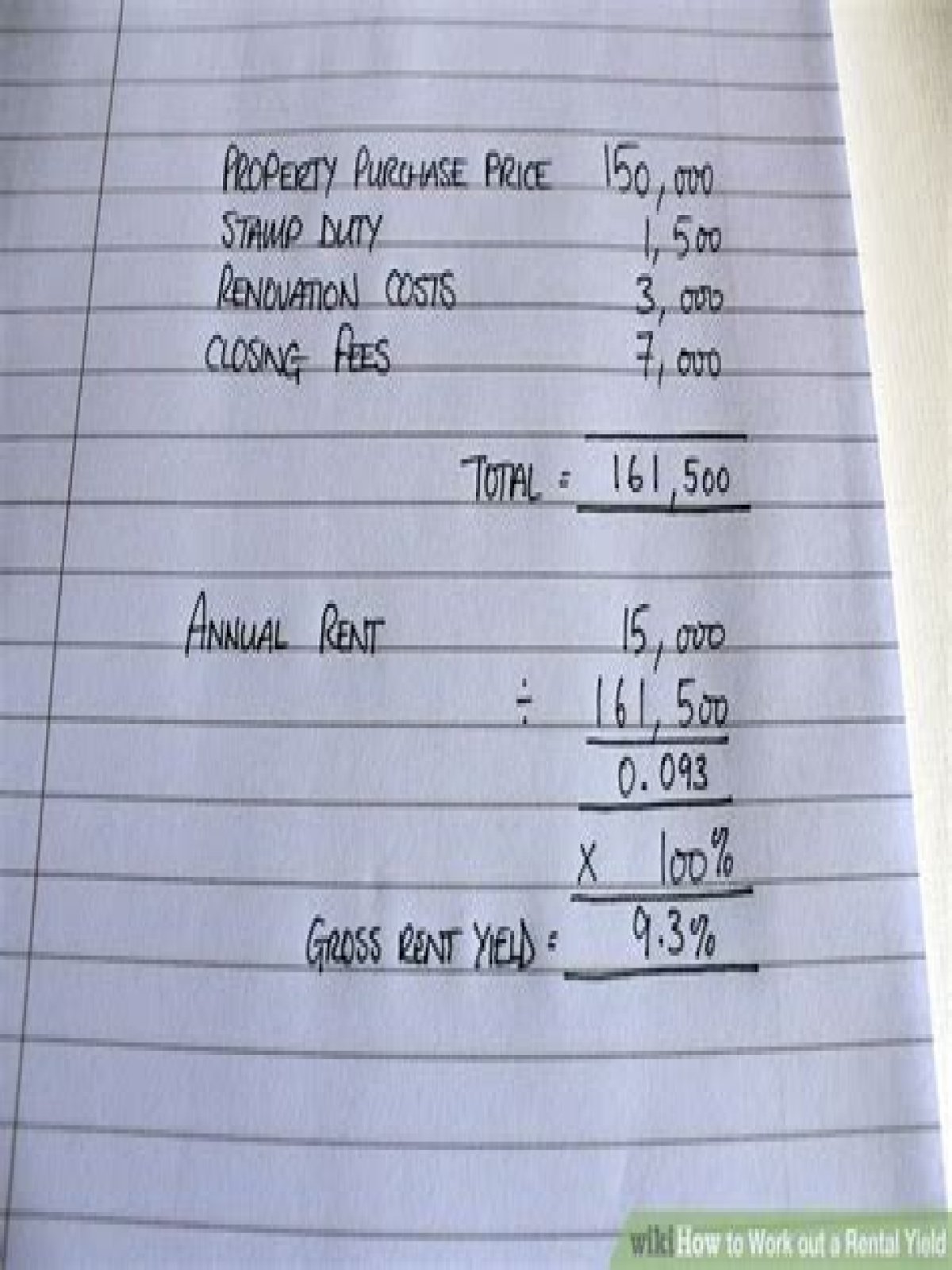

Calculate gross rental yield

- Sum up your total annual rent that you would charge a tenant.

- Divide your annual rent by the value of the property.

- Multiply that figure by 100 to get the percentage of your gross rental yield.

How to calculate property value based on rental?

To calculate the gross rental yield of a property, divide your annual rental income by the property value and multiply that figure by 100. The property value can be the amount you bought it for, or its current market value.

What is considered a good net rental yield?

Anywhere between 5-8% is a good rental yield. Work out your rental yield by dividing your annual rental income by your total investment – or use a yield calculator.

How to calculate yield on properties?

It’s calculated by taking the annual rental income minus the costs associated with owning a buy-to-let property, then dividing by the property’s purchase price or the current market value. Here’s a step-by-step guide on how to calculate net rental yield.

Is 6 rental yield good?

London’s rental market is huge and there is always a demand for property. For this reason, a good rental yield in London is 6%.

How are expenses worked out when you rent out a property?

The £400 expenses that are left cannot be carried forward for use against rental income in future years, and cannot be used against any rental income from other rental properties. If Jane’s sister had lived in the flat rent free then Jane would not be able to claim any expenses at all for this property.

What are the allowable expenses for letting a property?

Allowable expenses are things you need to spend money on in the day-to-day running of the property, like: legal fees for lets of a year or less, or for renewing a lease for less than 50 years other direct costs of letting the property, like phone calls, stationery and advertising

How to record rental income / expense in QB?

From there, you can write a check for the reimbursable amount. Let me show you how: Go to Banking. Select Write Checks. Choose your bank account. Under PAY TO THE ORDER OF, select a payee. From the Expenses tab, select your Owners Equity account. Enter the reimbursable amount. Click Save & Close.

How to calculate the rental yield of a BTL property?

While calculating the Rental Yield of a BTL property is relatively straight forward, there are a few points to consider: Void periods – ignoring void periods is a common mistake, and if you fall victim it can easily skew your calculations.