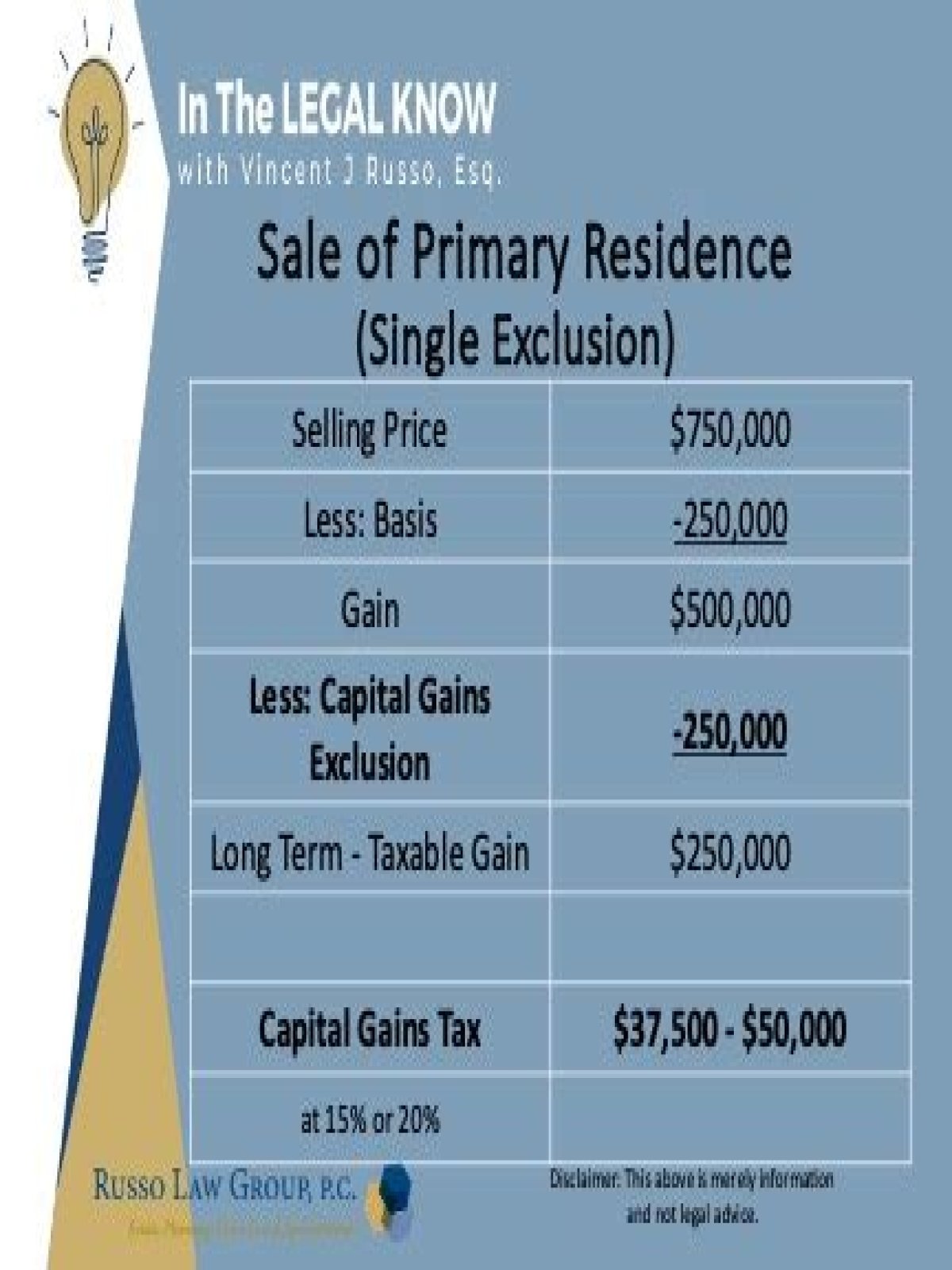

The IRS tax code has something called section 121, which allows primary residence homeowners to exclude a certain amount of gains on the sale of their home. As usual, with tax benefit perks, there are strings attached. The section 121 exclusion allows the following amounts to be excluded, depending on your tax filing status: Single — $250,000

Do you have to pay capital gains on sale of primary home?

When selling your primary home, you can make up to $250,000 in profit or double that if you are married, and you won’t owe anything for capital gains. The only time you are going to have pay capital gains tax on a home sale is if you are over the limit.

Is the sale of a primary residence a loss or gain?

The sales price minus the basis (plus sales cost) equals the gain or loss. A larger basis will result in a smaller gain and thus less in taxes. If you sell your home below the basis, you’ll have a loss. A loss on a primary residence is not deductible. Even if you don’t owe any taxes, it’s best to report it on your tax return.

How long does a home have to be a primary residence to be taxed?

The capital gains tax rate is 0%, 15% or 20% depending on your income. To qualify for the exclusion, You must have owned your home for at least 24 months out of the previous 5 years. It must have been your primary residence for at least 24 months out of the previous 5 years.

How to avoid capital gains tax on foreign property?

Avoiding capital gains tax on foreign property is possible so long as the UK resident declares the international home as their primary residence. The resident must declare to the government that the foreign home will serve as a primary residence. Typically, homeowners must make this declaration within two years of purchasing the foreign property.

Do you have to pay capital gains tax on property that is not your home?

You are required to pay capital gains tax on any property that is not your main home. The government will also make you pay the tax on your main home under specific criteria. If the house is rather large, was used for business, or has been let out, then avoiding capital gains tax on the property could be challenging.

Can a person be exempt from capital gains tax?

— In this case, Mr. Buendia shall be exempt from the capital gains tax otherwise due from him since the entire proceeds of the sale has been fully utilized to acquire his new principal residence. (b) To compute for the basis of the new principal residence.