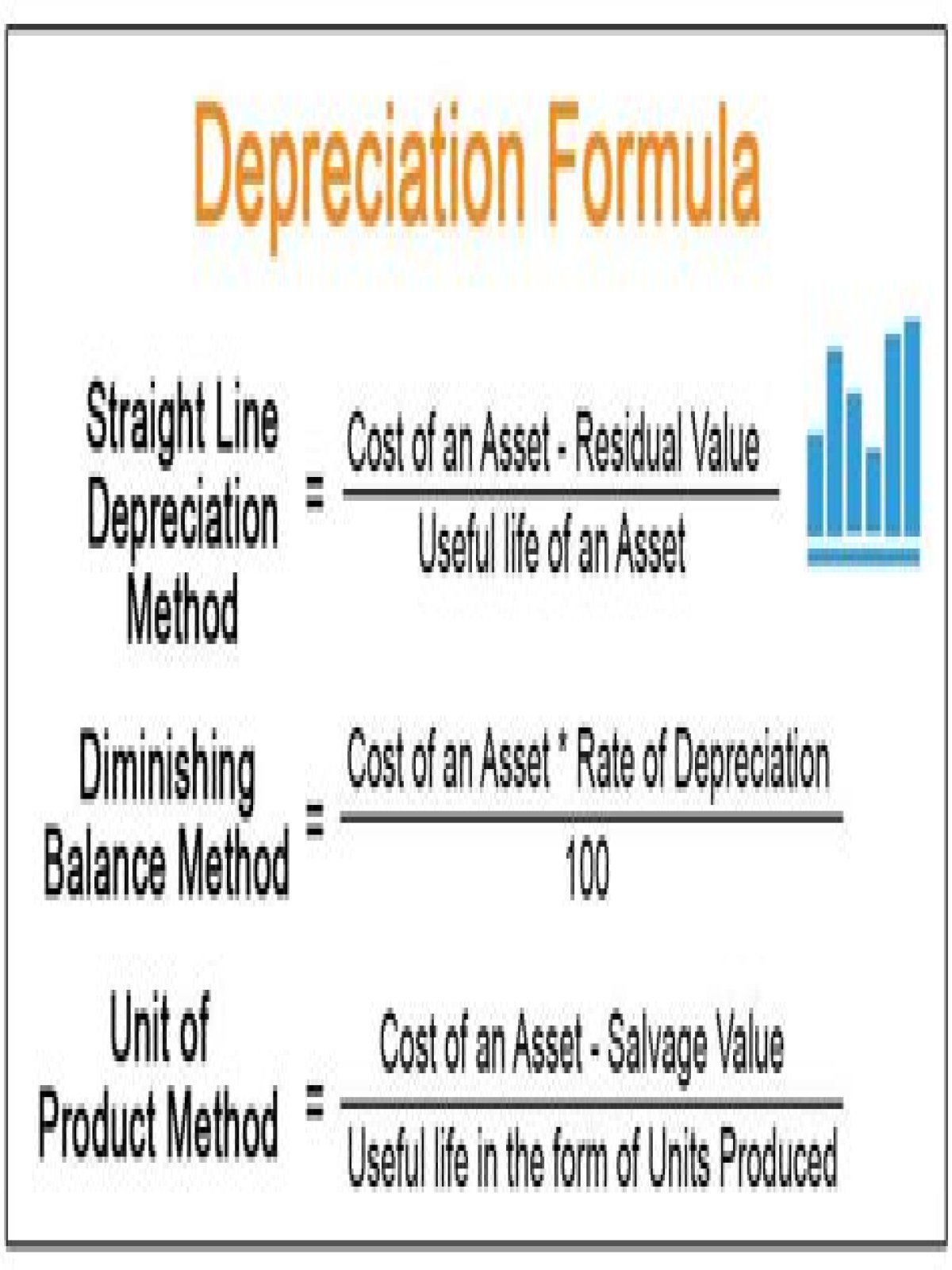

The straight-line formula used to calculate depreciation expense is: (asset’s historical cost – the asset’s estimated salvage value ) / the asset’s useful life.

What does line 10a mean?

Child Deduction (On Line 10a, enter the number of dependent children for whom you were allowed a federal child tax credit. On Line 10b, enter the amount of the child deduction. See instructions.)

What is a D 400 form?

Pay individual income tax. Pay a balance due on your Individual Income Tax Return for the current tax year, and prior years through tax year 2003.

How to calculate depreciation using the straight line method?

The straight line method assumes that the asset will depreciate by the same amount each year until it reaches its residual value. The residual value is how much it will be worth at the end of its life. In this case, we know this amount is $20,000. That means the submarine is going to depreciate by $80,000 over five years.

What should be included on the depreciable assets line?

Other depreciable assets should also be included. Ideally, you want to expense (i.e. take a full deduction for) everything in the year you buy it, but there are some items you can’t do that with and must depreciate. Lines 11a and 11b are for “depletable assets”.

How to calculate the depreciation of a submarine?

However, you know that in 5 years of time, the submarine will only be worth $20,000. The straight line method assumes that the asset will depreciate by the same amount each year until it reaches its residual value. The residual value is how much it will be worth at the end of its life. In this case, we know this amount is $20,000.

How to calculate accumulated depreciation for an asset?

Accumulated depreciation, as the name suggests, is the total amount of depreciation that has built up over the years. For example, if our asset depreciates by $100 for each of the last 3 years, our accumulated depreciation will be $300.