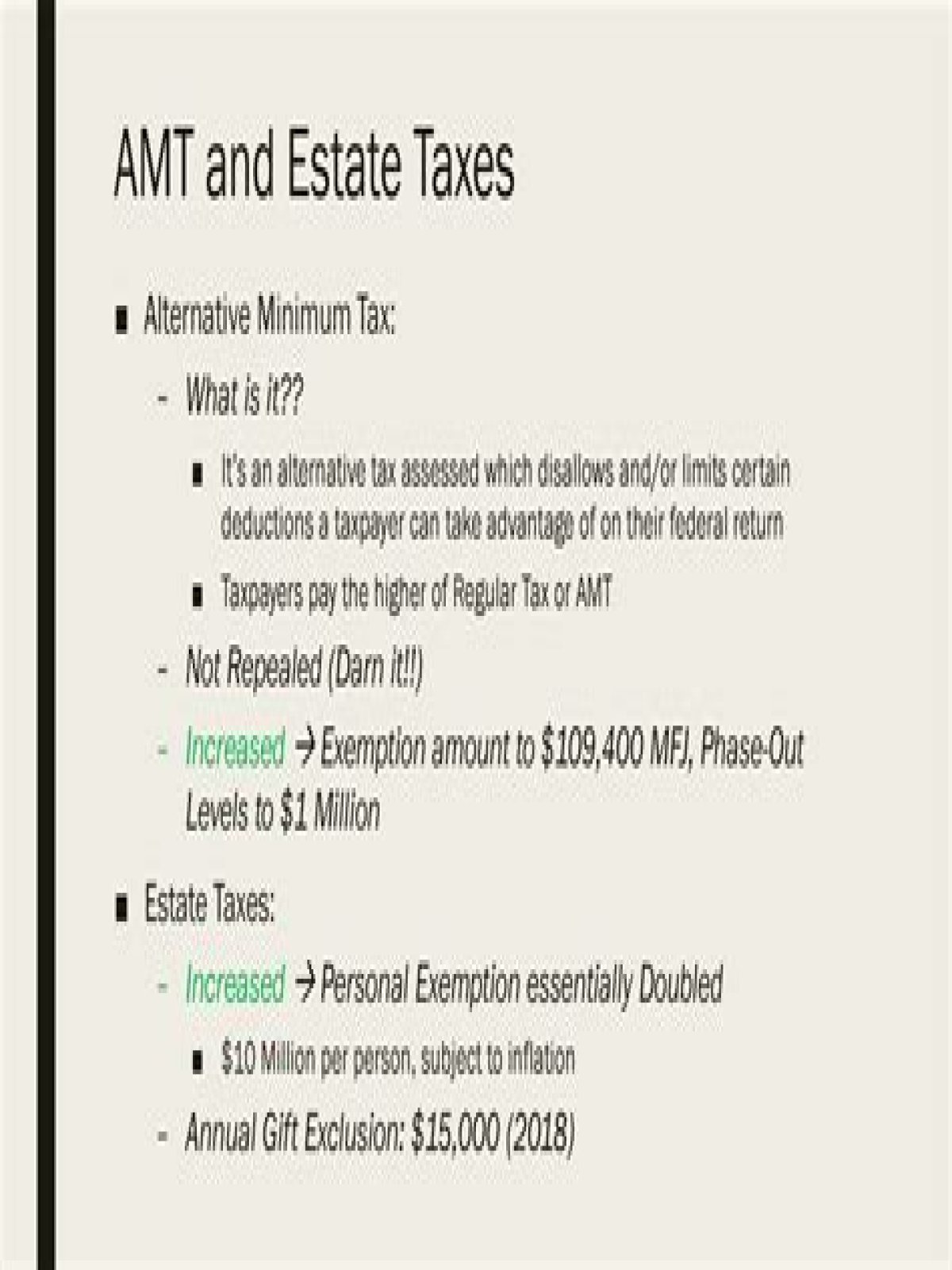

The alternative minimum tax provisions apply generally to trusts and estates as well as to individuals (IRC § 55 ). For individuals, estates and trusts, a graduated, two-tiered alternative minimum tax (AMT) rate schedule applies.

Do trusts pay AMT?

Trusts, like individuals, may be subject to an alternative minimum tax (AMT) at the rate of 26% or 28%, depending on the trust’s alternative minimum taxable income. In the past, trusts had the same AMT exemption amount as married individuals who filed separate returns.

What kind of taxes do I have to pay on inheritance?

1 Inheritance tax applies to the person inheriting assets, based on the value of their inheritance 2 Surviving spouses are exempt and the tax rates are higher the less closely related you are to the deceased 3 There’s no federal inheritance tax and only six states impose one

Are there inheritance taxes in the state of Maryland?

Maryland is the only state with a state-level estate tax and an inheritance tax. For more information, try our guide to estate taxes. If you live in a state with an inheritance tax, there are a few main ways to minimize or avoid inheritance taxes for a beneficiary: Leave your whole estate to your spouse (or other exempt individuals).

When to know if you have to pay taxes on inherited property?

Consult with an estate planning attorney or an accountant long before your tax return is due if you’re not sure if you’ll have to pay taxes on inherited property. The information contained in this article is not tax or legal advice and is not a substitute for such advice.

What kind of taxes do you have to pay on an estate?

There are three types of taxes you can pay: income tax, inheritance tax and estate tax. Estate tax is levied on what you pass on after your death. These items can include cash, retirement accounts, property and more. Currently, you don’t have to pay federal estate tax if the estate is less than $5.45 million for 2016.