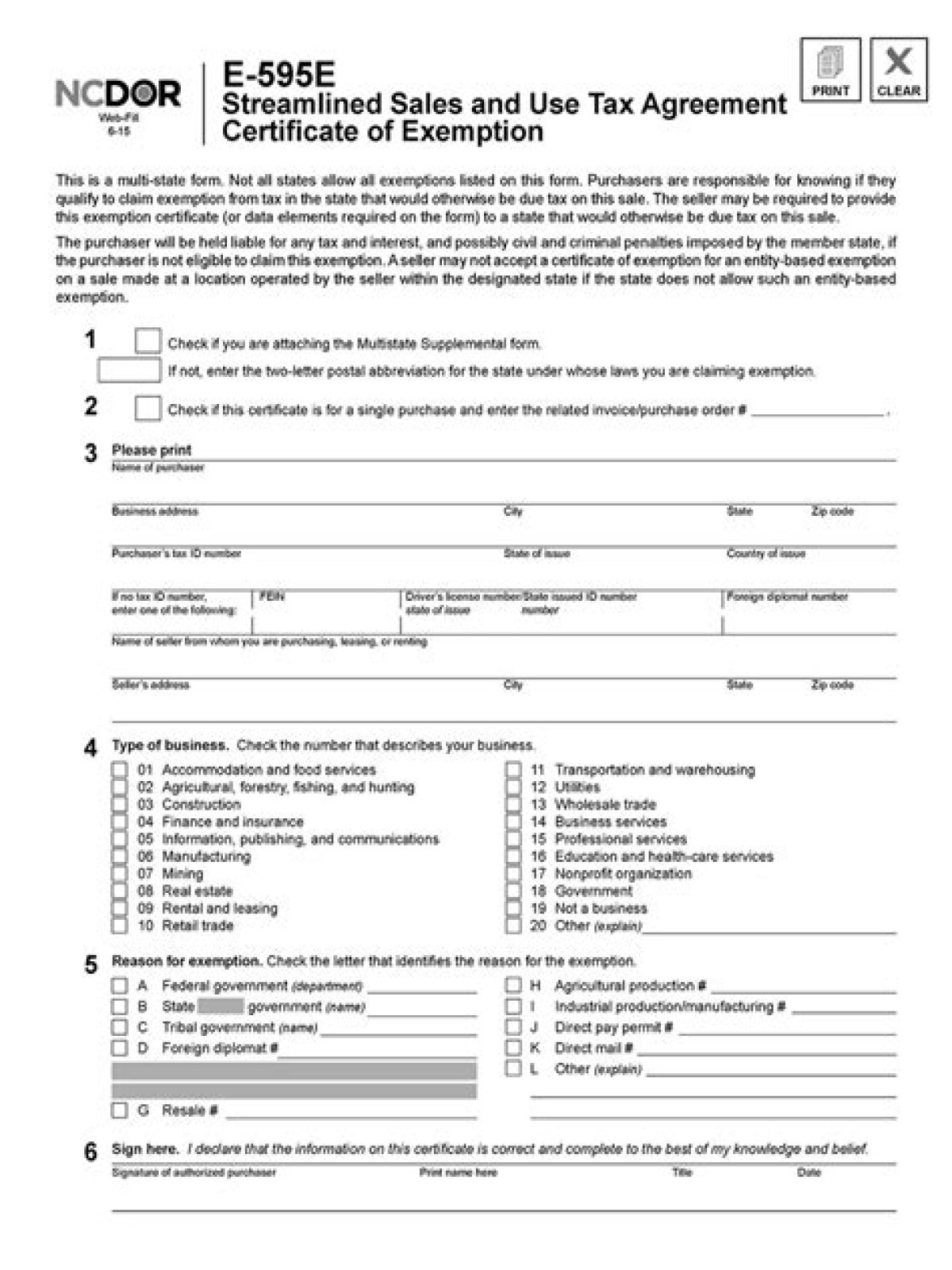

North Carolina does not require registration with the state for a resale certificate. How can you get a resale certificate in North Carolina? To get a resale certificate in North Carolina, you may fill out the Streamlined Sales and Use Tax Agreement Certificate of Exemption Form (Form E-595E).

How do I get a NC resale number?

Registration for Sales and Use Tax Account You may obtain Form NC-BR online, by mail, or by contacting the Taxpayer Assistance and Collection Center at 1-877-252-3052 (toll free).

What is a resale certificate NC?

The Sales Tax Permit allows a business to sell and collect sales tax from taxable products and services in the state, while the Resale Certificate allows the retailer to make tax-exempt purchases for products they intend to resell. Related: How to register for a North Carolina Sales Tax Number.

What is the difference between a tax ID number and a resale number?

A resale number allows your business to avoid paying sales taxes on items purchased for resale to customers. A tax ID number, on the other hand, identifies your business in your dealings with tax agencies.

How does ncdor work for sales and use tax?

The general State and applicable local and transit rates of sales and use tax apply to the sales price of each article of tangible personal property that is not subject to tax under another subdivision in N.C. Gen. Stat. NCDOR: General Sales and Use Tax Skip to main content

Where to get sales and use tax number in NC?

The North Carolina Department of Revenue is aware that some private, third-party websites claim to offer services—for a fee—that allow taxpayers to obtain a certificate of registration, often called a sales and use or resale tax number, throughout the country.

How to contact the NC Department of revenue?

Taxpayers who come across companies providing such services in NC should contact the Department of Revenue at 1-877-252-3052.

When did ncdor change from July 2005 to April 2009?

Changes to Monthly Report of State Sales and Use Tax Gross Collections and Gross Retail Sales (July 2005) Collections for Month Ending April 30, 2008 Collections for Month Ending A