While the grantor is still alive, he or she can transfer assets in and out of the trust and buy and sell trust assets. During the grantor’s lifetime, the trust’s income is reported on the grantor’s income tax returns. However, when the grantor dies, the revocable trust becomes irrevocable and cannot be changed.

What happens to a family trust if the trustee dies?

If the company is the trustee of the family trust, the death of a director of the trustee company is not necessarily a cause for alarm. The company itself will continue (a company does not die). If there were two or more directors, the remaining director/s of the company can continue to run the family trust.

How are irrevocable trusts divided for tax purposes?

Irrevocable trusts are divided into two types for tax purposes— grantor trusts and non-grantor trusts. Grantor trusts are those in which the creator of the trust—the grantor—retains significant benefits or rights, such as the right to receive all the trust income or change trustees.

When does a revocable trust go through probate?

These trusts are designed to terminate upon the grantor’s death, at which time, the assets are distributed to beneficiaries. Those assets are valued as of the grantor’s death date. There are no particular tax advantages to a revocable trust, but the trust does not go through probate.

Is there an estate tax exemption for an irrevocable trust?

The grantor may set conditions for the timing of distributing assets from an irrevocable trust. For example, the grantor may decide that beneficiaries cannot receive assets until they reach the age of 30 to prevent a young beneficiary from misusing the income. For persons who died in 2017, the federal estate tax exemption is $5.49 million.

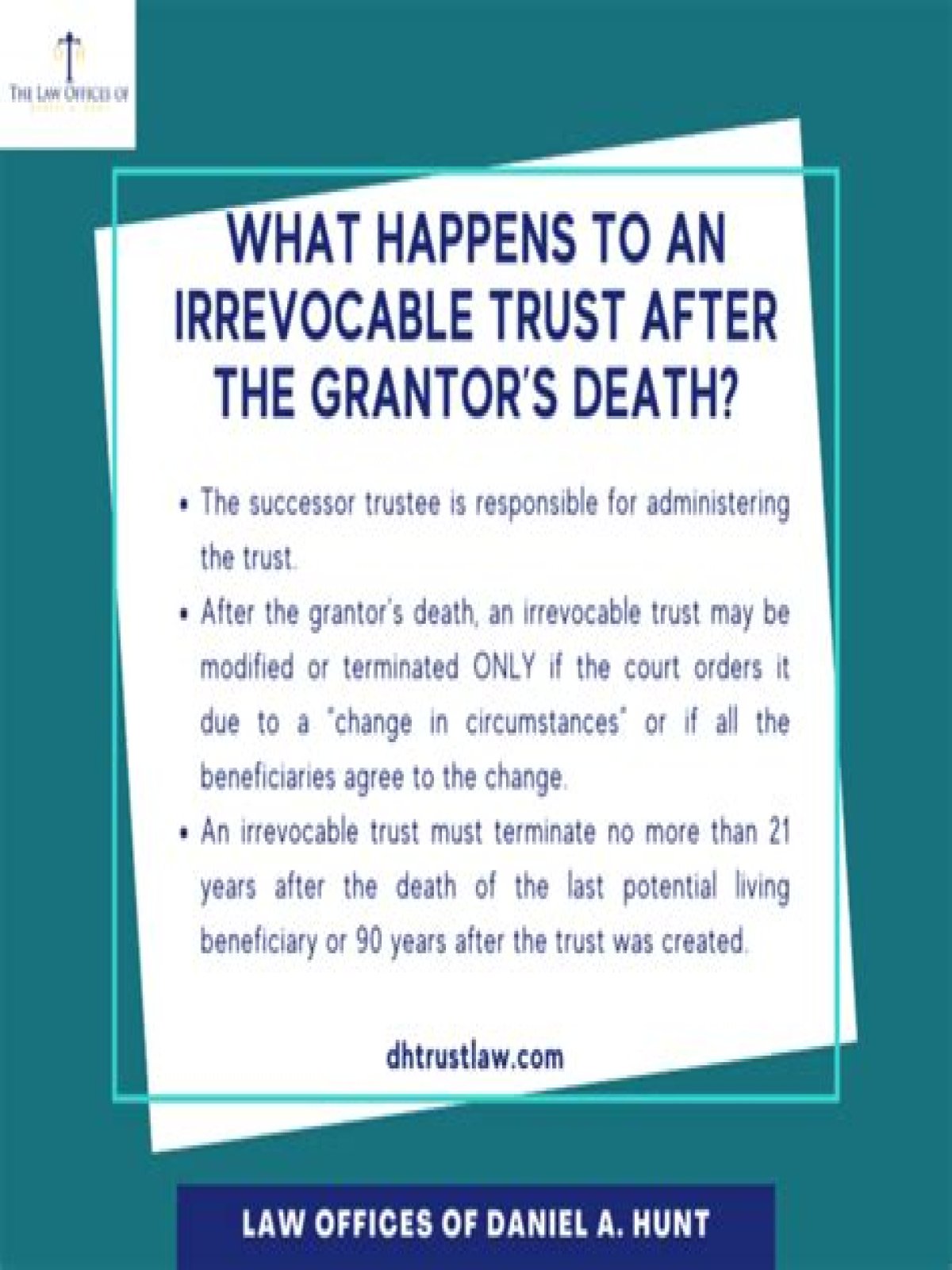

How can I terminate an irrevocable family trust?

If all of them agree to end it, then they can petition the court for the trust’s termination. For example, if the trustee fulfills the legal document’s purpose, such as providing college tuition, then the court may grant the termination request. If beneficiaries want to enforce their rights under an irrevocable family trust, they may do so.

How to step up basis in irrevocable trust assets?

It causes the step up in the basis of assets held in an irrevocable trust through exercise of the special power of appointment. The springing of the trap can be utilized in other irrevocable trusts (not just Bypass Trusts) so long as a person has a special power of appointment exercisable at his or her death.

Can a trust beneficiary take a loss on sale of a property?

In carrying out his duties, and depending on the trustor’s instructions, the trustee may sell some or all of the property in the trust. When property is sold directly from a trust, the trust benefits from any profit made by the sale. If property is sold for less than its basis, the trust incurs the loss.

How much did the irrevocable trust sell the House?

You did not disclose what was the value disclosed by the Estate on the Form 706 Estate Return, if filed and necessary, but it would have been the Fair Market Value, and not the original cost of $450,000. You mention that the selling price was $1.6M less $100,000 in costs, and a net proceeds of $1.5M.