You Didn’t Pay a Future Debt If you file a subsequent return on time and it has a balance due but you don’t pay it, the IRS will do the same thing as if you didn’t file the return on time. It will send a notice terminating the agreement and force you to re-supply your financials.

Does the IRS take monthly payments?

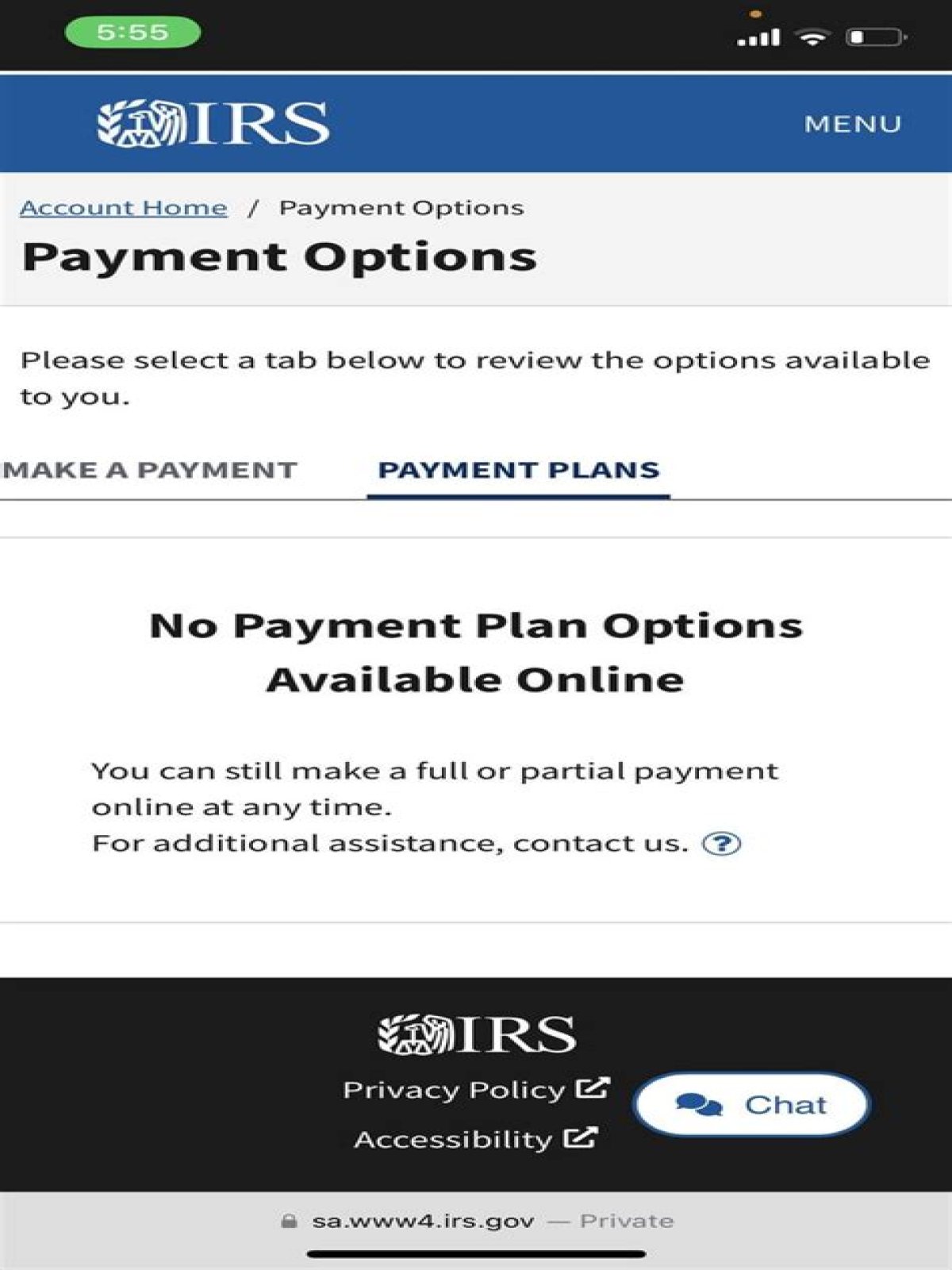

Am I eligible to apply online for a payment plan? Your specific tax situation will determine which payment options are available to you. Payment options include full payment, short-term payment plan (paying in 120 days or less) or a long-term payment plan (installment agreement) (paying monthly).

Can a tax payment be withdrawn after a month?

IRS tax payment has not been withdrawn after a month…normal? This is the first time I ended up owing money after filing my taxes, so I apologize if this is a silly concern. I filed both returns using TurboTax as usual for me this year. The federal return was accepted FEB 1st and the state FEB 2nd.

When does the IRS take money out of your account?

During non-peak times, funds are usually withdrawn on the payment date you specify, assuming your e-filed return has already been accepted (received) by the IRS. If that date happens to fall on a weekend or federal holiday, the funds are typically withdrawn the next business day.

When does my federal tax payment go through?

– Both your Federal and State will be listed separately if you filed both. When will my tax payment go through? During non-peak times, funds are usually withdrawn on the payment date you specify, assuming your e-filed return has already been accepted (received) by the IRS.

How to make payments to the Internal Revenue Service?

Make monthly payment directly from a checking or savings account (Individuals only) Make monthly payment electronically online or by phone using Electronic Federal Tax Payment System (enrollment required) Make monthly payment by check, money order or debit/credit card; Fees apply when paying by card: Apply (revise) online: $10 fee