Form 5472 Penalties An automatic $10,000 penalty will be assessed on any reporting corporation that fails to file Form 5472 by the filing due date. The penalty will also be assessed if the reporting corporation fails to properly maintain records as required by the IRS, or if a substantially incomplete Form 5472 is filed.

Is there an FTA for Form 5471 late filing?

With respect to a Form 5471 late-filing penalty, the IRM provides for an FTA if an FTA was applied to the taxpayer’s related Form 1120 or Form 1065 late-filing penalty (IRM § 21.8.2.19.2 (3)).

What happens if you fail to file Form 5471 or 8865?

If a taxpayer fails to timely file Form 5471 or 8865, the IRS may assert a $10,000 penalty for each failure for each applicable annual accounting period, plus an additional $10,000 for each month the failure continues,…

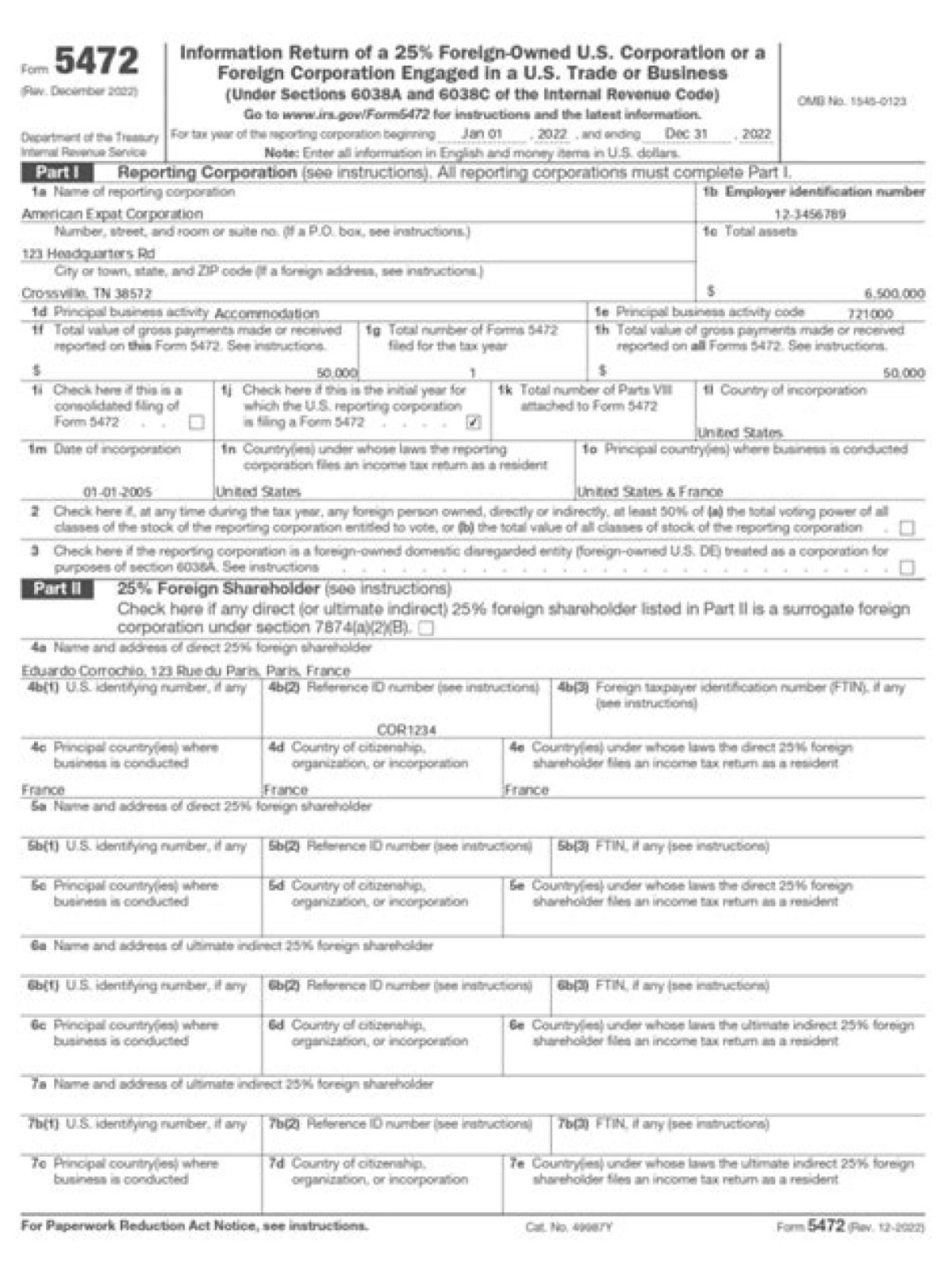

What do you need to know about IRS Form 5472?

The Form is IRS Form 5472, and the failure to file the form may result in significant fines and offshore penalties. The Internal Revenue Service has also developed various Penalty Waivers, Reasonable Cause options & Abatement

When do I need to file Form 5472?

Form 5472, Information Return of a 25% Foreign-Owned U.S. Corporation or a Foreign Corporation Engaged in a U.S. Trade or Business, is required to be filed as an attachment to Form 1120 or Form 1120-F (and certain other Forms or Returns) if the reporting corporation had a reportable transaction with a foreign or domestic related party.

Are there penalties for late filing of Form 8621?

Taxpayers that late-file foreign information returns (including Forms 5471, 5472, 3520, 8938, 8865, 8858, 926, and 8621) have large penalty exposure. Penalties do not apply, however, to taxpayers that demonstrate reasonable cause.

When does the IRS issue a cp215 notice?

Within weeks of filing late income tax and foreign information returns, the IRS will issue a CP215 Notice to notify the taxpayer that a penalty has been assessed. Taxpayers who wish to challenge this penalty could submit an abatement request to the IRS Service Center, and be prepared to fight penalties at IRS Appeals.