Tier 1 tax is the RRT1; Tier 2 Tax is RRT2; RRTM is Medicare Tax; RRTA is Additional Medicare Tax.

What is a corrected w2?

If an employer makes a mistake on a form W-2, the employer will issued a corrected form W-2, called a form W-2c, Corrected Wage and Tax Statement. If you have not yet filed your tax return, just use the corrected amounts as reported on the W-2c on your tax return.

What is sec125?

SEC 125 is your employer’s benefit plan. It is also known as a “cafeteria plan”. Usually, what is reported there is your medical insurance premiums that are paid with pre-tax income. They are not taxed and are not included in your W-2 Box 1 wages so you can not deduct them as medical expenses.

Where do I enter RRT2 on railroad W-2?

See General Instructions for Forms W-2 and W-3. On screen W2, enter only Tier I and Tier II withholding. In box 14 Other, enter RRT1 or RRT2 in the first field and the amount withheld in the second. Press F1 to see the Help screens for the box 14 fields.

Where are Tier I and Tier II contributions on a W-2?

If you work for a railroad, you may notice Tier I and Tier II contributions listed in Box 14 of your annual Form W-2. These numbers represent taxes withheld from your paycheck for future retirement benefits.

Where is W2 Amt in dropdown box 14?

W2 has amt in box 14 labeled Tier1 and tier2 that we contribute to RR. He is not retired, so this is just our contribution amt. what option do I pick in dropdown box June 3, 2019 6:27 PM W2 has amt in box 14 labeled Tier1 and tier2 that we contribute to RR.

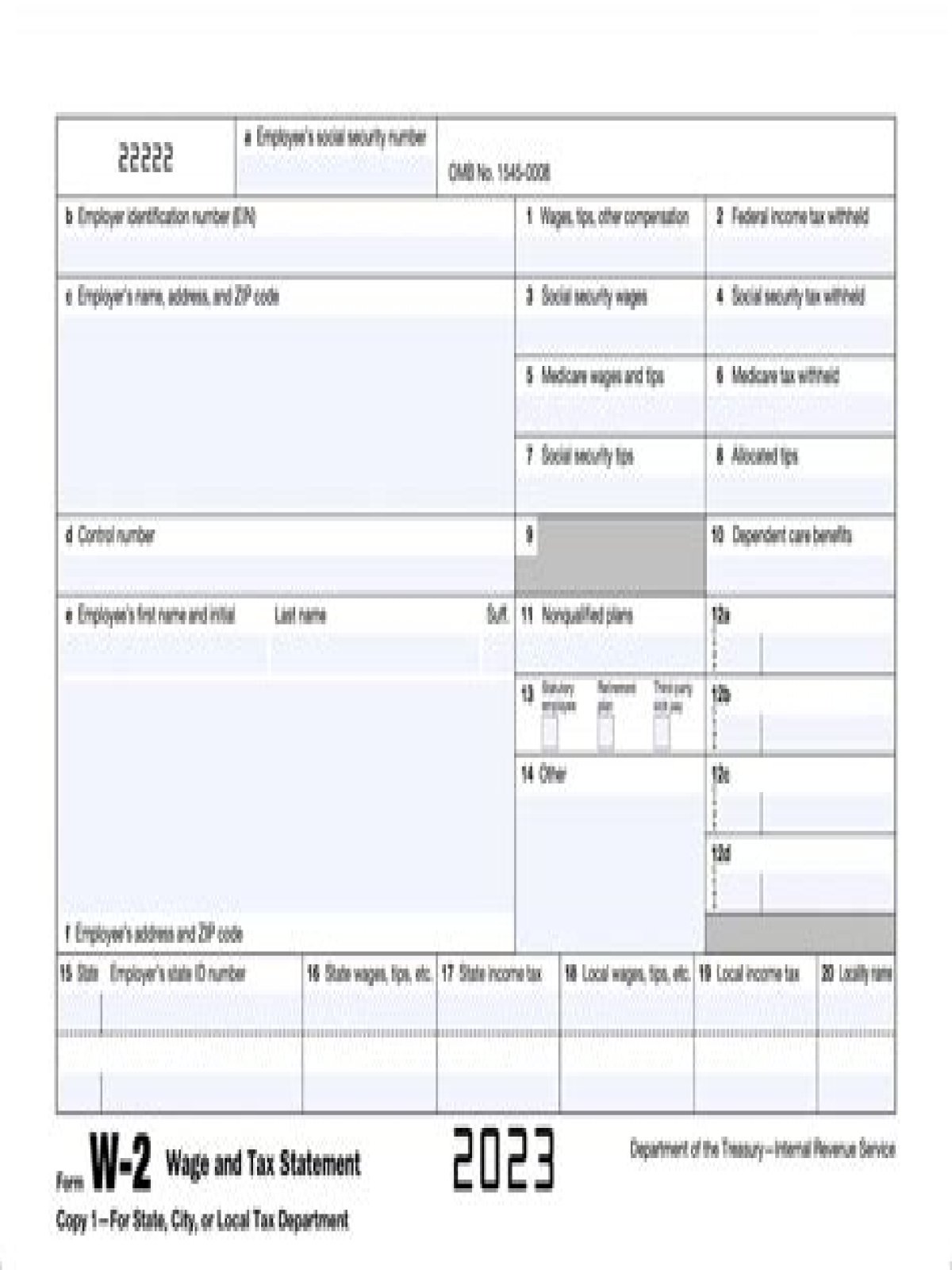

What do the codes mean on the W2 form?

Answer. The W2 boxes and codes show the wages you’ve earned and any taxes paid through withholding. To help you understand your Form W2, we’ve outlined each of the W-2 boxes and the corresponding W2 box codes below. Box 1 — Shows your wages, tips, prizes, and other compensation for the year.