If you choose to set up your LLC with just one spouse as a member, you can classify it as a sole proprietorship. If your LLC has more than one member, you can classify it as a partnership or a corporation. A C corporation will file its own tax return.

Can I split rental income with my spouse?

Where a property is owned jointly by spouses, each spouse is subject to income tax on 50% of the rental profit irrespective of the respective percentage ownership of the property by each spouse. If each spouse is liable to income tax at the same marginal rate, the 50/50 split is acceptable for tax purposes.

Can a LLC be owned by a husband and wife?

It depends on the form and location of the LLC. According to the IRS, if an LLC is owned by husband and wife in a non-community property state, the LLC should file as a partnership. LLCs owned by a husband and wife are not eligible to be “qualified joint ventures” (which can elect not be treated as partnerships) because they are state law entities.

When to form a LLC for a rental property?

Etc., etc. Easiest way to start is to form an LLC for the first few properties that you buy and then see how the organization and management goes from there. This way, once you purchase three or four properties you’ll know whether you want to continue and keep setting up an LLC for each property or you want to start combining them.

Can a husband and wife own a rental property?

The same is true if the rental property is owned by a husband and wife who elect to be treated as a single taxpayer by filing a joint return.

What are the benefits of creating a rental property LLC?

There are four benefits of creating an LLC for your rental property. If you own your property as an individual and someone files a lawsuit against you, then your personal assets are at stake. However, if you create an LLC, then the only assets at stake are those owned by the LLC.

Actually, @Nathan Emmertthat is not the case. A husband and wife can form a partnership or a multi-member LLC. It is probably somewhat better than a single member LLC. Because the parties are closely related though it is going to be easier to go after personal assets and bypass the protections of an LLC.

Where to find single member limited liability company?

If the single-member LLC is owned by a corporation or partnership, the LLC should be reflected on its owner’s federal tax return as a division of the corporation or partnership. Taxpayer Identification Number

How does a single member LLC ( SMLLC ) work?

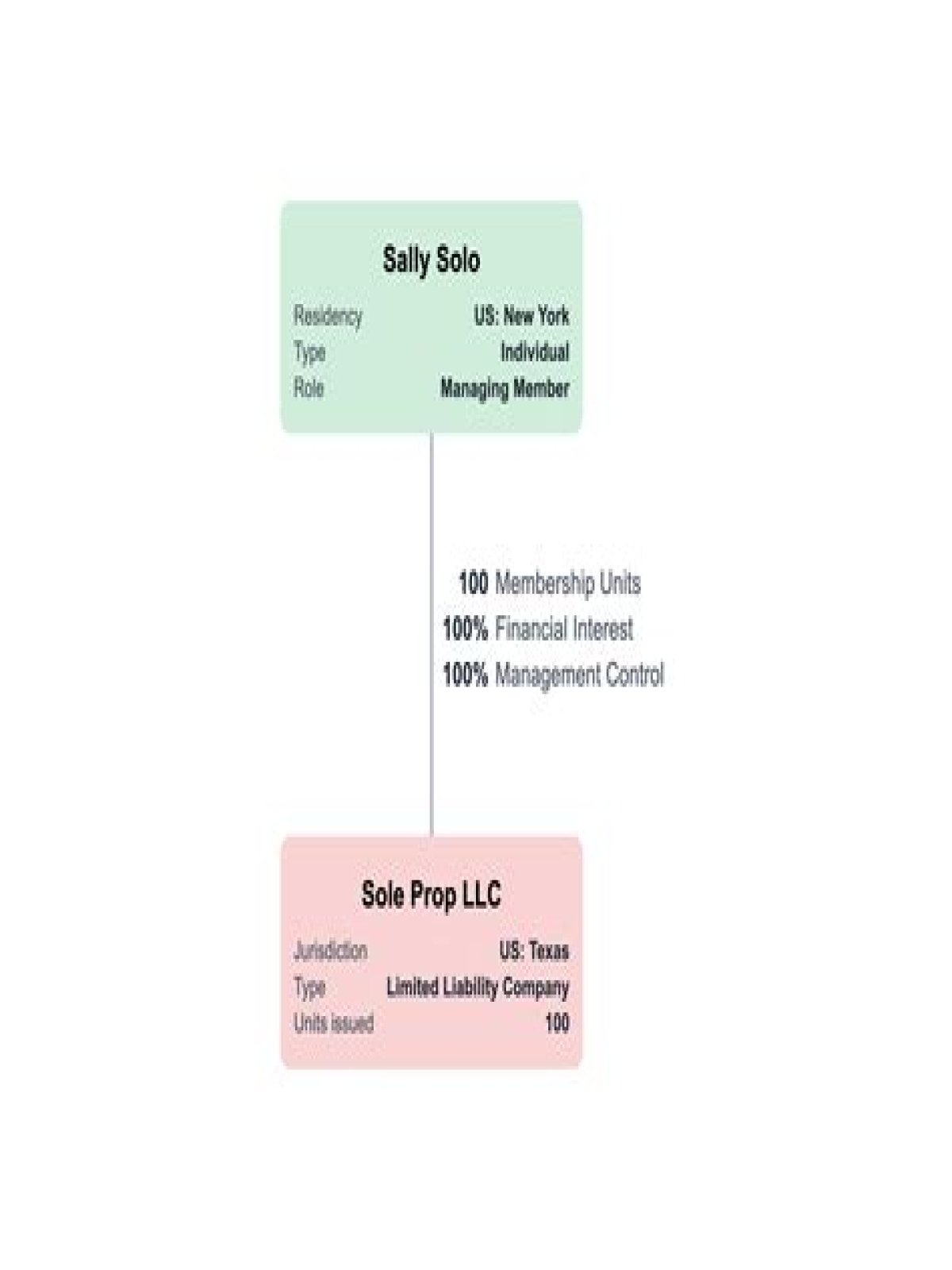

By default, a Single-Member LLC is treated as a “ disregarded entity ” by the IRS for federal tax purposes. This means you will pay taxes the same way as a Sole Proprietorship does. The LLC will report its income or losses on a schedule C, which will become a part of your personal 1040 income tax return.

How is a single-member LLC treated by the IRS?

Have a professional LLC service file for you: By default, a Single-Member LLC is treated as a “ disregarded entity ” by the IRS for federal tax purposes. This means you will pay taxes the same way as a Sole Proprietorship does.