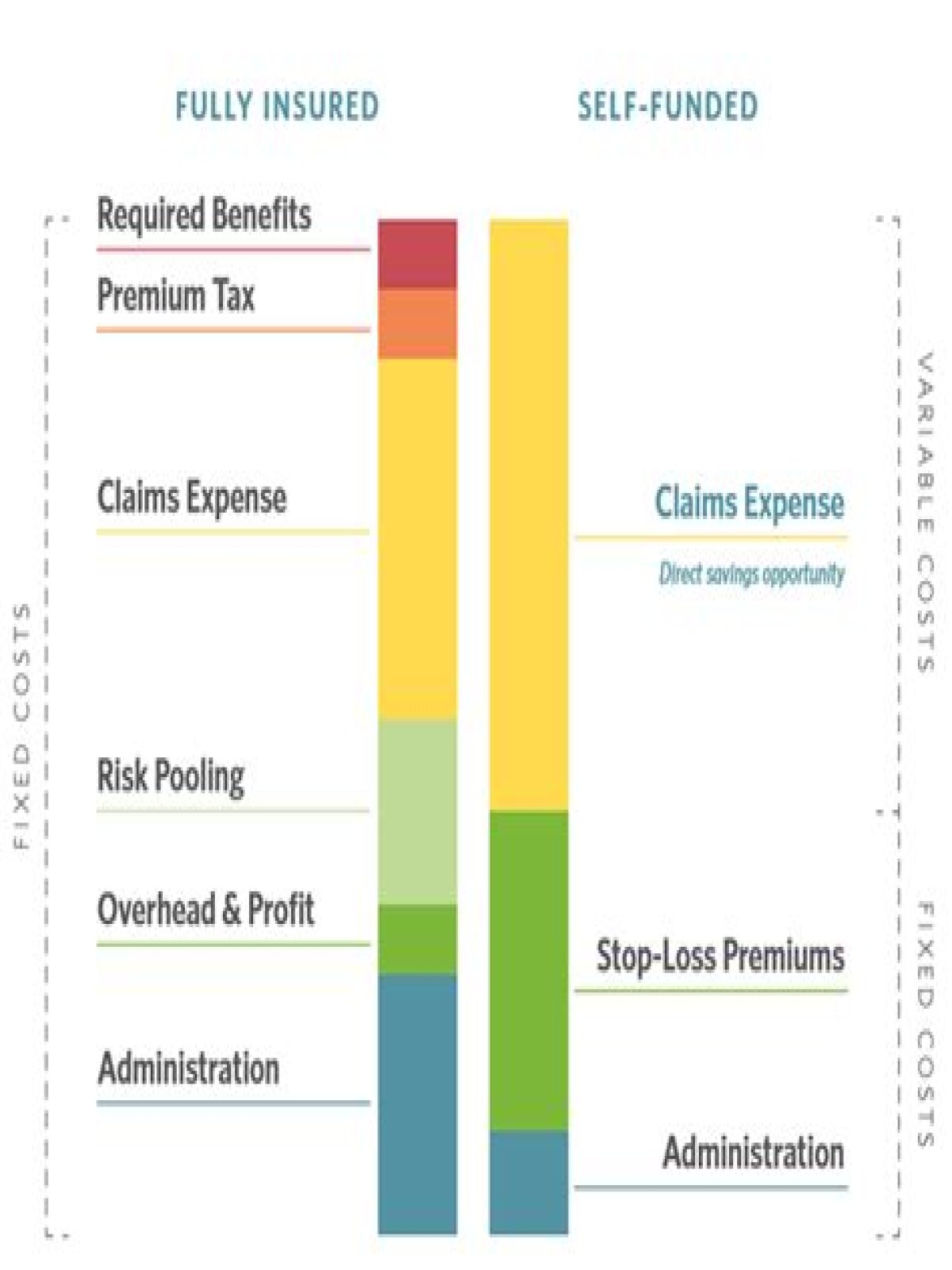

In a traditional fully insured health plan, your company pays a premium. The premium rates are fixed for a year, and you pay a monthly premium based on the number of employees enrolled in the plan. So the total cost of a self-funded plan is the fixed costs plus the claims expense less any stop-loss reimbursements.

How does a self funded health plan work?

Self-insurance is also called a self-funded plan. This is a type of plan in which an employer takes on most or all of the cost of benefit claims. The insurance company manages the payments, but the employer is the one who pays the claims.

What is a self funded health care plan?

A Self Funded, or Self-Insured plan, is one in which the employer assumes the financial risk for providing health care benefits to its employees. Typically, a self-insured employer will set up a special trust fund to earmark money (corporate and employee contributions) to pay incurred claims.

How are self funded group health insurance plans funded?

In practical terms, self-insured employers pay for each out of pocket claim as they are incurred instead of paying a fixed premium to an insurance carrier, which is known as a fully-insured plan.

What is the difference between self-funded and fully funded insurance?

In a nutshell, self-funding one’s health plan, as the name suggests, involves paying the health claims of the employees as they occur. With a fully-insured health plan, the employer pays a certain amount each month (the premium) to the health insurance company.

What is the difference between self-funded and level funded?

In a nutshell, self-funded plans provide a pay-as-you-go healthcare model. Level funding puts a cap on those costs. Self-funded plan: “An insurance arrangement in which the employer assumes direct financial responsibility for the costs of enrollees’ medical claims.

How do level funded plans work?

With a level-funded plan, an employer pays a health carrier the same monthly amount to cover the estimated cost for expected claims, the premium for stop-loss insurance that covers health care costs over a set dollar amount, and plan administration costs.

What is the difference between employer-sponsored and self-funded health plans?

A fully-insured health plan is the traditional way to structure an employer-sponsored health plan and is the most familiar option to employees. On the other hand, self-insured plans are funded and managed by an employer, often in an effort to reduce premium costs.

Who pays an insurance premium?

When you sign up for an insurance policy, your insurer will charge you a premium. This is the amount you pay for the policy. Policyholders may choose from several options for paying their insurance premiums.

What is fully-funded and self-funded?

In a self-funded plan, the risk transfers over to the employer, but so do the potential benefits. In comparison, the money that would normally be going to the insurance carrier in a fully-funded plan is now being spent by the employer.

Is self-funded insurance good for employees?

Employers with self-funded (or self-insured) plans retain the risk of paying for their employees’ health care themselves, either from a trust or directly from corporate funds. Most employers with more than 200 employees self-insure some or all of their employee health benefits.

Who regulates self-funded insurance?

3. Self-insured plans are governed by federal laws through the Department of Labor.

Why should employers consider a self-funded plan?

Enhanced cash flow accounts for one of the biggest reasons employers are choosing to switch to self-funded insurance. Unlike the traditional health insurance plans that require employers to pre-pay potential claims through monthly premiums, a self-funded health insurance plan gives businesses more flexibility.

What if I have a self-insured health plan?

Self-insured health insurance means that the employer is using their own money to cover their employees’ claims. Most self-insured employers contract with an insurance company or independent third party administrator (TPA) for plan administration, but the actual claims costs are covered by the employer’s funds.

How can TPAs help self-funded health plans?

Some insurance companies contract as TPAs.

How self-funded health insurance can save your company money?

Cost Savings from Benefit Design Changes. Self-funded employers who choose to use the services of TPAs have been found to save more money on their health plans per enrolled