The current payroll tax rate is 4.85 per cent. View previous rates and thresholds.

What taxes do government employees pay?

In most cases, individuals who serve as public officials are government employees. Therefore, the government entity is responsible for withholding and paying Federal income tax, social security and Medicare taxes. They must also issue a Form W-2, Wage and Tax Statement, to a public official.

How much of your salary gets taken out for taxes?

Overview of California Taxes

| Gross Paycheck | $3,146 | |

|---|---|---|

| Federal Income | 15.32% | $482 |

| State Income | 5.07% | $159 |

| Local Income | 3.50% | $110 |

| FICA and State Insurance Taxes | 7.80% | $246 |

Do government employees have to pay tax?

It is fully exempt for Central and State government employees. For non-government employees, the least of the following three is exempt. The amount chargeable to tax shall be the total leave encashment received minus exemption calculated as above. This is added to your income from salary.

Do government jobs give bonuses?

Bonuses: Recruitment bonuses are cash incentives up to 25 percent of base pay given to new employees for jobs that have been difficult to fill in the past. Relocation bonuses up to 25 percent may be paid for current Federal employees to relocate to a new commuting area. Decisions are made on a case-by-case basis.

What kind of taxes does the government pay?

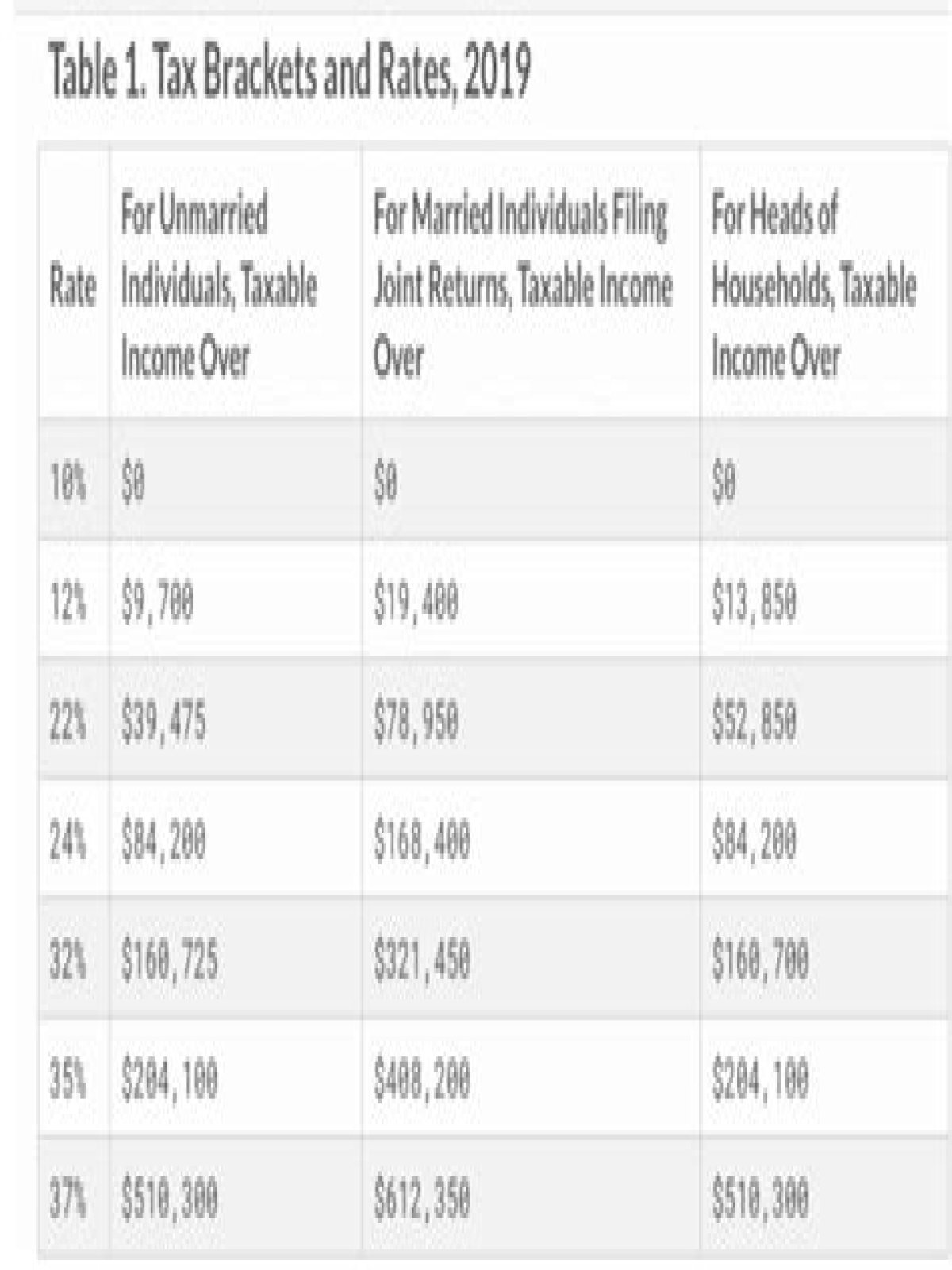

Individual and payroll taxes are two categories with the third being corporate income tax. In 2018 individual and payroll tax revenue accounted for 86% of the government’s revenue. In 2019 this percentage is estimated at 85%.

How does the government take money from your paycheck?

The big one is income tax. The federal government collects your income tax payments gradually throughout the year by taking directly from each of your paychecks. It’s your employer’s responsibility to withhold this money based on the information you provide in your Form W-4.

What kind of taxes do we pay in India?

The income tax, corporation tax, GST, customs, etc that we pay to government comes under the head of “Tax Revenue”. So it is not that we (Indian residents) pays for all expenses of the nation.

Do you have to pay tax on all types of income?

Income Tax is a tax you pay on your income. You do not have to pay tax on all types of income. This guide is also available in Welsh (Cymraeg).