Donations to charity from individuals are tax free. You can get tax relief if you donate: through Gift Aid. straight from your wages or pension, through Payroll Giving.

Are 501c3 donations tax-deductible?

You may be able to claim a deduction on your federal taxes if you donated to a 501(c)3 organization. To deduct donations, you must file a Schedule A with your tax form. With proper documentation, you can claim vehicle or cash donations.

Are donations to foreign nonprofits tax-deductible?

The IRS reminds donors that contributions to foreign organizations generally are not deductible. Taxpayers must itemize their deductions on Schedule A for the year in which they made the contribution in order to take a charitable contribution deduction.

Are donations to US English tax-deductible?

Under the Internal Revenue Code, only U.S. charities are eligible to receive tax-deductible charitable contributions from individual U.S. taxpayers. Thus, U.S. taxpayers cannot take charitable deductions for contributions made to foreign charities.

What donations are tax deductible UK?

Tax relief when you donate to a charity

- Overview.

- Gift Aid.

- Donating straight from your wages or pension.

- Donating land, property or shares.

- Leaving gifts to charity in your will.

- Keeping records. Table of Contents

Can you claim donations to overseas charities?

The Overseas Aid Gift Deduction Scheme (OAGDS) enables Australian organisations to issue tax deductible receipts for donations to their overseas aid activities. These activities must be to support aid activities in countries that are declared as ‘developing’ by the Minister for Foreign Affairs.

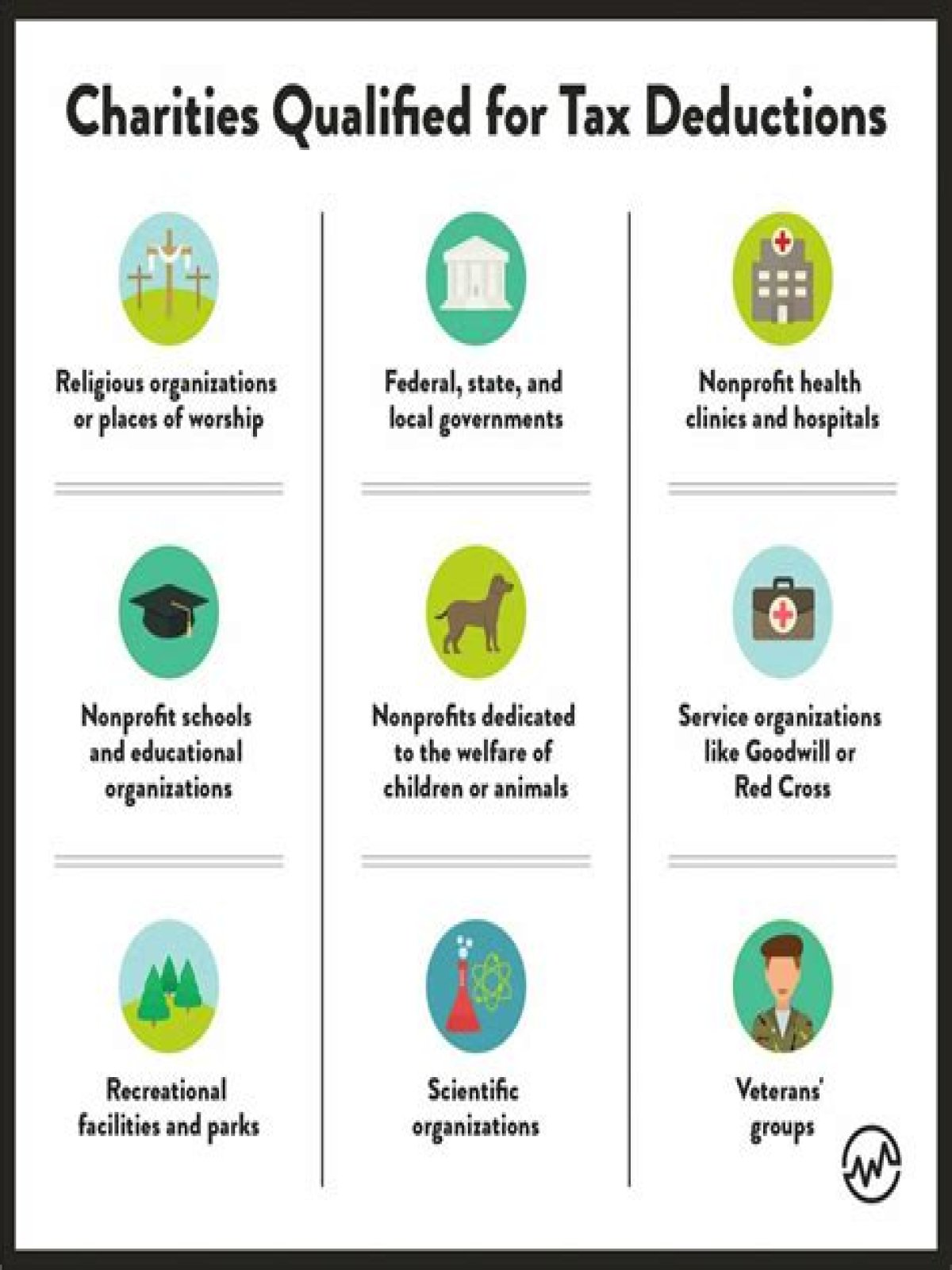

Can a 501 ( c ) ( 3 ) charity receive tax deductions?

A general rule is that only 501 (c) (3) tax-exempt organizations (i.e. public charities and private foundations) – formed in the United States – are eligible to receive tax-deductible charitable contributions. The organization must be exempt at the time of the contribution in order for the contribution to be deductible for the donor.

Can a US citizen donate to a UK charity?

US/UK dual qualified charities. US citizens (and other individuals subject to US income tax) who are resident in the UK, may be subject to tax in either the US or the UK when they make contributions to charity unless the charity is dual qualified.

How much can a corporation deduct for charitable contributions?

A corporation may deduct qualified contributions of up to 25 percent of its taxable income. Contributions that exceed that amount can carry over to the next tax year.

Is the US tax deduction available in the UK?

The problem arises because the US income tax charitable deduction is only available for gifts to charities organised under the laws of the US, whilst UK tax relief is only available for contributions made to charities established in England and Wales and governed by English law.