As a self-employed person, you will pay your tax and NICs on the 31 January following the end of your tax year. However, HMRC will ask for payments on account for the following year’s estimated tax – on 31 January and 31 July each year.

How do you claim self-employment on your taxes?

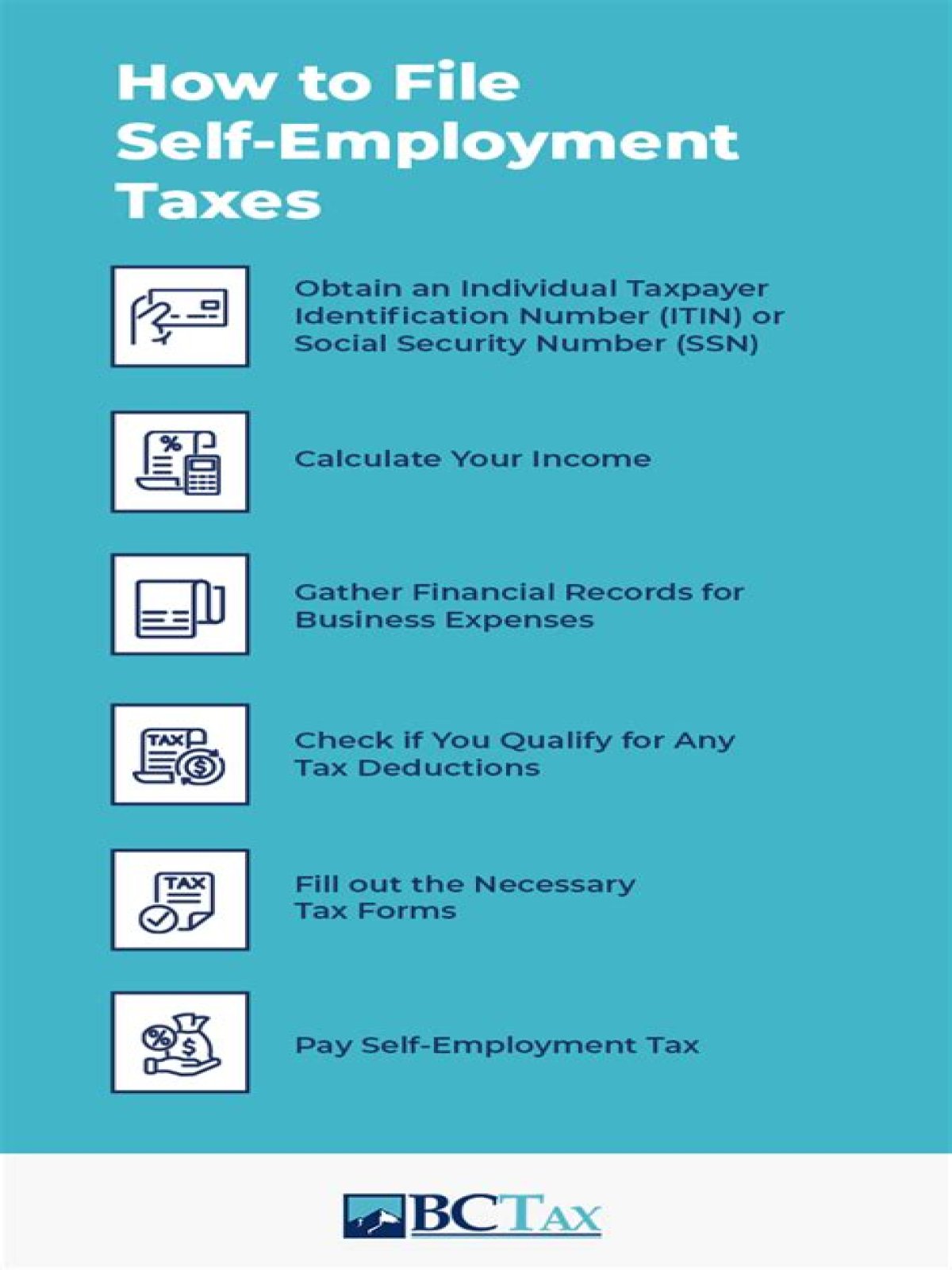

You figure self-employment tax (SE tax) yourself using Schedule SE (Form 1040 or 1040-SR). Social Security and Medicare taxes of most wage earners are figured by their employers. Also, you can deduct the employer-equivalent portion of your SE tax in figuring your adjusted gross income.

When do you have to pay self employment tax?

Your federal income tax return for any year is generally due on April 15 of the following tax year. However, because you’re self-employed, you may need to make quarterly estimated tax payments to cover both your income tax and your self-employment tax obligations.

How to file estimated tax for self employed?

Use the worksheet found in Form 1040-ES, Estimated Tax for Individuals to find out if you are required to file quarterly estimated tax. Form 1040-ES also contains blank vouchers you can use when you mail your estimated tax payments or you may make your payments using the Electronic Federal Tax Payment System (EFTPS). If this is your first year …

When do you have to report self employed income to HMRC?

If this is the case you may not need to report this income to HMRC. Once you have registered as self-employed with HMRC you will receive a notice shortly after the end of the tax year to tell you that you need to complete a tax return for the tax year that has just finished.

Do you have to file Social Security taxes if you are self employed?

Self-Employment Tax (Social Security and Medicare Taxes) It should be noted that anytime self-employment tax is mentioned, it only refers to Social Security and Medicare taxes and does not include any other taxes that self-employed individuals may be required to file.