You reach age 70½ after December 31, 2019, so you are not required to take a minimum distribution until you reach 72. You reached age 72 on July 1, 2021. You must take your first RMD (for 2021) by April 1, 2022, with subsequent RMDs on December 31st annually thereafter.

Can I cash out an IRA that I inherited?

If you inherit a traditional IRA, you can cash out the account at any age — even before you reach age 59½ — without having to pay a 10% early-withdrawal penalty. But you will have to pay taxes on the money in the account (except for any nondeductible contributions).

What are the rules for withdrawals from an IRA?

There are several rules for withdrawals that apply before you reach retirement age, and others for when you’re ready to retire and enjoy the fruits of your labors. There are five main types of IRA withdrawals: early, regular withdrawals, Required Minimum Distributions (RMDs), Roth IRA withdrawals, and IRA rollovers or transfers.

When do you have to start taking distributions from your IRA?

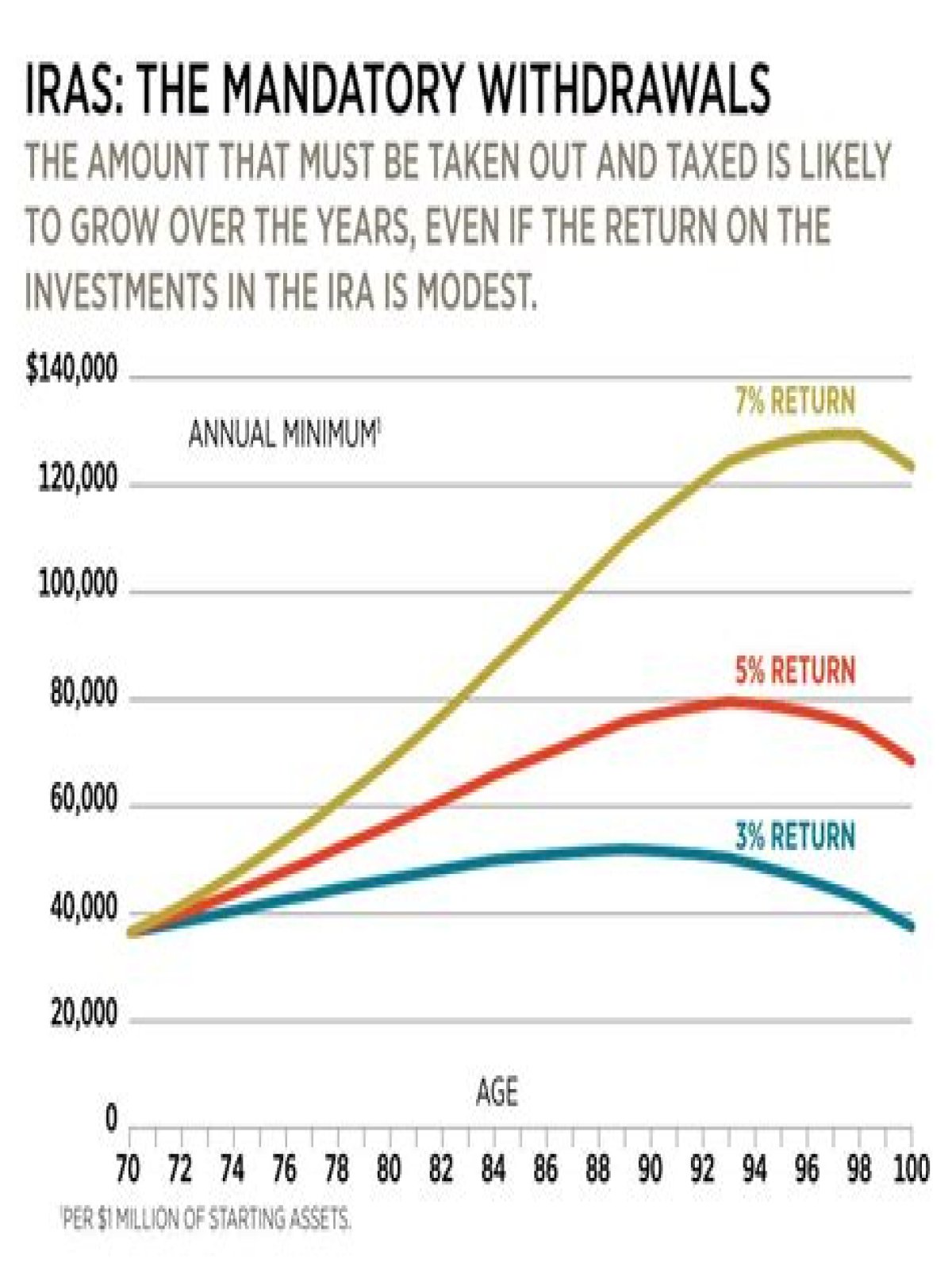

Your required minimum distribution is the minimum amount you must withdraw from your account each year. You generally have to start taking withdrawals from your IRA, SEP IRA, SIMPLE IRA, or retirement plan account when you reach age 70½.

What is the penalty for not taking required minimum distributions from a traditional IRA?

If you do not take your full required minimum distributions, the penalty is 50% of the difference between what should have been distributed and what was actually withdrawn. With the exception of the recovery of previous nondeductible contributions, all traditional IRA withdrawals are subject to ordinary income tax no matter when you take them.

What are the new rules for inherited IRAs?

There are two major changes under the new SECURE Act rules in 2020 and beyond: Unlike Roger (above), Inherited IRA account owners are not required to take Required Minimum Distributions. Inherited IRA account balances must be fully withdrawn within ten years of inheritance.