Many people use online tax services such as TurboTax to file, you can still use this even if you are self employed with a 1099. Although, it will be a bit more difficult, and with something like this, it’s often a better idea to work with a tax professional who will help you prepare your taxes.

When do I need to file a Form 1099?

If you own a small business or are self-employed, use this IRS guidance to determine if you need to file form 1099 or some other information return.

What does nonemployee compensation mean on form 1099-nec?

If payment for services you provided is listed on Form 1099-NEC, Nonemployee Compensation, the payer is treating you as a self-employed worker, also referred to as an independent contractor. You don’t necessarily have to have a business for payments for your services to be reported on Form 1099-NEC.

Who are 1099 MISC, independent contractors, and self-employed?

1099 MISC, Independent Contractors, and Self-Employed 1 | Internal Revenue Service Skip to main content An official website of the United States Government English Español 中文 (简体) 中文 (繁體) 한국어 Русский Tiếng Việt Kreyòl ayisyen Information Menu Help News Charities & Nonprofits Tax Pros Search Toggle search Search

Do you have to pay estimated tax on self employed income?

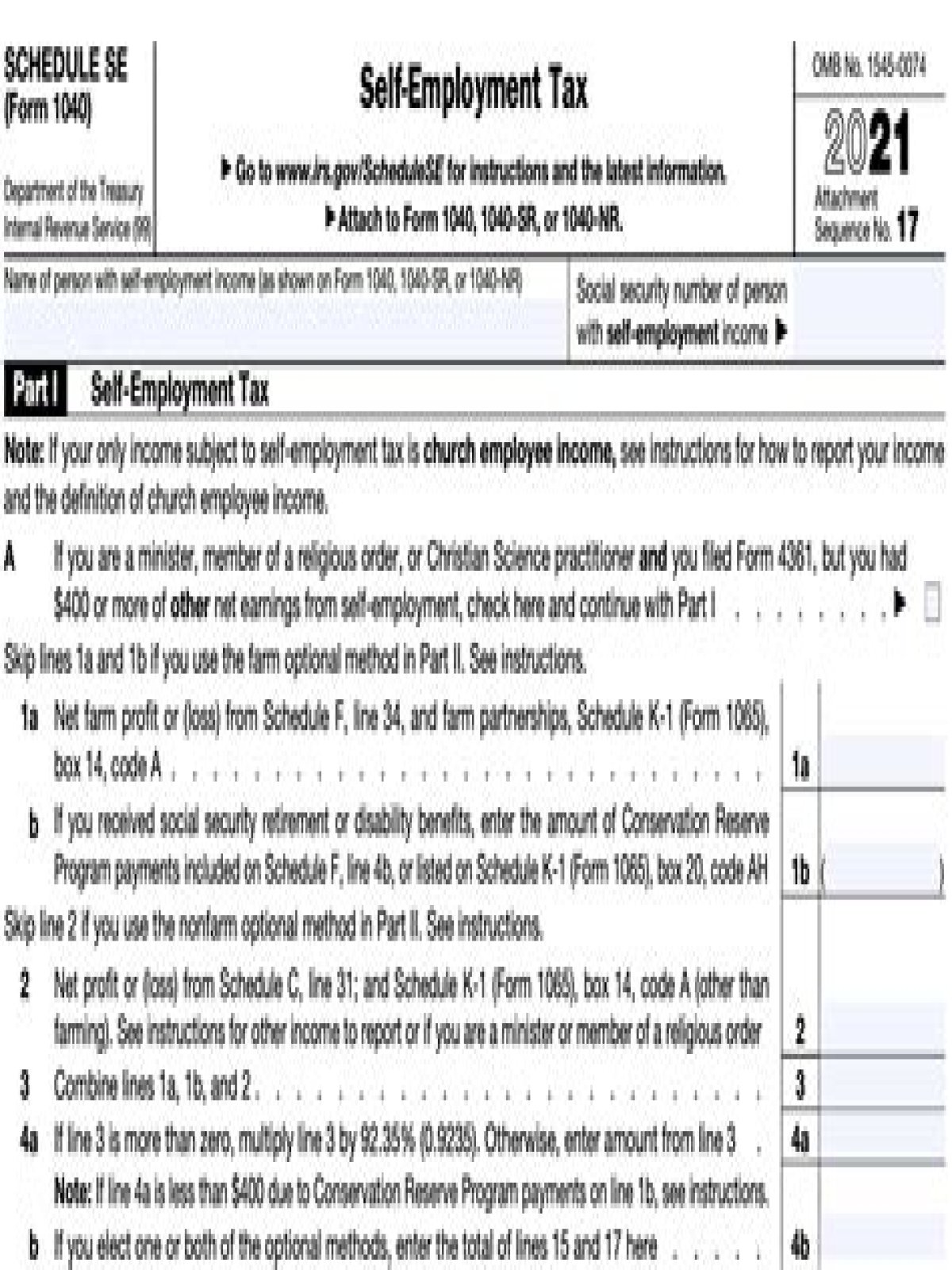

There’s no withholding of tax from self-employment income. As a self-employed individual, you may need to make estimated tax payments during the year to cover your tax liabilities. Refer to Form 1040-ES, Estimated Tax for Individuals for more details on who must pay estimated tax.

What’s the tax rate on a 1099 MISC?

The biggest reason why filing a 1099-MISC can catch people off guard is because of the 15.3% self-employment tax. The 1099 tax rate consists of two parts: 12.4% for social security tax and 2.9% for Medicare.