Once you submit it, the IRS receives it. To confirm the IRS receives it, you’ll see the “accepted” message in your tracking software. All “your tax return was accepted” means that it passed a basic test of having a valid social security number and other data. It doesn’t mean anything except that it’s in the IRS queue for processing.

When do I expect my income tax refund?

If you have the Earned Income Tax Credit or Additional Child Tax Credit, your refund does not start processing until February 15. Your 21 day average starts from this point – so you can usually expect your tax refund the last week of February or first week of March. How long does it take to process a return sent by mail?

When does the IRS start processing tax returns?

The IRS announced that it will begin processing tax returns on January 28, 2019. However, many tax programs have not been fully completed to start filing due to the government shutdown.

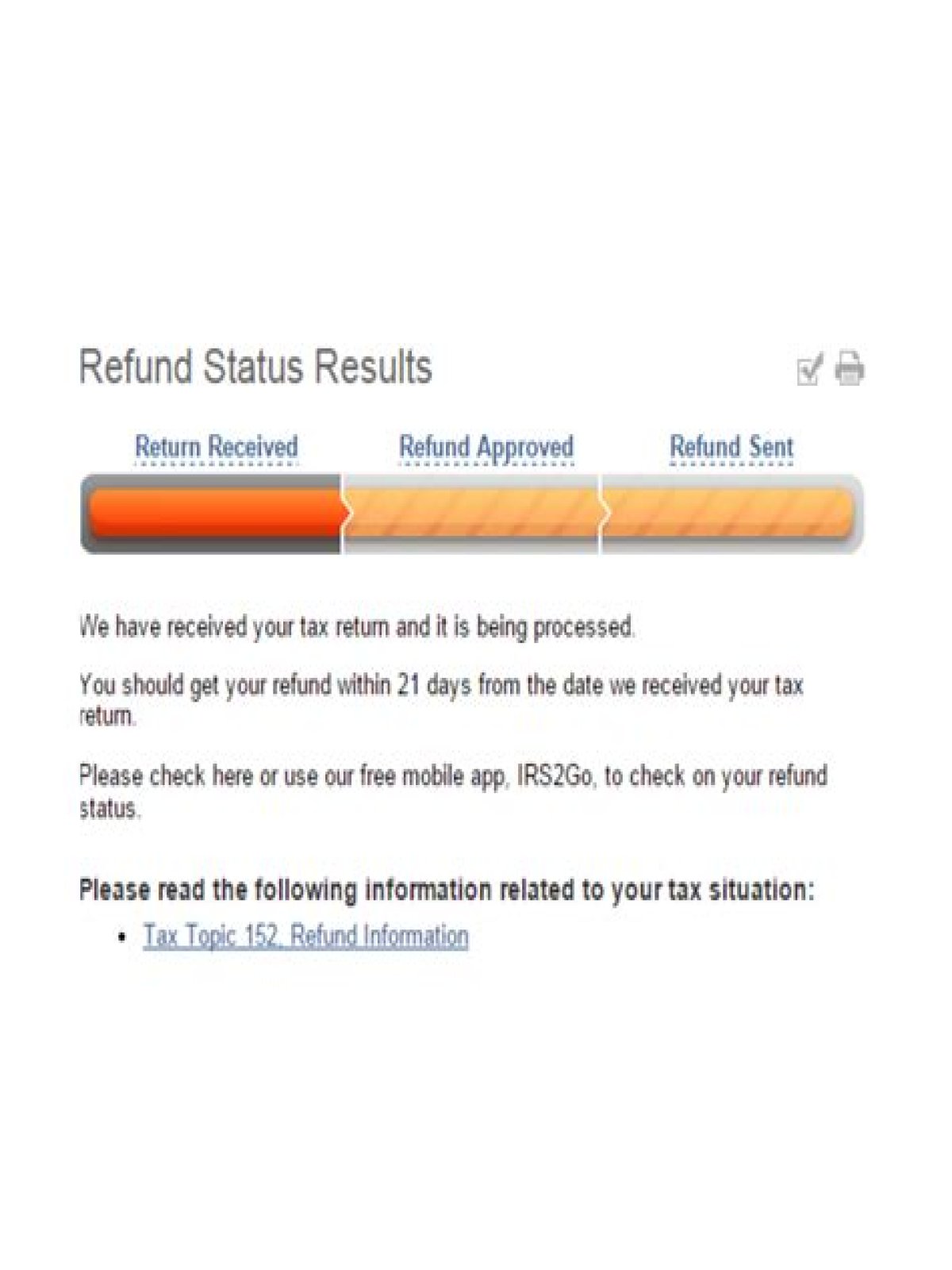

Where can I find the status of my tax refund?

Note: the old “Where’s my Refund” site is now simply called Check My Refund Status on the IRS webpage. It’s essentially the same tool. First, it starts with your tax software, tax preparer, or your paper refund. Once you submit it, the IRS receives it. To confirm the IRS receives it, you’ll see the “accepted” message in your tracking software.

Where do I get proof that my taxes were filed?

I need proof that my taxes were filed and accepted. Where do I get that? If you already e-filed your tax return. Your e-file status will show the date you transmitted your return and if it was accepted or rejected. Both your Federal and State will be listed separately if you filed both.

How do I find out if my tax return was accepted?

It must match what the IRS shows. Social Security Number (SSN) mismatch. To be accepted, each SSN listed on the tax return should match the SSN on file with the Social Security Administration office. Name misspelling. Each name listed on the tax return should also match what is on file with the IRS.

When does the IRS start processing efile tax returns?

The IRS hasn’t announced when the will open eFile yet for 2021. However, based on our conversations with several large tax preparers, it appears the tentative date to start processing eFile tax returns will likely be January 25, 2021.

What makes you eligible for a tax refund?

There are several possible scenarios. You might have overpaid your estimated taxes or had too much withheld from your paycheck at work. You might also qualify for so many tax deductions and tax credits that you eliminate your tax liability and are eligible for a refund.

How can I get my tax refund faster?

1 Request Direct Deposit of Your Refund According to the IRS, eight out of 10 taxpayers use direct deposit to receive their tax refunds faster. 2 File Your Tax Return Electronically Combining both direct deposit and electronic filing can greatly speed up your tax refund. 3 Double Check Your Tax Return Before You File

How does a tax return calculator work for You?

A tax return calculator takes all this into account to show you whether you can expect a refund or not, and give you an estimate of how much to expect. Remember that a tax deduction reduces your taxable income, cutting your tax bill indirectly by reducing the income that’s subject to a marginal tax rate.