Dividends are the most common type of distribution from a corporation. They’re paid out of the earnings and profits of the corporation. Whereas ordinary dividends are taxable as ordinary income, qualified dividends that meet certain requirements are taxed at lower capital gain rates.

How are C corporation distributions taxed?

The corporation pays out most or all of its after-tax profits to the shareholders as taxable dividends that qualify for the 20% maximum federal rate. Plus, the shareholders pay individual-level federal income taxes on dividends at a rate of 23.8%, including the 3.8% net investment income tax (NIIT).

Do you have to pay taxes on S corporation distributions?

General Overview of S Corporation Distributions Unlike a partnership, an S corporation is not subject to personal holding company tax or accumulated earnings tax. When income is earned by an S corporation, it is taxed only once, regardless of whether the income is distributed or invested.

Do you have to pay taxes on cash distributions to shareholders?

Rather, the shareholders are the ones who must be concerned with taxation. Although distributions of cash or property to the shareholders will reduce the corporation’s earnings and profits (E&P), such distributions will not reduce the corporation’s taxable income.

What happens when a C corporation makes a distribution?

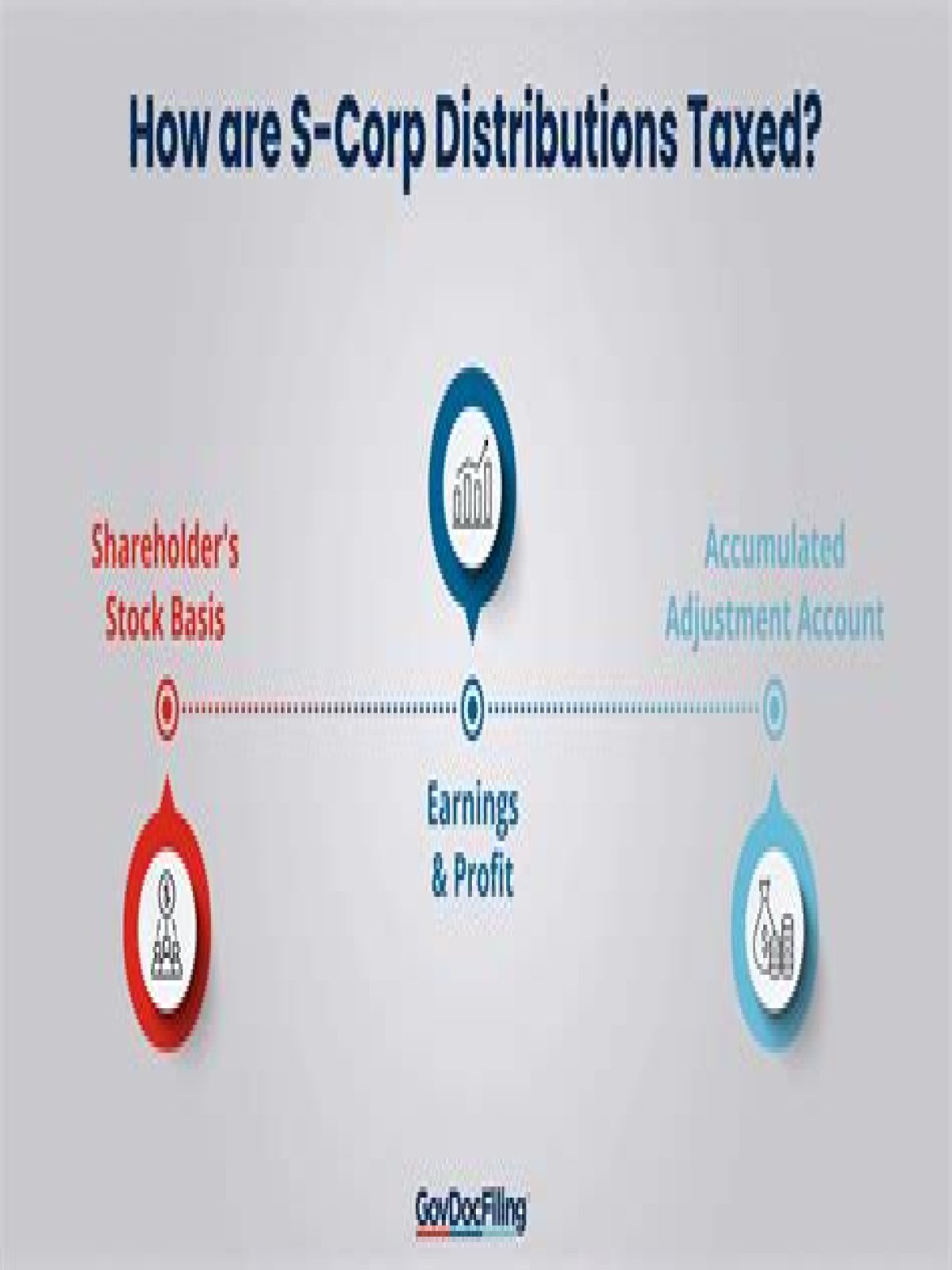

A distribution in excess of the corporation’s earnings and profits is generally viewed as a nontaxable return of capital to the shareholder. In other words, it is seen as merely a recovery or return of the shareholder’s investment in the corporation. The amount of this distribution first reduces the basis of the shareholder’s stock.

When do s Corp’s not pay dividends to shareholders?

S corporations, in general, do not make dividend distributions. They do make tax-free non-dividend distributions unless the distribution exceeds the shareholder’s stock basis.