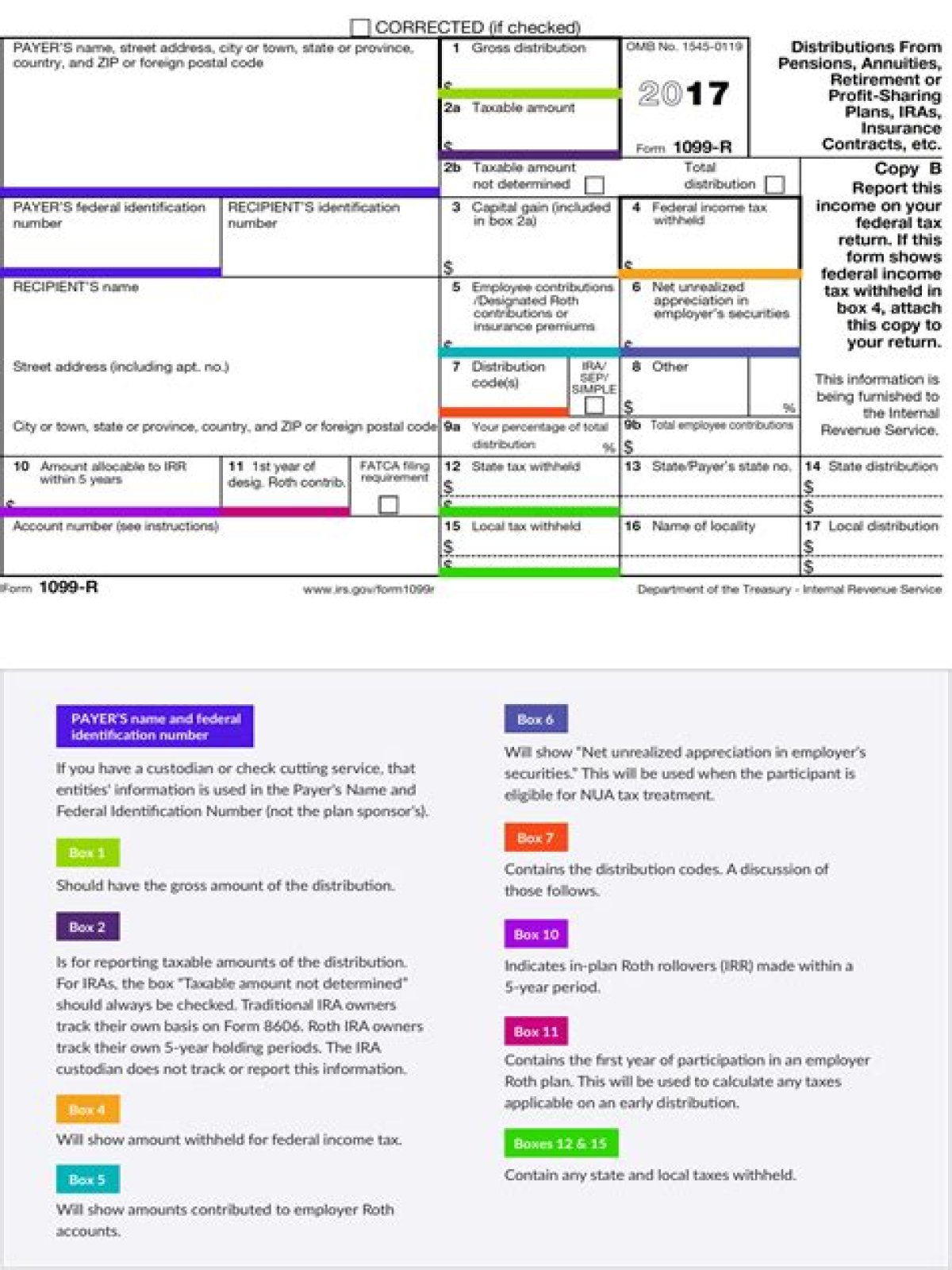

IRS Form 1099-R Box 7 Distribution Codes

- Use Code 1, Early distribution, no known exception, for Traditional and SIMPLE IRAs and QRPs only if the individual is not age 59½ or older and codes 2, 3, and 4 do not apply.

- Code 1 may be used with codes 8, B, D, K, L, M, or P.

What is code U on 1099r?

Code U: Dividends distributed from an ESOP under section 404(k). Use Code U for a distribution of dividends from an employee stock ownership plan (ESOP) under section 404(k). These are not eligible rollover distributions. Continue to report those dividends on Form 1099-DIV.

What are the box 7 codes for 1099-R?

1099-R Codes & Distribution Exceptions 1099-R Box 7 Codes Generally, distributions from pensions, annuities, profit-sharing and retirement plans, IRAs, insurance contracts, etc. are reported to recipients on Form 1099-R. The codes entered in Box 7 of Form 1099-R indicate the type of distribution received and its taxability.

Where to find code 1 on 1099-R?

If the client meets an exception to the early withdrawal penalty, but code “1” (early distribution, no known exception) is shown in Box 7 of Form 1099-R, then add Form 5329to the tax return. Select Other Taxesthen select Beginnext to Tax on Early Distribution. In Part 1, select the client who received the distribution (if MFJ).

Where to put gross distribution on Form 1099-R?

If an IRA conversion contribution or a rollover from a qualified plan is made to a Roth IRA that later is revoked or closed, and a distribution is made to the taxpayer, enter the gross distribution in box 1 of Form 1099-R. If no earnings are distributed, enter 0 (zero) in box 2a and Code J in box 7.

What is the early distribution code for 1099-R?

For more information on filing Form 1099-R and other plan sponsor deadlines, visit our Knowledge Center here. Code 1: Early distribution, no known exception. This distribution is subject to the 10% penalty.