For an S corporation you must:

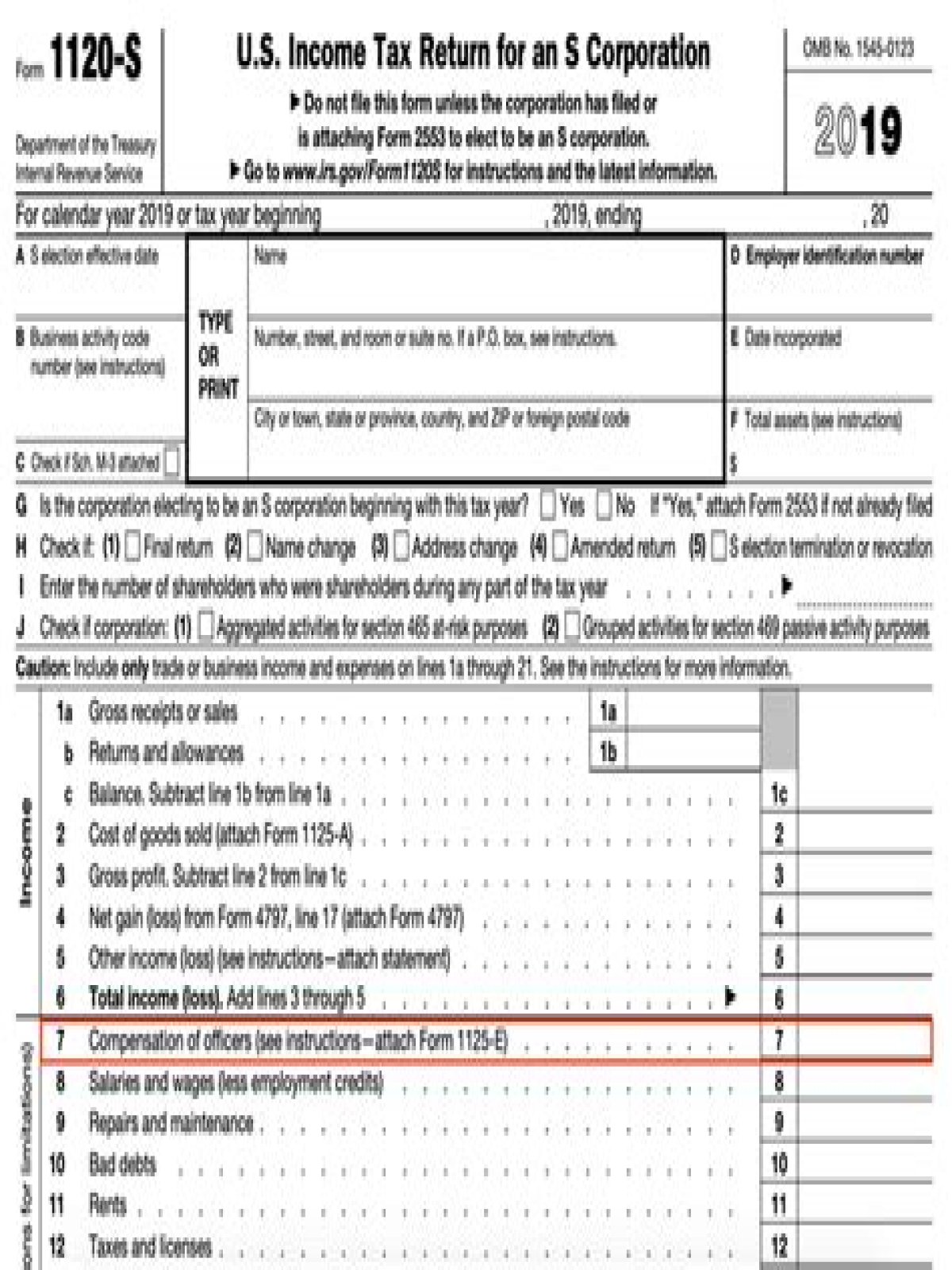

- File Form 1120-S, U.S. Income Tax Return for an S Corporation for the year you close the business.

- Report capital gains and losses on Schedule D (Form 1120-S).

- Check the “final return” box on Schedule K-1, Shareholder’s Share of Income, Deductions, Credits, Etc.

- What does final return mean on 1120S?

- How do I close down an S Corp?

- Is there a penalty for not filing form 966?

