New York requires you to pay taxes on income you earned working there, even though you live in New Jersey. You should prepare a New Jersey Resident return and a New York non-resident return.

Is New York a pension friendly state?

New York Retirement Taxes When it comes to income taxes, New York State is very tax-friendly for retirees. All Social Security retirement benefits are exempt from taxation. Income from retirement accounts or a private pension is deductible up to $20,000. New York also has its own estate tax.

Do you have to file taxes if you live in NJ and work in NY?

If you live in New Jersey and work in New York, you have to file tax in both states. According to TurboTax, if you work in New York and live in New Jersey you have to file an income tax return for both states. You must pay New York State income tax on any income you earned while you were working in that state.

Do you pay New York state income tax if you are a nonresident?

As a resident, you pay state tax (and city tax if a New York City or Yonkers resident) on all your income no matter where it is earned. As a nonresident, you only pay tax on New York source income, which includes earnings from work performed in New York State, and income from real property located in the state.

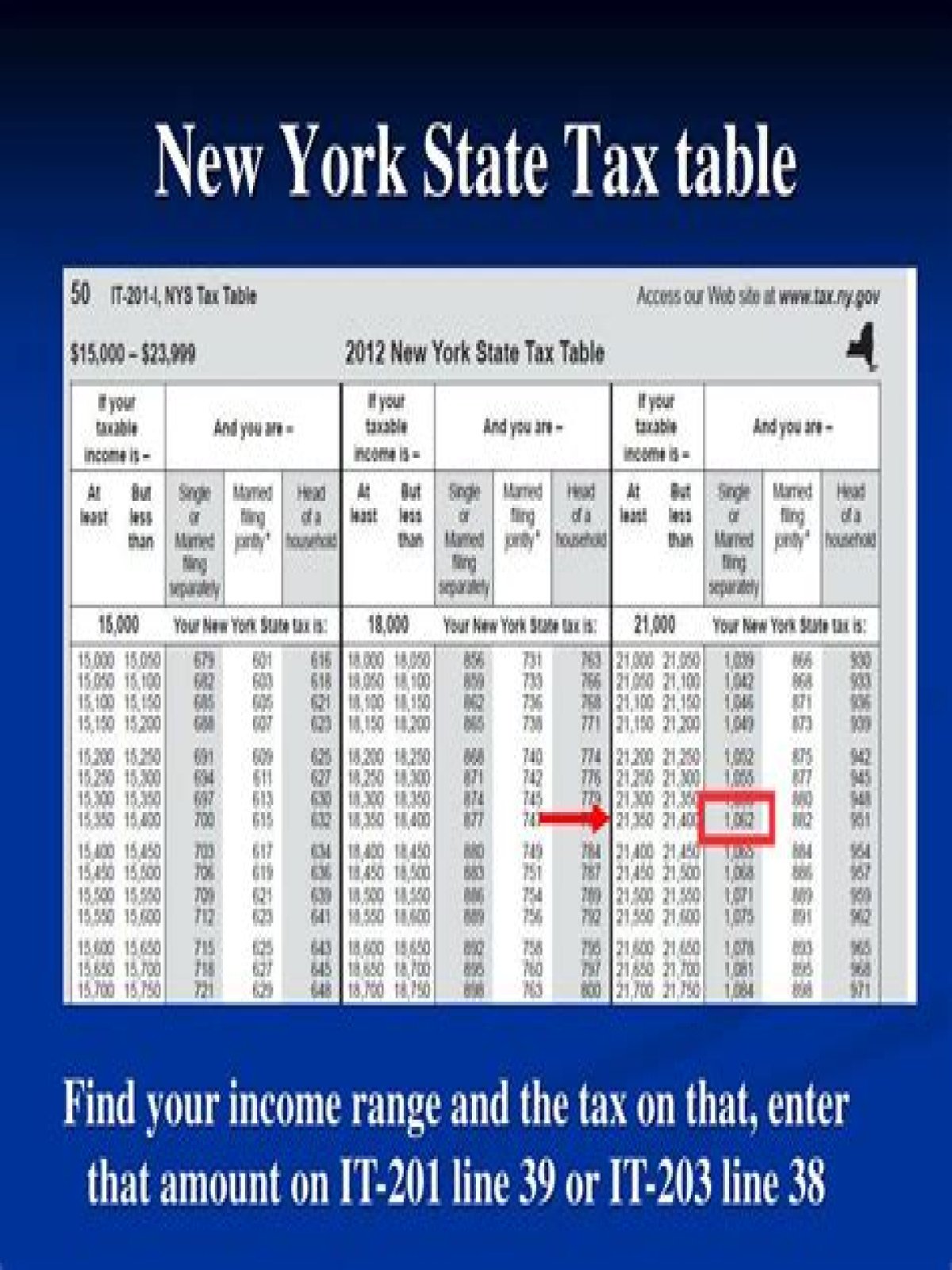

How are income taxes calculated in New York?

This means that when calculating New York taxes, you should first subtract that amount from your income (unless you have itemized deductions of a greater amount). A tax credit reduces your income taxes by the full amount of the credit. So if you owe $5,000 in taxes and are eligible for a tax credit of $500, you only need to pay $4,500 total.

Do you have to pay New York state income tax when you telecommute?

In general, unless your employer specifically acted to establish a bona fide employer office at your telecommuting location, you will continue to owe New York State income tax on income earned while telecommuting. If I live in New York but work in another state, am I taxed twice?