Taxpayers frequently have income reported on Form 1099-MISC. Of course, net income from a trade or business is subject to both income tax and the 15.3% self-employment tax, while other income generally is subject only to income tax.

What type of income is not subject to self employment tax?

Other Income Not Subject to Self Employment Tax Participation in a drug trial or clinical study that paid one time. Hobbies that include creation and patenting of inventions, when done occasionally. Occasional leasing of a commercial permit to another party with intention to return to using the permit when able.

When to use a 1099-MISC form for self employment?

Long answer: This lie has an understandable origin. The most common use of the 1099-MISC form is a business letting a contractor know how much he received in income from them that year. However, that self-employment income will appear in Box 7. A lesser-known use of the 1099-MISC is in Box 3, Other income.

What does it mean to be independent contractor on 1099-MISC?

If payment for services you provided is listed in box 7 of Form 1099-MISC, Miscellaneous Income, the payer is treating you as a self-employed worker, also referred to as an independent contractor. You don’t necessarily have to have a business for payments for your services to be reported on Form 1099-MISC.

Do you have to pay Social Security on a 1099 MISC?

If you find yourself with a 1099-MISC document, and there’s a dollar amount listed in box 7 for Non-employee compensation, the IRS treats that as self-employment income and you’re supposed to pay Social Security and Medicare payments. This is also called self-employment tax which equates to 15% of that income.

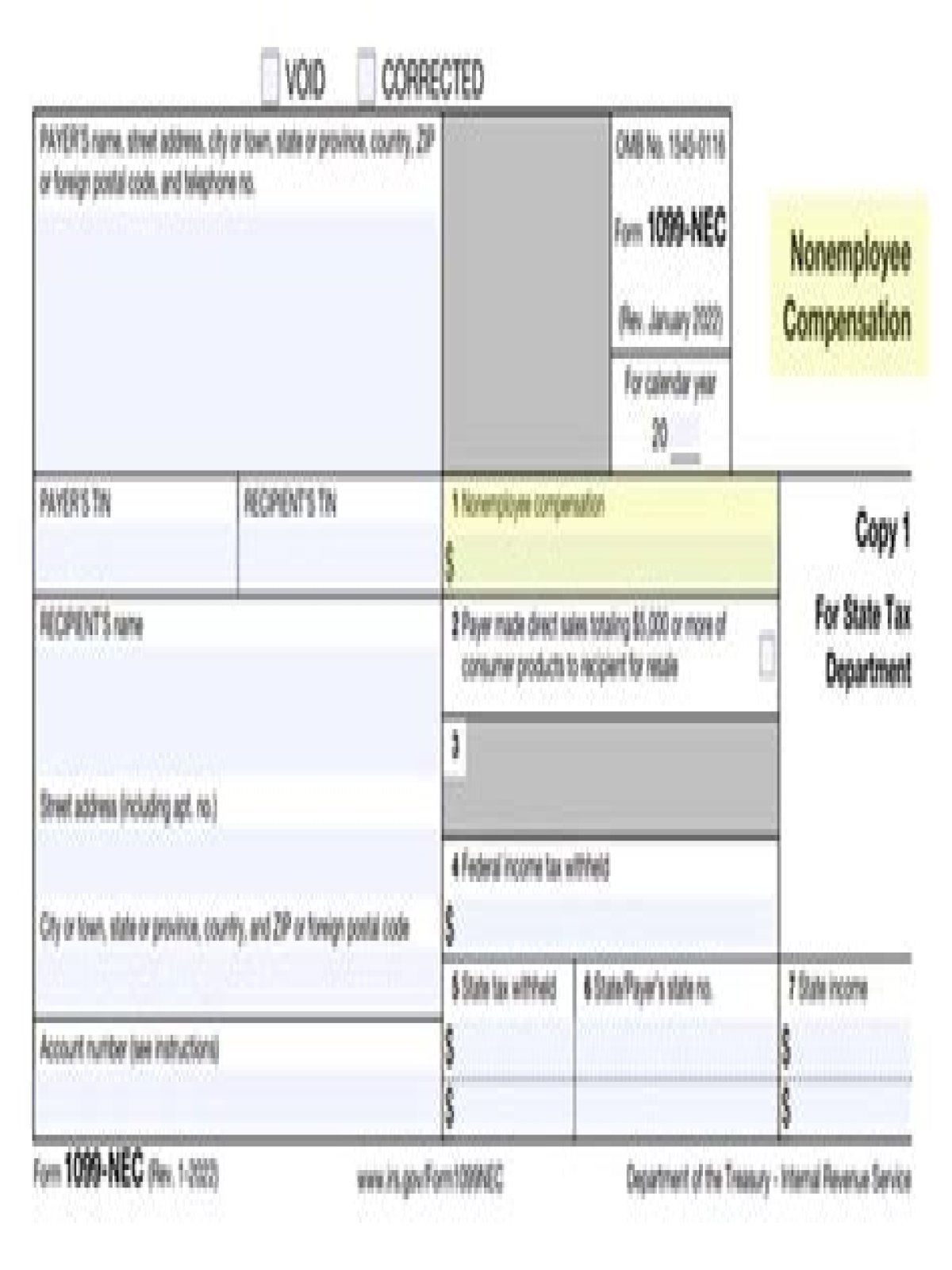

What does a 1099-nec or 1099 MISC mean?

A 1099-NEC having an amount appear in Box 1 and 1099-MISC with an amount in Boxes 1, 5, 9, or 10 is a good indicator that it’s self-employment. Instructions for entering a 1099-MISC form.