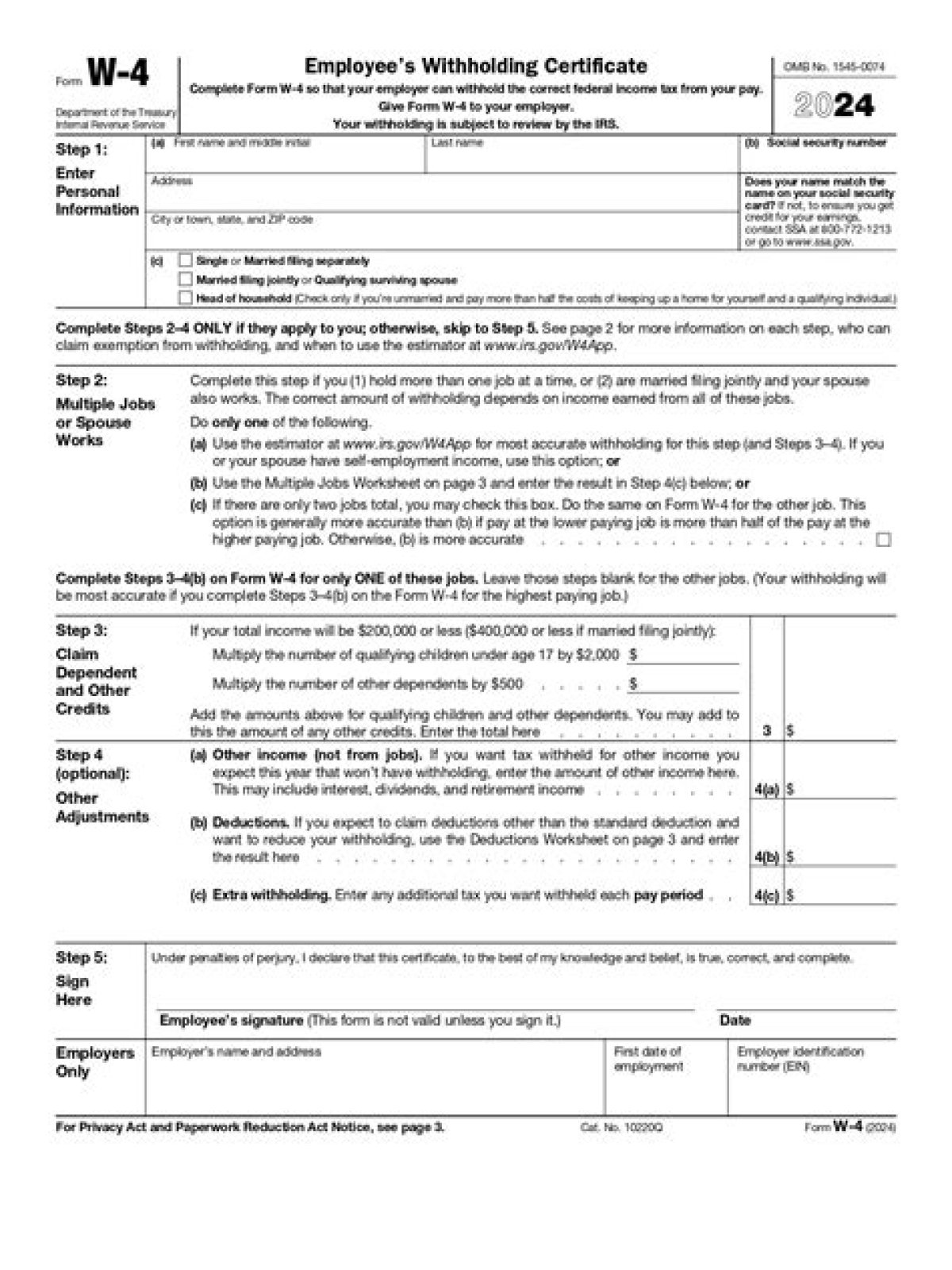

Exemption from Withholding To continue to be exempt from withholding in the next year, an employee must give you a new Form W-4 claiming exempt status by February 15 of that year.

How long do employers have to send w2?

Employers have until January 31 to deliver Form W-2s to employees, so bookmark this article until then in case there are any issues. Note: If an employer is mailing W-2s to employees, they must be postmarked by January 31 and may take a week or two to arrive.

Can I submit a w4 at any time?

You can adjust your W-4 at any time during the year. Just remember, adjustments made later in the year will have less impact on your taxes for that year.

Does employer send w4 to IRS?

A1: Employers are no longer required to routinely submit Forms W-4 to the IRS. However, in certain circumstances, the IRS may direct you to submit copies of Forms W-4 for certain employees in order to ensure that the employees have adequate withholding.

How long does an employer have to keep the Form W-4?

After the employee completes and signs the Form W-4, you must keep it in your records for at least 4 years (see Publication 15, (Circular E), Employer’s Tax Guide and Topic No. 305 Recordkeeping).

How long does the employer have to send out a corrected W2?

Employers are required to correct errors on Forms W-2 as quickly as possible. The penalty for filing an incorrect W-2 with the SSA increases over time. To avoid penalties, a Form W-2c is generally required within 30 days of becoming aware of an error.

How often can you change the amount on a W-4?

Employees may change the amounts on a W-4 form at any time and as often as they wish. The implementation timeline requirement above must be followed for changes as well as new hires. There is no time limit on how long a W-4 stays in effect; it remains in effect until the employee changes it.

What happens if an employee fails to submit a Form W-4?

The employee submitting such form will be treated as failing to furnish a Form W-4. Form W-4 includes detailed worksheets to help the employee figure his or her correct number of withholding allowances. Employees may also want to access the IRS Tax Withholding Estimator for help in completing Form W-4.