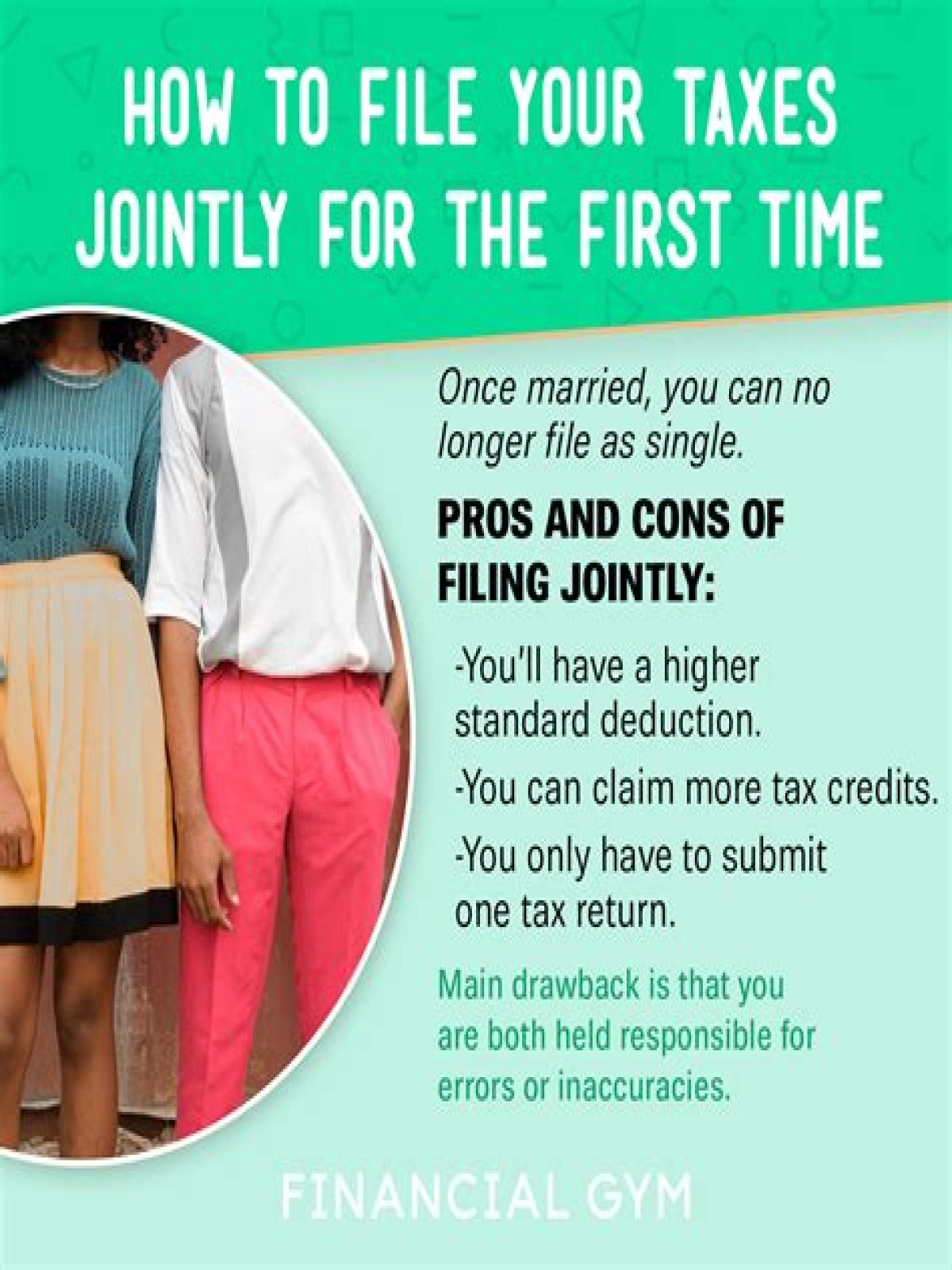

The IRS strongly encourages most couples to file joint tax returns by extending several tax breaks to those who file together. In the vast majority of cases, it’s best for married couples to file jointly, but there may be a few instances when it’s better to submit separate returns.

Which is better for a married couple to file separately or jointly?

For married couples, filing jointly as opposed to separately often means getting a bigger tax refund or having a lower tax liability. Your standard deduction is higher, and you may also qualify for other tax benefits that don’t apply to the other filing statuses. Tax deductions and tax credits may also be worth more for joint filers.

When to calculate Married Filing Jointly tax return?

Estimate your taxes with the Married Filing Jointly filing status, then do a new calculation with the Married Filing Separately filing status. When you prepare your 2020 Tax Return on eFile.com, use the filing status that gives you and your spouse the biggest refund or the lowest tax liability. Who Can File as Married Filing Jointly?

Are there any tax credits for Married Filing Jointly?

Tax deductions and tax credits may also be worth more for joint filers. For example, joint filers who have children that qualify them for the child tax credit can have modified adjusted gross income of up to $400,000 before their credit amount is affected. For all other filing statuses, that amount is $200,000.

Which is better filing jointly or Head of Household?

The head of household status isn’t available to everyone. Married filing jointly is definitely preferable to filing a separate married return when it comes to tax credits. These are different from tax deductions, which can only reduce your taxable income. Tax credits subtract and potentially erase any tax you might owe the Internal Revenue Service.