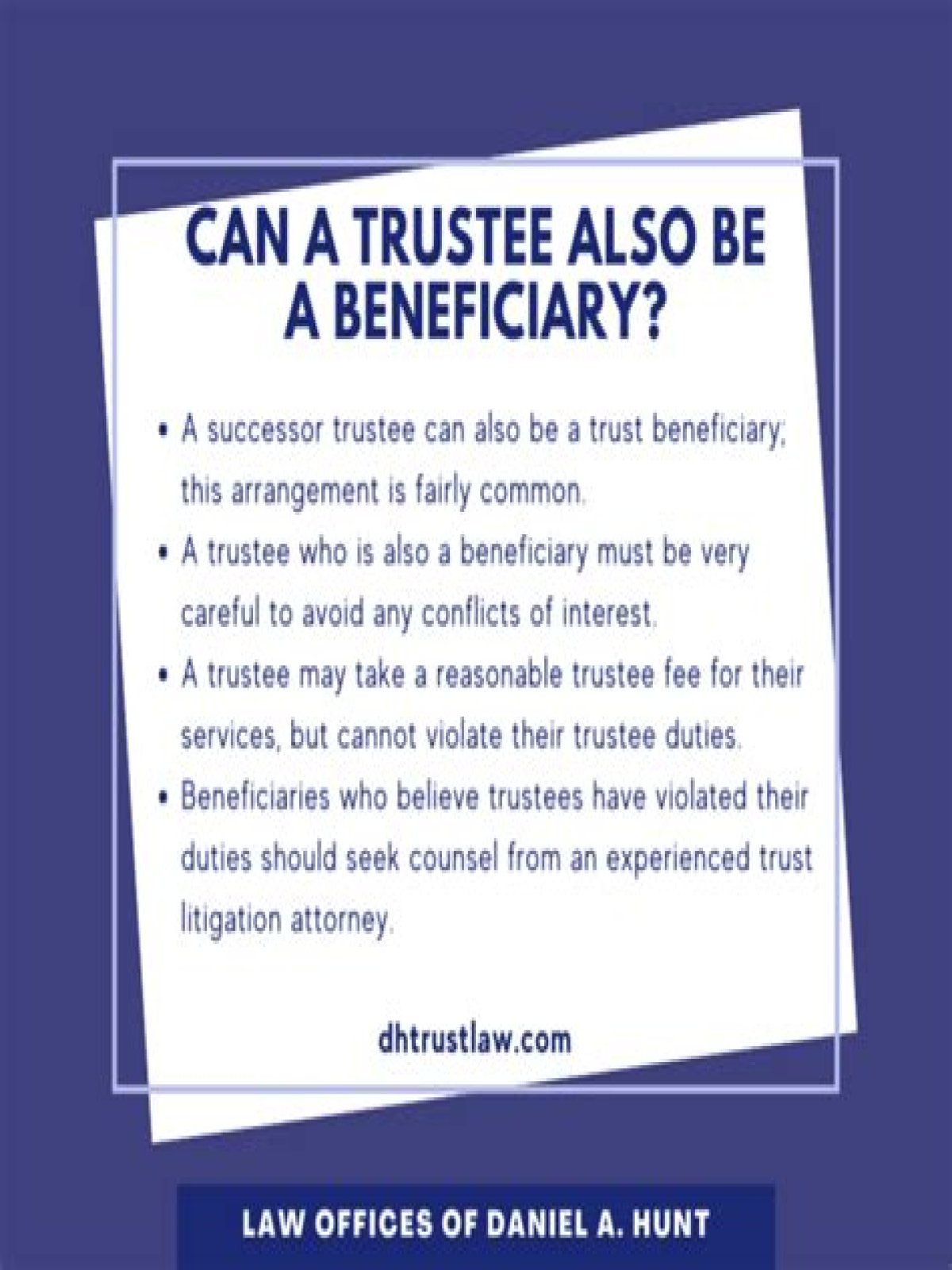

Can a trustee also be a beneficiary? In principle, there is nothing that prevents a beneficiary from being a trustee. However, certain factors may limit this from occurring. For example, the trust deed may state that neither the settlor nor a beneficiary can become a trustee.

What rights does a trustee have in a trust?

A trustee has a duty to report and account to the trust beneficiaries. If you are a trust beneficiary, you have a right to information about the trust, your interest in the trust, and the various assets of the trust and how they are being administered, invested and distributed.

Who is the beneficiary of a family trust?

The trustee manages the assets on behalf of the recipient. For example, this includes investing assets, paying taxes on specific assets, and creating written records. For family trusts, the beneficiary is a relative of the grantor. Most are revocable unless the arrangement states otherwise.

Who are the beneficiaries of an irrevocable trust?

Beneficiaries of an irrevocable trust have rights to information about the trust and to make sure the trustee is acting properly. The scope of those rights depends on the type of beneficiary. Current beneficiaries are beneficiaries who are currently entitled to income from the trust.

How does a Texas Qualified Income Trust work?

In practice, bank accounts required to open a Texas Qualified Income Trust (Miller Trust) operate like a “representative account” for the payment of a disabled individual’s expenses. It is vitally important to note that a Miller Trust does not operate like a typical asset-based trust fund.

Who is the grantor of a Miller Trust?

The Miller Trust bank account MUST be titled as a trust account — “THE JOHN DOE QUALIFIED INCOME TRUST,” where John Doe is the grantor of the trust (the “Grantor” is the person for whom the trust is established); Only the person named as Trustee is authorized to sign checks.