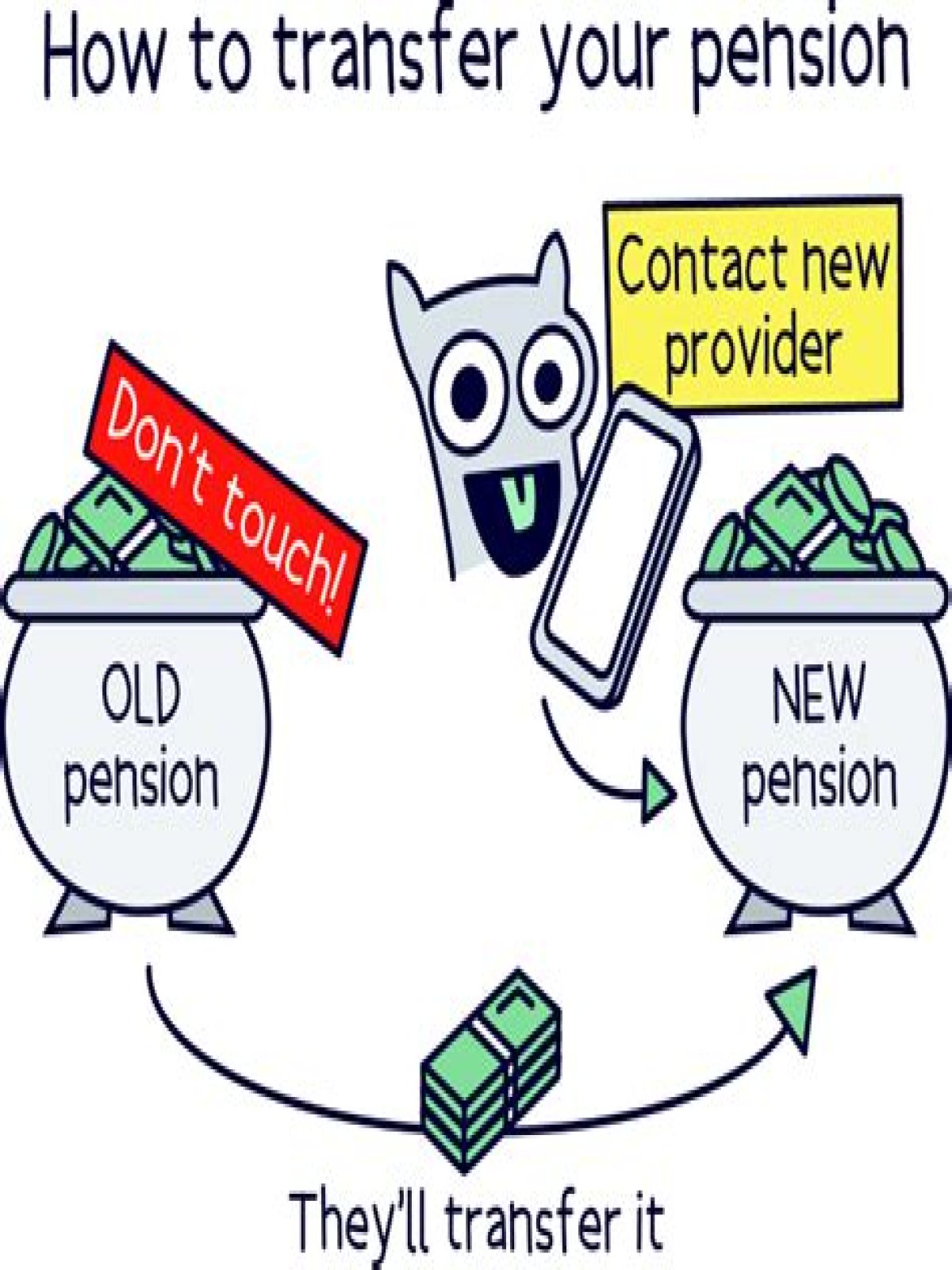

Transferring to a UK pension scheme You can transfer your UK pension pot to another registered UK pension scheme. Transferring your pension pot anywhere else – or taking it as an unauthorised lump sum – will be an ‘unauthorised payment’ and you’ll have to pay tax on the transfer.

Is it a good idea to transfer pension?

These schemes can prove lucrative if you’ve been in them a long time, so it might not always make sense to transfer out. In fact, if your defined benefit pension pot is worth £30,000 or more you’ll need to take independent financial advice before you transfer.

What happens to the money from a lump sum pension?

The lump sum amount you receive, after taxes are deducted, can be reinvested. If you die earlier than expected, there could be funds left over to be used as inheritance with your estate.

What happens when I transfer my pension from one pension to another?

If a member wishes to transfer out of their scheme then the member, given certain conditions, must be given a cash equivalent of their rights. What is a pension transfer? A transfer takes place when a member of a pension scheme transfers their accrued pension rights from one scheme to another.

Where can I find the transfer value of my pension?

Alternatively you can find a transfer value on your annual statement. A defined contribution scheme is one where the final pension is determined by the level of income that your pension pot can generate. This pension pot is dependent upon the amount of contributions you’ve paid into your pension and the associated investment growth over time.

Do you have to pay tax on uncrystallised pension lump sum?

Withdraw more than your 25% lump sum, which means you will have to pay income tax on the amount above the 25% threshold. The rest of your pot then remains invested until you need the money later on. Uncrystallised Funds Pension Lump Sum (UFPLS) – you take your 25% tax-free lump sum in stages and pay tax on the remaining 75% that is withdrawn.