Your salary is a gross dollar amount earned before taxes and deductions are taken out. Meanwhile, your Form W-2 shows your taxable wages reported after pre-tax deductions. Pre-tax deductions include employer-provided health insurance, dental insurance, life insurance, disability insurance, and 401k contributions.

How do small businesses report earnings?

Many small business owners use a sole proprietorship which allows them to report all of their business income and expenses on a Schedule C attachment to their personal income tax return. If you run the business as an LLC and you are the sole owner, the IRS also allows you to use the Schedule C attachment.

Can a business be a W2 employee?

Business owners can recruit two types of workers — employees and independent contractors, otherwise known as self-employed workers. The type of tax forms that you file will change depending on the worker classification.

What is considered earned income for a business?

Earned income includes all the taxable income and wages from working either as an employee or from running or owning a business. It also includes certain other types of taxable income. Earned income includes: Wages, salaries, tips and other taxable employee pay.

What do you need to know about W-2 forms?

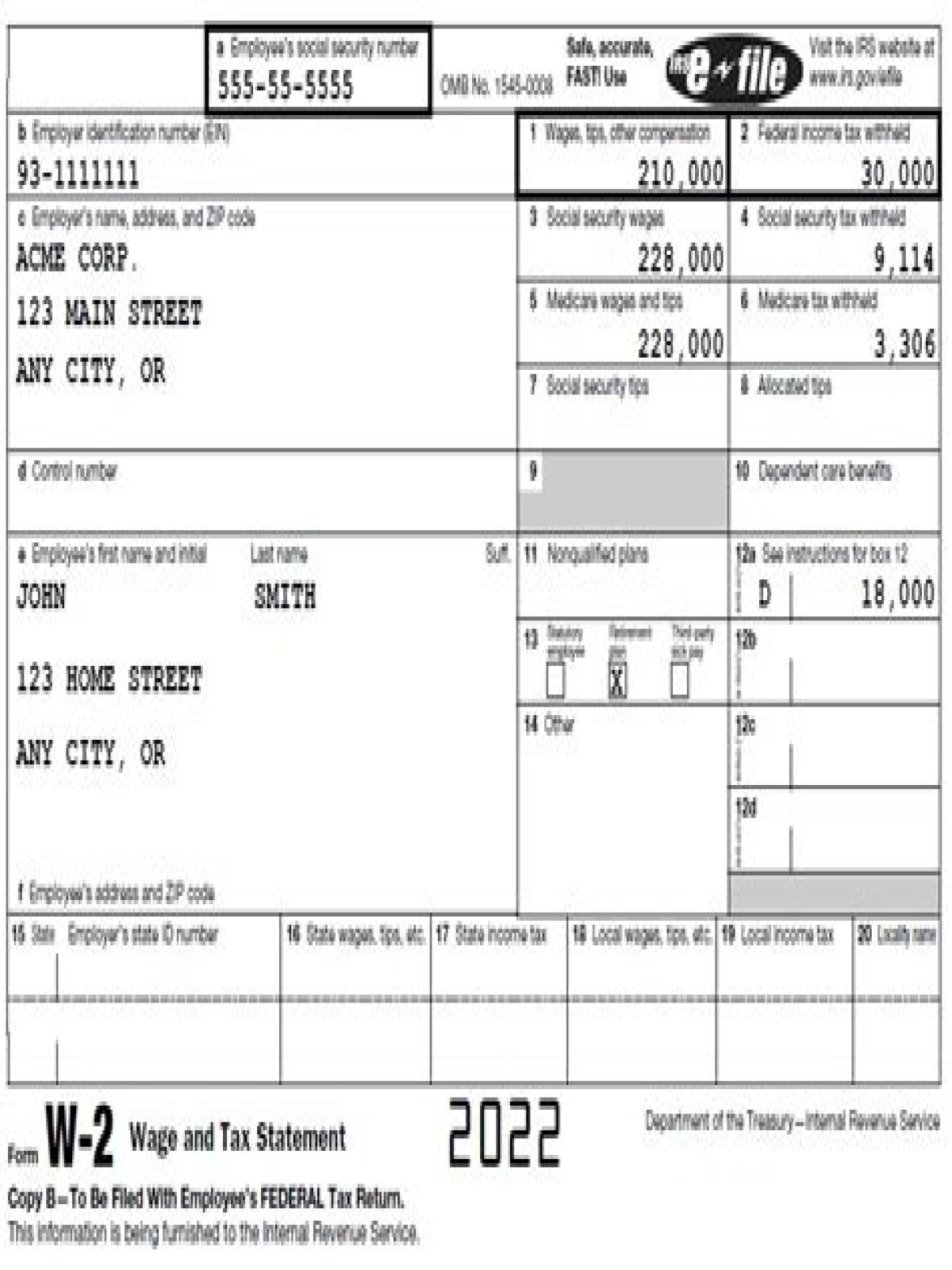

Form W-2 is filed by employers to report wages, tips, and other compensation paid to employees as well as FICA and withheld income taxes.

Is there a toll free number to file a W-2?

If you need immediate assistance, our toll free number is 1-800-772-6270 (TTY 1-800-325-0778) and is available Monday through Friday, 7:00 a.m. to 7:00 p.m., Eastern Time. For general assistance, you may send us an email at [email protected] For technical assistance, please send us an email at [email protected]

Do you have to register to file a W-2?

You must register to use Business Services Online – Social Security’s suite of services that allows you to file W-2/W-2Cs online and verify your employees’ names and Social Security numbers against our records.

Where to find code P on Form W-2?

Clarification on Code P Reporting in Box 12 of the 2019 Form W-2 — 23-APR-2019. Clarification on Code P Reporting in Box 12 of the 2018 Form W-2 — 19-MAR-2019. Exclusion from Wages and Compensation of Qualified Moving Expenses — 05-MAR-2019.