DFAS will enforce a garnishment order in cases involving spousal support (alimony) and/or child support, but ONLY if there is a court order. That order must contain specific language directing the employer to withhold funds from the military member.

How long does it take DFAS to garnish wages?

Time to Process and Challenges We will respond to a properly served garnishment within thirty (30) calendar days after receipt, or within such longer period as may be prescribed by applicable state or local law.

What is the process to garnish the wages of a member of the military?

The garnishment must direct the employing agency to withhold money from the employee’s wages and pay them to either the creditor or the court. State law directs the garnishment process. For questions regarding state law, we recommend that you consult a private attorney. What is the process to garnish the wages of a member of the military?

Can a retired soldier get a pay garnishment?

Retiree Pay Garnishment. Military.com. Just like active duty pay, your retired pay may be garnished to pay back debts for things like unpaid or overdue child support, alimony, taxes, bills, and other debts. There are two types of garnishments: voluntary and involuntary. Usually, garnishments are involuntary and ordered by a court.

How much of my wages can be garnished?

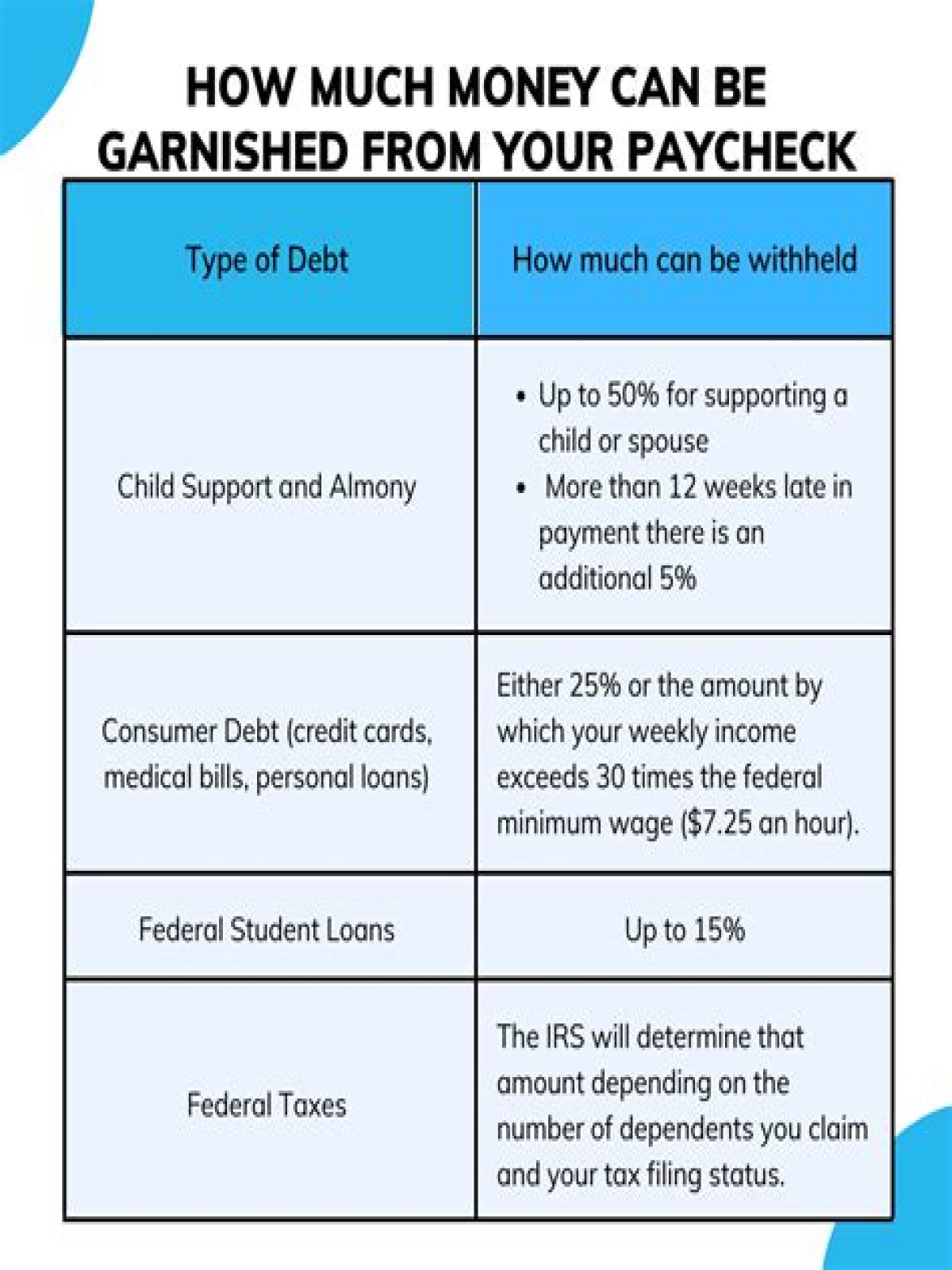

How much of my wages can be garnished? There’s a limit to how much creditors can garnish from your wages. Under federal law, the garnishment amount can’t be more than 25% of your net (take home) pay, or the amount by which your take home exceeds 30 times the federal minimum wage (currently set to $7.25/hour), whichever is less. [ 1]

Can a DFAs employee contest a garnishment?

An employee must contact the court directly to contest the garnishment. Since DFAS was not was not a party to the initial legal action awarding the judgment and subsequent garnishment, we have no legal authority to authenticate previous payments made toward the debt.