A trust that qualifies as a simple trust in one year may be taxed as a complex trust in a prior or subsequent year, if the amount or nature of required income or corpus distributions take the trust outside the definition of a simple trust (Reg. §1.651(a)-1 ).

What means complex trust?

A “Complex Trust” gives the Trustee discretion to either distribute the income or to hold the income within the trust. The word complex means that the trustee has more discretion, rather than the trust’s terms are more complicated. A tax return for a Simple Trust will show that all income passed out to the beneficiary.

What is the difference between simple trust and complex trust?

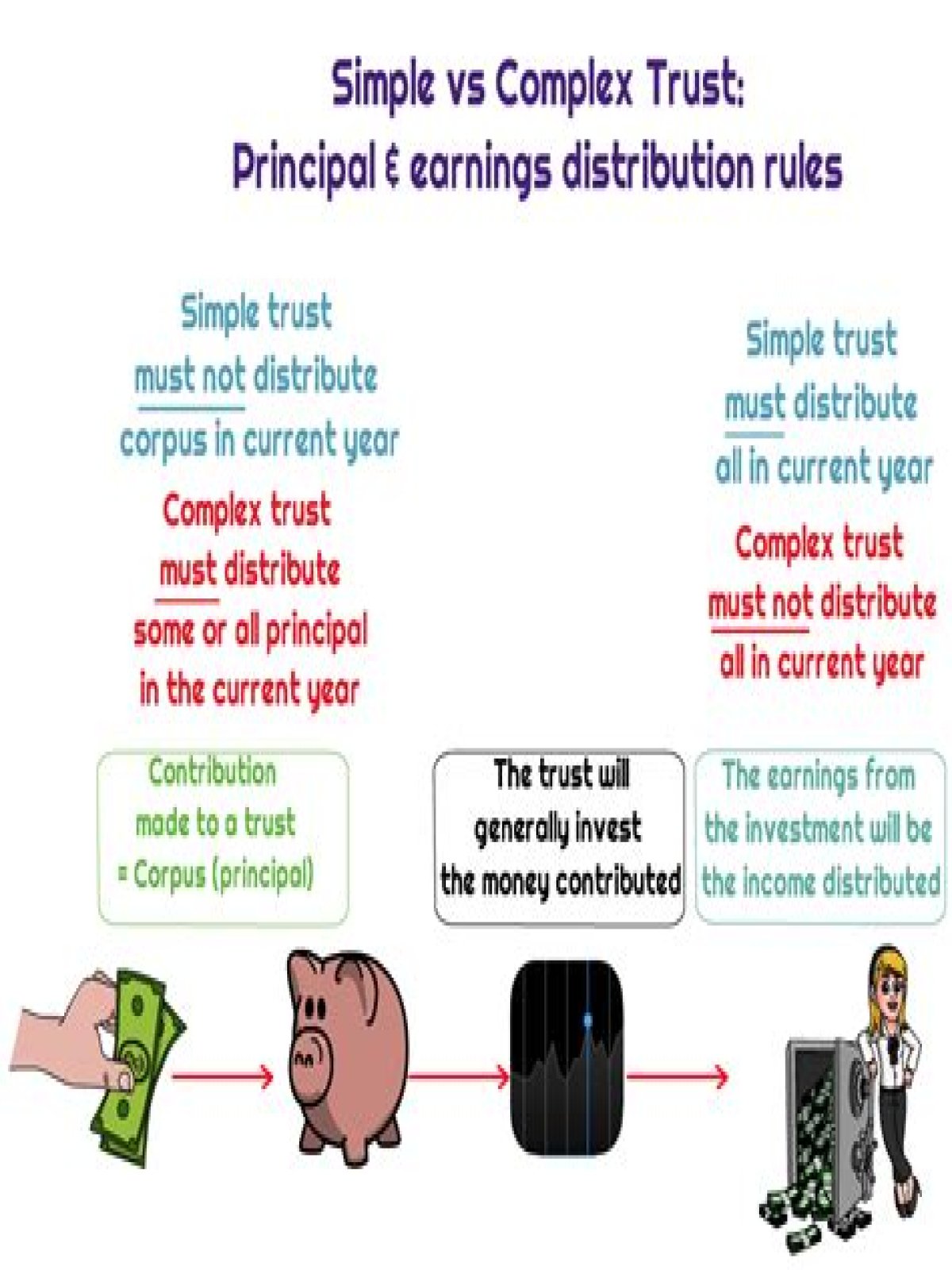

A simple trust must distribute all its income currently. Generally, it cannot accumulate income, distribute out of corpus, or pay money for charitable purposes. A complex trust is any trust that does not meet the requirements for a simple trust.

What kind of trust is a complex trust?

A complex trust is any trust that does not meet the requirements for a simple trust. Complex trusts may accumulate income, distribute amounts other than current income and, make deductible payments for charitable purposes under section 642(c) of the Code.

What’s the difference between a trust and a simple trust?

Trusts are treated as separate taxable entities, so they must file tax returns and pay income tax on their income. Trusts can deduct their expenses and are permitted a small tax exemption: A simple trust can take a $300 exemption. A complex trust can take a $100 exemption.

Can a simple trust be a non grantor trust?

A non-grantor trust will either be a simple trust or a complex trust, depending on how it handles distributions to beneficiaries. A simple trust must pass three tests. It must distribute all income to the beneficiaries; it cannot distribute principal; and it cannot make distributions to charities.

How is interest distributed in a complex trust?

Any accumulated interest is distributed once an established period had passed. A complex trust, on the other hand, may retain income from investments but the funds may be distributed as long as the terms and conditions of the trust are met.