- What happens when an S Corp goes out of business?

- Who Files Form 966?

- What is the penalty for filing an S Corp tax return late?

- Do you have to file 1120S if no activity?

- Do you need to print proofs on Form 1120?

- When to report charitable contributions on Form 1120?

What does final return mean on 1120S?

Marking the “Final Return” box tells the IRS you are closing the S-corporation. If you dispose of business property when you close the S-corporation, you must report the disposal to the IRS on Form 4797. Attach Form 4797 to your final 1120-S income tax return.

Where do I mail my 2019 form 1120S?

More In File

| And the total assets at the end of the tax year are: | Use the following IRS center address: |

|---|---|

| Any amount | Department of the Treasury Internal Revenue Service Ogden, UT 84201-0013 |

| Any amount | Internal Revenue Service P.O. Box 409101 Ogden, UT 84409 |

How do you report S Corp income on personal return?

The total S corporation income (or loss) that you show on Schedule E is included on your personal Form 1040 on the line for income from rental real estate, royalties, partnerships, S corporations, trusts, etc.

How do I close down an S Corp?

You’ll have to do the following:

- Obtain a shareholder vote to dissolve.

- Stop conducting business.

- Notify creditors.

- Liquidate assets.

- File a certificate of termination.

- File final government documents.

Is there a penalty for not filing form 966?

There is no direct Form 966 penalty for non-filing or late filing, but by not properly notifying the IRS of a dissolution or liquidation, it may result in collateral damage and other penalties.

What tax forms does an S Corp file?

Form 1120-S: U.S. Income Tax Return for an S Corporation is a tax document that is used to report the income, losses, and dividends of S corporation shareholders. Essentially, Form 1120-S is an S corporation’s tax return.

How long does it take to close an S Corp?

In most cases, a business with at least 100 employees must give them sufficient notice that it’s dissolving; the typical time frame is a minimum 60 calendar days advance notice, no matter what type of business you run.

What happens when an S Corp goes out of business?

If my S-Corp is out of business, do I need to file bankruptcy on the debts? Only if you are personally liable in some way. If you are not, you simply pay the outstanding debts out of the assets, and wind up the corporation according to state law. “S-Corp” status is simply an IRS designation for tax reporting.

Who Files Form 966?

A corporation (or a farmer’s cooperative) must file Form 966 if it adopts a resolution or plan to dissolve the corporation or liquidate any of its stock. Exempt organizations and qualified subchapter S subsidiaries should not file Form 966.

Do I have to file S corp return if no income?

S Corp owners must file Form 1120-S, U.S. Income Tax Return for an S Corporation. If you had no income, you must file the corporation income tax return, regardless of whether you had expenses or not. The bottom line is: No income, no expenses = Filing Form 1120 / 1120-S is necessary.

Where do I send my federal tax return 1120S?

What is the penalty for filing an S Corp tax return late?

Penalties for filing late When S corporations fail to file Form 1120S by the due date or by the extended due date, the IRS will impose a minimum penalty of $205 for each month or part of the month the return is late multiplied by the number of shareholders.

Do you have to file 1120S if no activity?

How to file a final tax return for 1120s?

It is fairly easy to file a final return for 1120S. The box H 1 on page 1 must be marked. See the instructions below to have TurboTax mark it. The “end of tax year” side of Sch L Balance Sheet should be blank.

When do C corporations have to file their final tax returns?

C Corporations. C corporations should file Form 1120, U.S. Corporation Income Tax Return, and check the box that this is their final return. This form must be filed by the 15th day of the fourth month after you close your business. Corporations also need to file IRS Form 966, Corporate Dissolution or Liquidation, to report their dissolution.

Do you need to print proofs on Form 1120?

The type and rule above prints on all proofs including departmental reproduction proofs. MUST be removed before printing. 2019 Instructions for Form 1120-S U.S. Income Tax Return for an S Corporation Department of the Treasury Internal Revenue Service Section references are to the Internal Revenue Code unless otherwise noted.

When to report charitable contributions on Form 1120?

Code G of Schedule K-1 (Form 1120-S), box 12, is now used to report certain cash contributions made in calendar year 2020 or 2021. See Line 12a. Charitable Contributions under Specific Instructions for Schedules K and K-1. New employee retention credit. The Coronavirus Aid, Relief, and Economic Security Act (CARES Act) allows a new